By Akira Tsuruta & Yuying Qian, 2025.07.07

Introduction

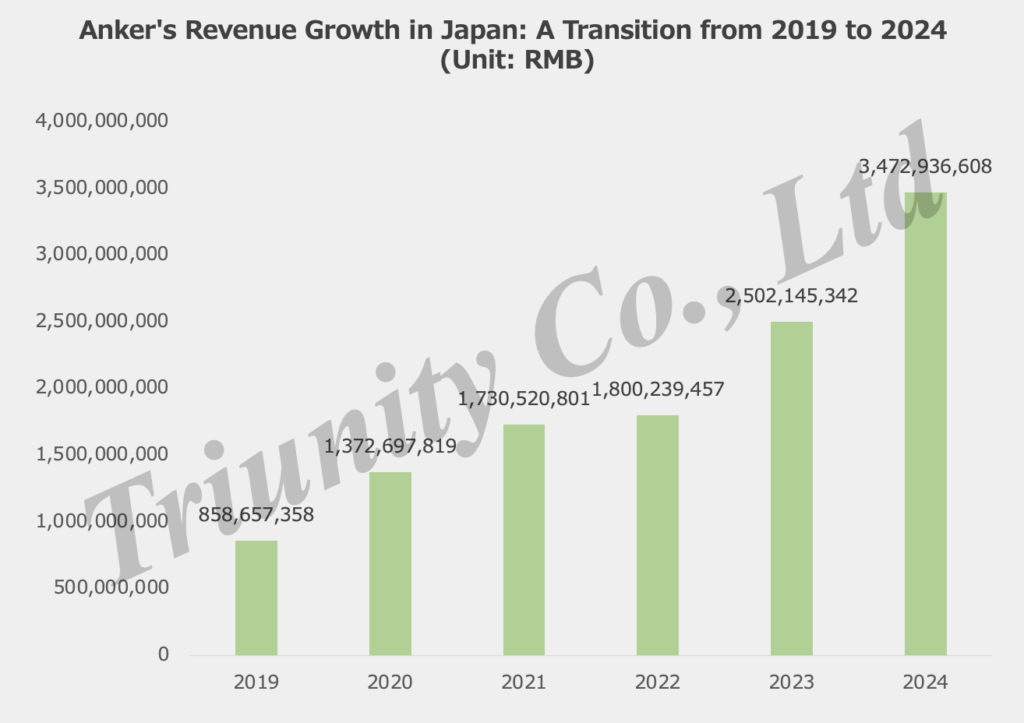

Anker entered the Japanese market in 2013 and swiftly expanded through e-commerce platforms like Amazon and Rakuten. Within five years, its turnover approached 10 billion yen (approximately 490 million yuan). By 2023, Anker’s turnover in Japan soared to approximately 2.50 billion yuan, securing its position as the leading power bank brand in the market.

Figure 1. Anker’s Sales in Japan from 2019 to 2024

Source: 安克创新科技股份有限公司 2020-2024年年度报告

In Japan, where psychological barriers to consumer electronics from developing countries persist partly due to strong loyalty and trust in domestic brands like Sony and Panasonic, Anker has successfully overcome entrenched consumer biases against Chinese electronics, achieving robust brand recognition and a relatively premium market position in highly mature and competitive Japan’s consumer electronics market.

Anker Japan’s CEO, Ayumu Saruwatari, noted, “Building a brand takes time, but it can be destroyed in an instant.” Establishing and sustaining a strong reputation requires a deep understanding of Japanese culture and its consumers. This article examines Anker’s success in Japan by analyzing key factors: strategic brand positioning and targeting, establishment of an independent local team, effective management and analysis of Amazon ratings, and robust user relationship management supported by sincere after-sales service.

1. Leveraging High Quality-to-Price Ratio and Innovative Features for Precise Brand Positioning

Charging products have the limitation of product differentiation, so effective product development and strategic brand positioning are critical to success. Like other global markets, before Anker entered the Japanese market, battery products were limited to major two segments: expensive original batteries and low-cost, low-quality third-party alternatives. Anker swiftly identified this market gap and introduced a compelling third choice—high-quality, affordable products—positioned strategically between premium genuine batteries and inferior low-priced options. The brand commits to delivering exceptional value through durable, reasonably priced products and top-tier after-sales service.

