By YUYING QIAN (created on 2024.7)

Background of the EU’s investigation into Chinese electric vehicles:

On August 20th, 2024, the EU proposed the final draft of imposition of temporary countervailing duties on pure electric vehicles (BEVs) imported from China. Considering the EU’s standard tariff of 10% on passenger cars, automakers like SAIC will face a tariff of 46.3%, while other manufacturers will encounter tariffs ranging from 27% to 31.3%. Previously, an executive from a vehicle manufacturer indicated that if the EU tariff rate surpasses 25%, most Chinese automakers will incur losses. Except for firms like BYD, Geely, SAIC, and Chery, which have factories in Europe, there is essentially no price advantage for companies relying on domestic production in China and then transporting vehicles to the EU.

What is EU’s real motivation behind this policy?

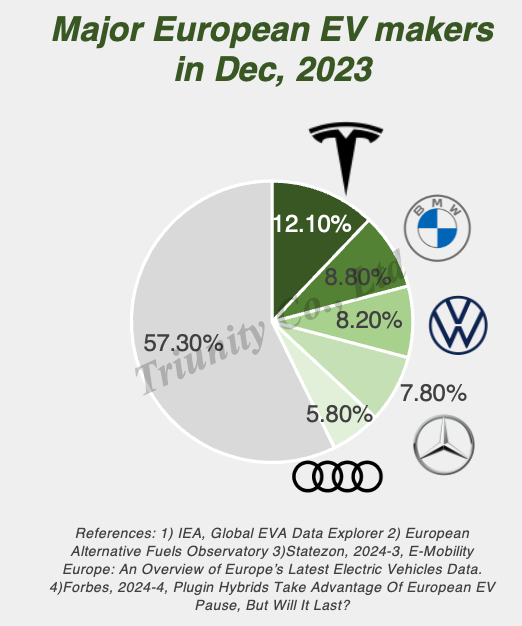

The foremost and most intuitive reason is that the EU feels pressured by China’s burgeoning new energy vehicle industry. The sales penetration rate of Chinese electric vehicles in the EU has surged from 0.5% in 2019 to 8.5% in 2023. Although their total market share remains below 10%, the growth rate is significant. According to the European Transport and Environment Organization, this figure is expected to reach 20% by 2027. One of the primary reasons for the high growth rate is that electric vehicles produced in China are more affordable than local EU brands, leaving EU electric vehicle manufacturers without a significant price advantage. In order to protect the local automobile industry, the EU plans to implement tariffs to curb the price competitiveness of Chinese electric vehicles over the next three to five years. Additionally, EU may increase subsidies for local electric vehicle manufacturers. At present, EU does not impose any requirements regarding the origin of electric vehicle subsidies. This means that whether electric vehicles are produced in EU countries or China, they receive the same subsidies. However, in the future, EU may require local production of components and other parts to qualify for subsidies, or it might increase the subsidy ratio for local companies. These measures aim to enhance the price competitiveness of local brands.

Photo from “BYD Official Website”

Unlike the stringent approach by the U.S., which imposes a 100% tariff on Chinese electric vehicles, EU currently advocates for an open market. EU continues to welcome Chinese electric vehicle manufacturers to establish factories in Europe and encourages cooperation within the China-EU supply chain. This strategy ensures that the EU does not form an absolute opposition to China. Because EU’s long-term objective is not to entirely hinder the development of Chinese electric vehicles within its borders. Instead, the EU aims to establish itself as a key rule-maker in the global green economy, gain a significant voice in shaping the global green supply chain, and thereby create regulations that align more closely with its own interests. In other words, Chinese electric vehicles are welcome to develop in Europe, but they must adhere to the rules set by the EU. Leveraging its position as the world’s largest unified market, the EU incorporates specific regulatory clauses into its trade agreements with other countries, including China. For instance, under the new battery law concerning electric vehicles, Chinese companies must comply with the EU’s battery recycling regulations and meet its carbon footprint standards before their products can be imported into Europe. Gradually, to facilitate exports to Europe, Chinese companies will develop battery recycling systems and carbon footprint collection systems that comply with EU standards. Through these regulatory clauses, EU subtly encourages other countries to implement institutional reforms and align with its legal framework over time. This approach not only extends the EU’s global influence but also helps shape industry standards that favor local EU companies.

