By Akira Tsuruta, 2025.03.17

Intro

In our previous blog, we discussed Japanese consumers’ preference for subtle, natural sweetness in food and drinks, avoiding overt sugar. This aligns with China’s new tea brands’ health-oriented approach, like HEYTEA. By emphasizing natural fruit sweetness, fruit tea brands can capture the Japanese market, similar to the bubble tea trend from 6-7 years ago. In February 2025, HEYTEA opened its first store in Japan at Doton Plaza, Osaka. Today, I analyze HEYTEA’s marketing strategy in Japan. (For information on Japanese consumers’ preferences regarding sweetness, please refer to our previous article: How to Satisfy Picky Japanese Consumers on Sweetness Level)

Figure 1. HEYTEA’s first store in Japan in Osaka

1. The ‘New Style’ Tea Market in Japan: Still in Its Infancy

1-1. Japanese tea culture

Like Chinese, Japanese consumers regularly drink Japanese tea and Chinese tea without adding sugar, except black tea. According to a survey conducted in 2023 by Japanese marketing research firm Cross Marketing, Green tea is the most popular beverage, with its consumption increasing among older age groups. Barley tea and black tea are also widely enjoyed. Rooibos tea is particularly popular among women.

Figure 2. Top 8 types of tea Japanese consumers usually drink in 2023

Source: Cross Marketing’s survey

The most common way to enjoy tea is from a plastic bottle, though tea bags are also a popular choice. In contrast, individuals in their 60s are more likely to brew tea using a teapot or strainer. In this survey, approximately 30% of respondents stated, “I can’t live without tea and only about 10% clearly said they don’t need tea. “ Thus, tea is essential to Japanese life.

1-2. Tea or Coffee in Japan

Tea and coffee are both popular beverages in Japan, but coffee consumption currently appears to surpass tea. In 2022, Japan consumed about 433,000 tons of coffee beans compared to around 74,000 tons of green tea and nearly 15,000 tons of black tea. While green tea holds significant traditional value, cultural influences from cafes and modern lifestyle changes have boosted coffee’s popularity, making it a common choice for breakfast and work.

According to the survey of 550 office workers drink coffee or tea on a daily basis by Hario Group, 65.5 % of office workers have a coffee or tea after launch break. 67.5% chose coffee, while 15.6% preferred tea. (Sources: コーヒーステーション (Coffee Station)). Given other reports and my Japanese friends’ consumption behaviors, in Japan, coffee drinkers are in the majority compared to tea drinkers. Consumers’ perceptions may play a role in this result. Japanese people often drink Japanese or Chinese tea without much thought, much like water, during tasks or to quench thirst. In contrast, coffee is typically chosen for a break or refreshment. This suggests some Japanese may unconsciously drink tea daily, while consciously choosing coffee for specific purposes. For example, I often choose Suntory’s Oolong Tea over water at convenience stores, and though I consume more tea, I consider myself a coffee drinker. New types of tea that are consciously chosen by consumers will face competition mainly from coffee, particularly from cafes, rather than from existing tea products.

1-3. Any difference between Japan and China

As coffee culture spreads, “new style tea” may find it challenging to enter the market. A key difference between Chinese and Japanese markets is the extent of coffee culture adoption. Japanese consumers have a longer history with coffee since 1960s than Chinese consumers, making it tougher for new style tea to gain a foothold in Japan.As mentioned in the previous article, Chinese Coffee Chains Going Oversea, “Grab-and-Go, Digitalized Coffee Life”, in Shanghai, bubble tea like Yidiandian (一点点) spreads earlier than Luckin coffee in my classroom although Starbucks already entered the market. In China, chain stores of coffee and new tea stands emerged almost simultaneously, but in Japan, new style tea must compete with the ubiquitous Starbucks, entrenched in daily life. Consequently, new style tea faces tougher competition from cafes like Starbucks and Blue Bottle among Japanese consumers compared to Chinese consumers. HEYTEA might need to convert coffee drinkers to tea or encourage them to occasionally choose tea in Japan. Entering the Japanese market appears more challenging than in China or other Asian regions, aligning it closer to Western markets like Europe.

1-3-1. Taste-related differences

Also, as we mentioned the preference of sugarless beverages as mentioned in our previous article: How to Satisfy Picky Japanese Consumers on Sweetness Level, generally, Japanese people do not add milk and sugar to Japanese or Chinese tea excluding black tea, which is different from the current new tea style in China. According to the survey above, regarding taste preferences, just under 30% of people say they prefer sweeter flavors, while only 20% express a liking for drinks with milk. It can be assumed respondents who said adding milk to tea means they sometimes add milk not to Japanese or Chinese tea, excluding black tea, but to black tea. Alternatively, it could refer to the case of having bubble tea.

From a Chinese perspective, Japanese consumers often seem to have more traditional or monotonous preferences and may not be as accustomed to complex or blended flavors as Chinese consumers. This can pose challenges when introducing innovative products, such as cheese tea, to the Japanese market. When I first encountered cheese tea in Shanghai with my Japanese friends, we initially felt hesitant and found the idea a bit awkward. However, after trying it at the suggestion of my Chinese friends, I discovered that it’s actually quite delicious and quickly became a fan.