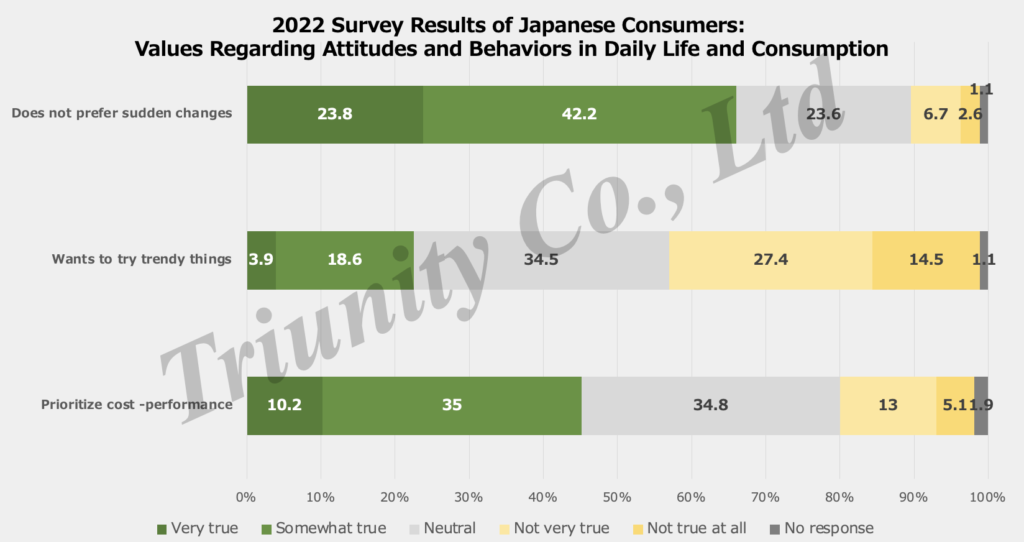

Figure 2. Values Regarding Attitudes and Behaviors in Daily Life and Consumption of Japanese Consumers

Source: 消費者庁. 令和4年度消費者意識基本調査 調査結果の概要. *Some numbers are adjusted by Triunity slightly.

As illustrated in the graph above, Japanese consumers tend to be highly conservative and risk-averse while valuing cost-performance, suggesting that they are a challenging target for new brands. Aligned with other markets, Anker first targeted tech enthusiasts, or “geeks“, as its primary customer base in Japan. They have strong potential to be early adopters, eager to explore innovative products regardless of their origins. In fact, they played a key role in establishing Anker’s initial user base and driving its early success. They are highly discerning and critical when selecting products, carefully evaluating whether they are worth purchasing. They have begun to highly praise Anker products, noting their exceptional cost-performance value.

“Cost-performance is a key factor influencing Japanese consumers’ purchasing decisions. A low price alone is insufficient to attract Japanese consumers; manufacturers must also prioritize performance. So, Anker’s brand positioning matched with Japanese consumer’s demand.”

Alongside its compelling price-to-quality ratio, globally Anker introduced innovative product features early on to drive differentiation and stand out in the market. By closely studying user behavior, Anker identified three key pain points in product design.

- Users owning both Android and Apple devices faced the inconvenience of switching between charging devices. To address this, Anker launched a versatile charger in 2012, compatible with both iOS and Android, supporting 99% of electronic devices on the market and gaining widespread popularity.

- Due to the limited availability of computer charging solutions, Anker introduced a versatile charging socket that simultaneously powers both laptops and power banks. Users don’t need to charge a charger alone and can avoid forgetting to charge it.

- Recognizing the demand for compact and stylish charging solutions among female consumers, Anker launched the first lipstick-shaped power bank in 2014, achieving sales of over one million units.

Figure 3. Anker’s Innovative Product Examples

Source: Anker’s official websites

This reflects Anker’s core marketing strategy in Japan, with Amazon selected as their primary sales channel. As is well known, e-commerce platforms offer the advantage of reducing initial market entry costs. However, the absence of physical touchpoints can hinder consumers’ ability to assess product quality, potentially making it challenging and time-consuming for Anker to establish its targeted brand positioning. Unknown brands tend to be recognized as poor quality, especially when their product price is affordable. Many brands relying solely on online channels struggle to secure a middle- or high-end market position. Let’s examine how Anker successfully achieved this in the Japanese market through the Amazon platform.

2. Establishing an Independent Local Team

To understand deeply Japanese culture and its consumers, Anker has established a fully localized team in Japan, the only market worldwide operated entirely by a local team. Granting the Japanese team significant operational autonomy led to remarkable success. This success stems from Anker’s commitment to aligning its management and operations with Japan’s unique consumer culture.

The Japanese market is distinct from other Asian markets, making it risky to apply strategies from successes in regions like Southeast Asia without adaptation. Japanese consumers’ discerning standards rigorously evaluate products, meaning success in markets like China does not guarantee success in Japan.

It is not advisable to enter the Japanese market without thorough research or to randomly select local partners based on personal relationships or nepotism, delegating all operations in Japan without oversight. Establishing a reliable and competent independent local team is essential for effectively engaging with the Japanese market. (Alternatively, find a trusted consultant.)