Based on this underlying logic, tariffs are merely a temporary strategy. Beyond tariffs, there are several subsequent EU policies that Chinese electric vehicle companies will need to monitor closely. These measures include:

1) Regarding battery carbon footprints, EU’s latest ‘New Battery Law’ mandates the declaration and certification of carbon footprints for the entire life cycle of batteries with a capacity greater than 2 kWh. For companies exporting batteries, this means collecting carbon emission data at every stage—from the extraction of raw materials to battery production, recycling, and even reuse. Currently, most Chinese manufacturers continue to rely on coal for production. While this significantly reduces production costs, it will pose a disadvantage when complying with the EU’s carbon footprint certification. Furthermore, Chinese companies face challenges including the absence of a unified database or emission factors for carbon emissions throughout the lifecycle, and the lack of a mutual recognition mechanism between China and the EU.(This measure will be implemented for electric vehicle batteries in February 2025.)

2) In battery recycling, the “New Battery Law” mandates that battery manufacturers incorporate a specific percentage of recycled materials. By August 2031, the recycled content requirements are as follows: 16% for cobalt, 85% for lead, 6% for lithium, and 6% for nickel. By August 2036, these requirements increase to 26% for cobalt, 85% for lead, 12% for lithium, and 15% for nickel. Simultaneously, minimum recycling targets for materials in used batteries are established. Starting in 2027, battery manufacturers will be required to recycle 90% of nickel and cobalt, with this target increasing to 95% by 2031. Additionally, they must recycle 50% of lithium beginning in 2027, with the target rising to 80% by 2031. Battery manufacturers need to establish a recycling system to collect and process waste batteries, which significantly increases costs. ( This measure will be implemented for electric vehicle batteries starting in August 2028.)

3) Regarding charging stations, EU has proposed collaborating with the United States to develop unified standards for public electric vehicle charging infrastructure. In 2024, EU and the United States plan to jointly introduce a universal international standard for megawatt-class charging systems for heavy-duty vehicles. Currently, China’s charging station standards differ from those in Europe; Europe primarily uses the Combined Charging System (CCS2), while China follows the national standard (GB/T 20234 series). If the cooperation between Europe and the United States results in the adoption of these standards internationally, it could put pressure on China’s electric vehicle industry exports.

4) In terms of data security, the General Data Protection Regulation (GDPR) currently in effect, the Data Governance Act set to take effect in 2025, and the upcoming Artificial Intelligence Act all introduce new requirements for the security of connected devices—including the software and hardware ecosystem of smart cars—and any data entering the EU market.

Who determines the final outcome for the final tariff, and what are their attitudes towards them?

First, we need to understand the decision-making process for the EU’s imposition of tariffs on electric vehicles from China. Initially, the entire investigation will be led by the European Commission, with specific commissioners making recommendations. These recommendations will then be submitted to the European Council, where government representatives from each member state will vote on them. This means that the final approval power lies with the European Council. Unless a specific majority (15 member states representing 65% of the EU population) opposes the recommendations, the proposed tariffs will be implemented on November 4 and will remain in effect for five years.

Positions of EU member states:

Based on previous public opinion and the voting results from July this year, EU member states are currently divided into two camps:

Member states supporting tax increases (France, Italy, Spain and 12 other countries)

France has consistently supported anti-dumping and countervailing duty investigations against Chinese electric vehicles. From an industrial standpoint, French cars are projected to comprise less than 0.5% of the domestic market share in 2023. Consequently, France may perceive that it has little to lose in China; implementing tariffs could also serve to protect its own domestic automobile industry. However, in today’s interconnected global economy, it’s challenging to determine whether such actions offer more benefits than drawbacks. In response, China has announced potential sanctions on EU aircraft and agricultural products, with France’s Airbus and wine industries likely to be targeted.

The situation is similar for Italy. Italian car brands have not reaped significant benefits in China and struggle to compete with German cars in the European market. Therefore, supporting the imposition of tariffs may appear to be an effective strategy to curb the dominance of German brands.