Then, let’s examine the actions taken by the local team Anker established to target the Japanese market.

3. Prioritizing Amazon Platform Ratings to Enhance Brand Awareness and Image

Constrained by a limited initial budget, Anker strategically has used e-commerce platforms like Amazon and Rakuten, although e-commerce adoption has been lower in Japan. By securing prominent placements in Amazon’s product category rankings, Anker boosts brand visibility and successfully transitions from unbranded to branded products, enhancing its market presence. The rankings in Amazon’s product categories shift rapidly, yet Anker consistently secures top spots across multiple categories, a testament to years of cultivating “subtle differences.”

Figure 4. Example of Amazon’s Product Ranking in the Mobile Charger Category

A critical key performance indicator (KPI) is customer reviews on Amazon, as Japanese consumers heavily rely on these reviews when making purchasing decisions. Their conservativeness may lead to this behavior. Anker has opted to manage this critical function in-house rather than outsourcing and allocated nearly half of its workforce to customer service, handling millions of cases annually.

Japanese consumers, including tech enthusiasts, highly value ratings, which helps save on advertising costs in the initial stages and serves as an effective way to promote products. This is why some resort to posting fake reviews. According to the Sakura Checker, the website to check whether comments are true or fake, in the AC charger category, poor-quality products with fake comments make up 58% of the market, so consumers must exercise great caution when selecting a product. However, Anker Japan’s CEO emphasizes medium- and long-term brand asset growth over short-term popularity. Strict internal controls, including a complete ban on employees commenting on any products—Anker’s, competitors’, or others—prevent false reviews. While fake positive reviews may boost sales briefly, they risk eroding consumer trust.

Fake reviews from foreign suppliers often raise suspicion among consumers due to unnatural word choices and grammatical errors, which can deter purchases. In Japan, tools like Sakura Checker (サクラチェッカー) help identify fake comments on e-commerce platforms. Even if reviews use proper Japanese, manipulating feedback can backfire and harm brand reputation, as savvy consumers are likely to detect and share such deceptive practices. Therefore, comment manipulation is strongly discouraged.

Figure 5. Image of Sakura Checker

Link: https://sakura-checker.jp/

4. Analyzing and Incorporating Customer Feedback to Enhance Products and Services

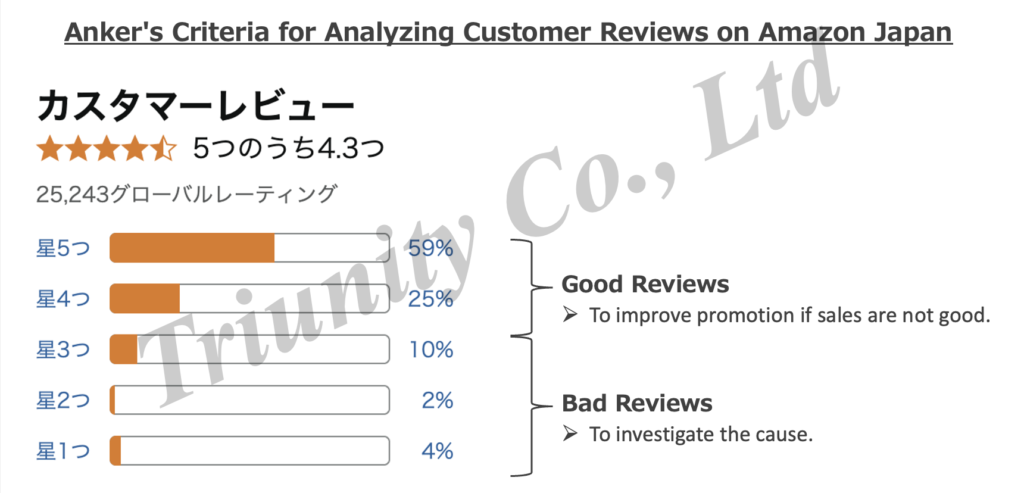

Each customer review is meticulously analyzed, with insights promptly relayed to the development and quality control teams, enabling swift product enhancements and improved post-purchase experiences. For instance, on Amazon, Anker categorizes reviews with 1 to 3 stars as “bad reviews” and those with 4 stars or higher as “good reviews.” (Note: Japanese consumers tend to be more reserved in giving five-out-of-five ratings compared to Chinese consumers.)

Figure 6. Anker’s Criteria for Analyzing Customer Reviews on Amazon Japan

The local team proactively analyzes reviews, assessing the proportion of star ratings and delving into the specifics of product feedback. If a newly launched product receives a bad review, the product team promptly investigates the cause. Conversely, if a product earns good reviews but fails to sell, the issue may lie in promotion, prompting Anker to collaborate with the marketing team to refine strategies and drive improvements.