Member states opposing the tax increase (Germany, Sweden, Hungary, and 6 other countries):

Germany, across its industry associations and government departments, has expressed unified opposition to the imposition of tariffs. German car brands such as Volkswagen and BMW currently manufacture electric vehicles in China and sell them to Europe. If the tax is increased, these vehicles will face extremely high tariffs. To protect its domestic car brands, Germany naturally opposes the tax hike. Additionally, China represents the largest single market for Volkswagen, BMW, and Mercedes-Benz, and Germany is keen to avoid provoking a trade dispute with the Chinese market. Notably, the European Commission is considering a significant reduction in tariffs on two Volkswagen and BMW electric models manufactured in China, which could influence Germany’s decision in the upcoming October vote.

Sweden has similar reasons for its stance. China is Volvo’s largest single market, accounting for 24% of Volvo’s global sales. Additionally, Volvo co-founded the high-end electric brand “Polestar” with Geely, primarily targeting the European and American markets. Although Volvo has divested most of its shares, it still retains an 18% stake.

And Hungary. While Germany and Sweden abstained from voting, Hungary, which is actively developing its automotive industry, directly voted against the measure. Hungary might seem like a small, landlocked country in Europe. In terms of natural advantages, Hungary may not measure up to Germany and France. However, under the open policies of the Orban government, Hungary has not only forged close ties with the German automotive industry but has also embraced a Eastern Opening policy, making it the most politically welcoming country in Europe for investment from East Asian nations. In 2022, CATL announced a significant investment in Hungary, and in 2023, BYD officially followed suit, prompting widespread enthusiasm across the entire Chinese battery industry to invest in Debrecen. Currently, China’s investment in Hungary has reached an impressive 7.6 billion euros, making up 58% of Hungary’s total foreign direct investment. It’s evident that Hungary is keen to avoid tariffs that could potentially deter further investments from Chinese companies in the future.

Photo from “Hungarian Conservative”

In terms of the European Commission, here are the key responsible individuals and their respective attitudes

Ursula von der Leyen:

Re-elected as President of the European Commission, Ursula von der Leyen is the primary advocate for the tariff increase on Chinese electric vehicles. Her stance is clearly in favor of this tariff hike. Von der Leyen is currently a member of the center-right European People’s Party (EPP) in the European Parliament, which emphasizes economic competitiveness within its environmental policy. The party believes that the implementation of the Green New Deal should mitigate any negative impacts on Europe’s industrial base and employment. In line with this, it supports increasing tariffs on Chinese imports to protect the local automobile industry. Previously, von der Leyen had already faced dissatisfaction from the EPP due to her efforts to promote the European Green Deal and her cooperation with the S&D group. In last year’s local elections in the Netherlands, farmers protested against the EU’s environmental legislation, leading to a significant loss for the EPP, which saw a 40% reduction in its seats. This further fueled discontent with von der Leyen within the party. In her speech as President of the European Commission in July this year, von der Leyen highlighted the need for the EU to strengthen the autonomy of its supply chain and reduce its dependence on Chinese production. Ursula cited “unfair” competition and the evolving Russia-China relations as factors that have shifted China-EU relations from “cooperation” to “competition.”

Photo from “Aljazeera”

Valdis Dombrovskis:

The current Executive Vice President of the European Commission and Commissioner for Trade is the highest-ranking official in charge of trade affairs within the European Union. The EPP party, which is part of the European Parliament, supports the imposition of tariffs. In a recent interview with the Financial Times, he stated, “It is clear that member states are aware of the need to protect the EU automotive industry because the risk of harm is there. The market share of Chinese electric vehicles is growing rapidly, and this unfair subsidy exists, which is a problem that needs to be solved.” He further mentioned that although some Chinese new energy vehicle companies have established factories in Europe, the EU will be considering the amount of added value created within the Union. He noted that tariffs can only be effectively circumvented if the requirements of the rules of origin are met.

Photo from “Bloomberg”

Margrethe Vestager:

The Commissioner for Competition of the European Commission is responsible for the EU’s competition policy. She is a member of the Renew Europe Group in the European Parliament, a centrist party. Previously dubbed the “antitrust czar” of Europe, she also supports the imposition of tariffs on Chinese electric vehicles. In April this year, during an appearance on a Bloomberg program, she emphasized the need to be cautious of China, stating, “The EU is making full use of trade tools and foreign subsidy regulatory tools to restore fair competition.”

Photo from “CNBC”

Overall, the voices within the EU that support the imposition of tariffs outweigh those that oppose it. While countries with strong connections to the Chinese auto industry—such as Germany, Italy, and Hungary—are concerned about potential negative impacts on their auto sectors from Chinese countermeasures, the broader context of growing global protectionism and populism, as well as the increasing competitiveness of China-EU trade relations, suggests that most EU countries are leaning towards supporting tariffs. France and Italy, in particular, are likely to favor the imposition of tariffs on Chinese electric vehicles.

How will Chinese electric vehicle companies respond to these tariffs and the EU’s subsequent regulatory policies?

In the short term, Chinese companies should promptly conduct risk assessments and engage in lobbying efforts:

1. Quickly understand the EU electric vehicle policies and their corresponding timelines, and identify the products and production processes that may be potentially affected.

2. Gain an understanding of the establishment and certification of carbon footprint mechanisms within the industry, and conduct preliminary investigations into battery recycling systems.

3. Unite its own EU importers and upstream and downstream industries, establish effective communication channels with local governments, and actively engage in lobbying efforts within the EU.

In the medium to long term, Chinese companies can adapt to EU policies and develop strategic business responses:

1. Actively promote localization reforms in the European market. Currently, European consumers exhibit stronger loyalty to local brands such as BMW, Volkswagen, and Audi, and are less familiar with Chinese brands. Notably, Volvo and MG, two of the top three Chinese electric car brands in Europe, are originally European brands that have been acquired by Chinese companies, rather than being native Chinese brands. In 2023, the market share of Chinese electric vehicles in Europe will be only 8.6%, with MG accounting for 5% of this share. Pure electric vehicles from Chinese independent brands will make up less than 2%. The limited awareness among European consumers is largely due to the low market penetration of Chinese local brands, minimal brand marketing, and the scarcity of opportunities for European consumers to interact with these brands. Tesla’s success in Europe, particularly in Norway, can be attributed to its price reduction strategy and the extensive and comprehensive network of charging stations it offers. However, price wars are not a sustainable development strategy. Chinese electric vehicle brands need to make more localized efforts in various areas, including marketing strategies, post-sales service, charging infrastructure, and smart driving software.

Photo from Triunity

2. In addition to tariffs, the EU has implemented a comprehensive set of policies that impose requirements on the green supply chain of electric vehicles. Companies across the electric vehicle industry, from upstream suppliers to downstream manufacturers, need to optimize their production and recycling processes as much as possible. It is crucial for these companies to establish a measurable and verifiable carbon emission reduction platform promptly to help reduce overall carbon emissions.

3. Simultaneously, Chinese EV manufacturers must remain vigilant about the potential market collapse triggered by a price war resulting from the internal competition among domestic auto companies. Currently, Chinese electric vehicles have been stranded at the European port of Antwerp for over 18 months. Weak global demand for electric vehicles may pose a significant threat to the industry.