For the Anker Group, customer support is more than just a service department; it is a vital team that values customer feedback and actively leverages it to enhance products and services. By attentively listening to customer feedback and genuinely addressing their needs, Anker delivers innovative solutions to its customers.

5. Maintaining User Relationships to Uphold a Strong Brand Image

The Japanese market prioritizes after-sales service far above the global average. Even minor customer complaints can have worse impacts compared to other markets. Consequently, exceptional after-sales service is critical in Japan, particularly given the conservative stance of Japanese consumers toward product quality. During my time in the department store industry, I frequently visited customers’ homes to address their post-purchase concerns, resolve issues, and ensure their satisfaction through direct communication. For online purchases, I once traveled 200 km over four hours for a face-to-face meeting with a customer. While this may seem distinctly Japanese to outsiders, such dedication is crucial for upholding our brand’s reputation, sometimes referred to as “noren”, which symbolizes trust and quality.

Figure 7. Noren, the traditional Japanese shop curtain, serves as the welcoming face of a store, embodying its brand identity and heritage.

As noted, Anker dedicated almost half of its staff to customer service, managing millions of cases each year. It prioritizes swift responses, recognizing that prompt and courteous replies foster a sense of trust in customer support and strengthen the brand. Drawing from the author’s experience in the Japanese service industry, prompt responses are a critical factor in maintaining high customer satisfaction levels in Japan. Companies had better ensure sufficient staffing or implement AI systems to deliver prompt initial responses.

Additionally, Anker offers an 18-month warranty on Amazon, instilling confidence in buyers. This strategy has solidified Anker’s successful brand positioning, driving increased sales and higher Amazon rankings, which in turn boost brand awareness, creating a virtuous cycle.

Good after-sales service can improve customer satisfaction level and customer retention rates. Also, some blogs mentioned their writers’ experiences in Anker’s after-sale services can be found, which mention them positively and contributed to its successful branding.

Conclusion

Once Anker captures the loyalty of Japanese consumers, they are unlikely to switch brands, as customer switching costs are high. Similar to Apple’s dominance in the Japanese smartphone market, Anker can maintain a strong customer share in the mobile charger category. Additionally, satisfied customers begin recommending products to others. Buzz and word-of-mouth (WoM) among tech enthusiasts can spread on social media, attracting mainstream consumers and sparking a surge in popularity. Third-party endorsements are more trustworthy and impactful than a brand’s self-promotion, while also being more cost-effective.

A successful brand has the potential to dominate its market and expand into new product categories. After effectively establishing its brand, Anker is broadening its product range, significantly increasing its revenue.

Triunity provides expert consulting and training services to build a strong local team tailored to the Japanese market, ensuring effective service management and culturally aligned training. If launching a local team seems cost-prohibitive initially, Triunity can help you understand the Japanese market’s unique consumer behavior and cultural nuances through our advisory and research services. For any questions or inquiries, please feel free to contact us.

If you enjoyed this article, we also recommend: Can HEYTEA inspire Japanese consumers?

References

[1] 安克创新科技股份有限公司 2020-2024年年度报告

[2] 消費者庁. 令和4年度消費者意識基本調査 調査結果の概要

[3]日本流通产业新闻,2018.7.26,【アンカー・ジャパン〈アンカーダイレクト〉 井戸義経社長】Amazon特化が奏功、5年で売上高100億円射程に

[4]新浪财经,2024.4.25,安克创新:2023年年度报告

[5]ecnomikata,2021.10.1,AnkerのD2Cはいかにして成功したのか。「顧客体験」を起点にした事業戦略とは

[6]Medium,2020.7.19, 亞馬遜「傳奇」Anker的日本市場進入模式

[7]36ke出海,2024.7.4,36氪出海·洞察|独特的日本生态,不变的慢热和耐心

[8]出海指南,2024,海外收入破百亿,为什么Anker可以从一个普通的跨境卖家成长为全球知名品牌

[9]Marketing Native,2021.12.7, 『ブランディングの科学2』からひもとく、200億円企業「Anker」成長のポイント【みる兄さんが話題のプロダクトを考察する連載・第4回】

[10]Careerhack,2021.8.2, 売上9億円から200億円超へ。『Anker』躍進の立役者、猿渡歩が雑居ビルから切り拓いた先に見る景色

[11] Marketing Native,2023.12.14, 数字とロジックだけじゃない、アンカー・ジャパン 圧倒的強さの秘密【猿渡歩×みる兄さん】

[12] voc.AI. 急成長を続ける「アンカー・ジャパン」のファンを創出するカスタマーサポートのAI活用

[13] サクラチェッカー

[14] Amazon.jp

Leave a Reply