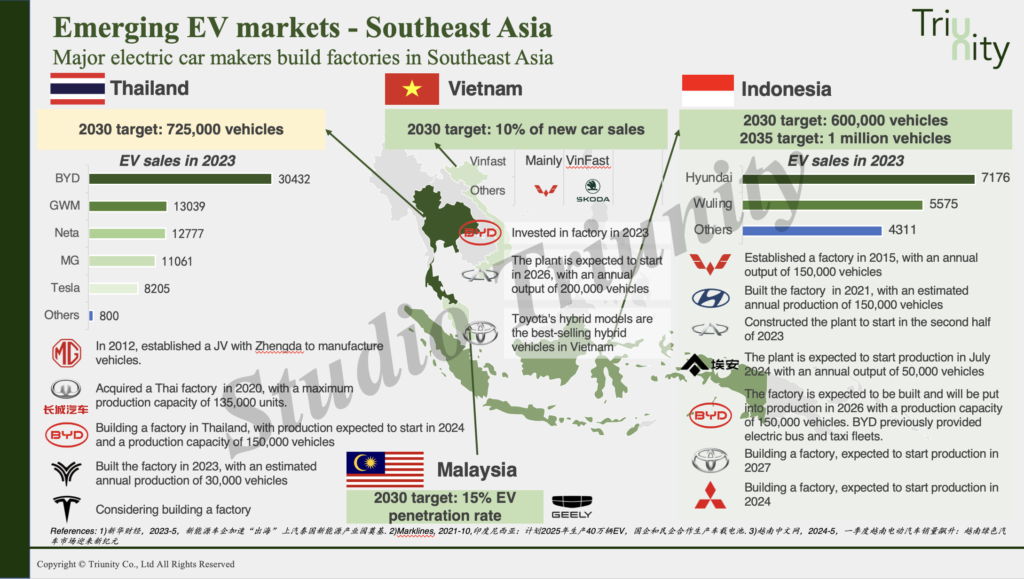

4. Consider the developing markets in Southeast Asia and Latin America. In Southeast Asia, companies like Great Wall Motor, BYD, and Neta have already established factories in Thailand, while Aion and BYD are constructing facilities in Indonesia. But to note here, even though these countries have introduced various subsidies, including import tariffs, consumption taxes, and corporate income tax incentives for electric vehicle companies, the local consumer purchasing power remains relatively low. The majority of vehicles on the roads in these regions are still two-wheeled and three-wheeled vehicles. And for Latin America, BYD and Great Wall Motors have established factories in Brazil, with BYD also planning to build a facility in Mexico aimed at serving the US market. However, it should be noted that Latin America faces significant challenges in infrastructure development. The influx of foreign capital has also led to a labor shortage. As a result, operating costs for factories in Latin America are estimated to be 40-50% higher than those for domestic facilities. Companies entering the Latin American market should be prepared for substantial financial investment and may need to sustain operations at a loss for at least 3-5 years.

Photo from Triunity

The key to success in the EU market lies in a robust localization strategy, including the establishment of manufacturing facilities in Europe. Concurrently, Chinese companies must continue to invest in overseas public relations and lobbying efforts to safeguard their long-term interests against future investigations. Although the price advantage of Chinese electric vehicles in the European market may diminish in the short term, there remains significant potential for Chinese new energy vehicles to expand internationally.

#BYD #Seal #China #EU #EV #EVtariffs #Chineseelectriccarsinvasion #Chineseevcompanies #eubatterylawonchineseev #regionalcompetiveness

References:

1. 欧萌达,2024.6.14,欧盟对中国加征关税,调查文件居然出现了错误

2. 车家号,2024.6.12, 最高加税25%,欧盟针对中国车,最后是中国消费者买单?

3. Al Jazeera, 2024.6.14, For China’s booming EV industry, US and EU markets a tough nut to crack

4. EU, 2023.7.28, REGULATION (EU) 2023/1542 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL

of 12 July 2023

5. 中国发展出版社,2023.9.28,智库视点|新能源汽车拓展欧洲市场面临新挑战

6. 36kr,2024.6.24,电车的出海脚步,关税挡不住

7. 东方财富网,2024.7.19,欧盟或大幅降低大众及宝马两款中国产电动汽车关税

8. Volvo Cars, 2024.1.5, Volvo Cars reports new global sales record in 2023

9. 中国一带一路网,2024.5.3,中国经济信息社发布《共建“一带一路”,新时代新内涵——中国—匈牙利投资合作报告》

10. 欧盟中国商会,2024.7.19,《周·知》| 热点透析:冯德莱恩再次当选欧委会主席 施政纲要四度提及中国

11. 中国电子装备技术开发协会,2024.8.7,关注:欧盟官员:成员国将支持在11月对中国电动车加征关税

12. 观察者网,2024.4.16,欧盟竞争专员泼脏水:我们被中国”耍”了

13. Al Jazeera, 2024.6.14, For China’s booming EV industry, US and EU markets a tough nut to crack

14. Statzon, 2024.3.6, E-Mobility Europe: An Overview of Europe’s Latest Electric Vehicles Data

15. 财经杂志,2024.7.8,21天走访墨西哥七城,中国工厂生存实录

Leave a Reply