1-3-2. Consumption Scenario-related differences

As described before in this blog: Chinese Coffee Chains Going Oversea, “Grab-and-Go, Digitalized Coffee Life”, takeaway options like Grab-and-Go with digital payment have not yet become widespread, although some bubble tea stands remain after the bubble tea boom ended around 2019 and brands like The Alley and Gong Cha have entered the market. One of the barriers to using takeaway services is the scarcity of trash cans in public places, which makes it inconvenient for consumers to enjoy food and drinks on the go.

Also, they are not so much familiar with delivery service of teas as Chinese consumers partly because of expensive delivery costs due to the higher labor costs. Japanese consumers primarily purchase tea from convenience stores, which offer a wide range of tea products. Or using bending machine where can be found everywhere in Japan is main channels to buy drinks especially on school or campus.

In terms infrastructure, many Japanese live in a house and not live in the community building like Xiaoqu (小区),it may be more difficult to open a tea stand in a residential areas than in China. Café like Starbucks tend to open their stores in shopping malls or near stations, which can create a physical and psychological distance between consumers and products. In Japan, I scarcely have the idea of ordering or grabbing coffee from places like Luckin or Starbucks on weekends when I was chilling at home because they were too far away and there were no affordable delivery options. Instead, I either made coffee myself or purchased coffee or ready-to-drink products from a nearby convenience store, like Lawson.

Figure 3. Typical residential areas in Japan

1-4. New Style Tea market is immature yet in Japan

Currently, new style tea market in Japan is still at the initial stage, which can be considered an opportune moment for new style tea brands to venture into the Japanese market. Previously, the Japanese market experienced a bubble tea fad around 2019, particularly among female teenagers and young female adults in their 20s. As the bubble tea became widely available downtown, its emotional value, novelty, as new fashionable products among the younger has waned. Moreover, the strict COVID-19 restrictions and lockdowns led to a drastic reduction in the bubble tea stands following this craze. However, unlike the previous tapioca boom before 2000, some bubble tea brands have established in the Japanese market through this fad. Gong Cha has 178 stores, The Alley has 11 stores, and CoCo has 6 stores in Japan. Although Naixue withdrew from the Japanese market, the recent entries of MIXUE Bingcheng (蜜雪氷城) and HEYTEA suggest that it’s a good time for new style tea brands to enter the Japanese market after the Covid-19. Given the recovering and increasing numbers of Chinese tourists to Japan, by targeting at them, these brands can get a certain revenue. (For ideas about targeting at consumers from home country, please refer to our previous article: A Taste of Home – Diaspora, Gateway to Penetrate New Market ) .

Additionally, while products like lemon tea and peach tea can be found on convenience store shelves in Japan, fruit teas generally lack real fruit particles, and their packaging is relatively simple. In contrast, HEYTEA’s fruit tea and similar kinds of products in other brands can be quite competitive in the Japanese market due to their appealing product presentation. We spoke with some Japanese friends in Shanghai, and most of them agreed that HEYTEA’s fruit tea has a photogenic appearance, which Japanese consumers would take a photo and post it on Instagram.

Figure 4. Photogenic picture of HEYTEA’s product from their Japanese X account

Existing brands like Gong Cha and Coco have already started selling fruit tea in Japan, and last month, HEYTEA finally opened a store in Osaka. Let’s take a look at HEYTEA in Osaka.

2. HEYTEA in Japan

2-1. HEYTEA’s current strategy

HEYTEA has opened over 70 stores across eight countries, including Singapore, the UK, Canada, Australia, Malaysia, the United States, South Korea, and Japan, in addition to locations in Hong Kong and Macau, China. They might find it challenging to enter the Japanese market due to supply chain issues related to fruits and a coffee-drinking culture, similar to that of Europe. Thus, after successfully entering Europe, they finally opened Osaka store although they started their overseas expansion from Singapore in Asia.

In its overseas expansions, HEYTEA aims to offer authentic quality tea and inspire joy among a broader audience by blending traditional Chinese tea culture with contemporary consumer demands, thereby providing a modern Chinese tea culture experience. The following factors are commonly observed in overseas stores.

- HEYTEA use ingredients like real milk, authentic tea, fresh fruit, and pure cane sugar. The quality is carefully selected, and the taste is meticulously controlled to offer consumers a fresh, healthy, and uniquely delicious experience. They highlight Hokkaido Tokachi Milk (北海道十勝牛乳), which is assosiated with ‘good quality milk,’ as an ingredient in the Osaka store.

Figure 5. Highlighting Hokkaido Tokachi Milk on the HEYTEA’s app and mini program

- HEYTEA incorporate a ‘tea-zen’ experience into their design, seamlessly blending Eastern and Western cultures in the aromatic embrace of tea. In Osaka store, the store design cleverly integrates the traditional Japanese garden art “karesansui (枯山水)“, which is related Zen.

Figure 6. Inside of HEYTEA’s Osaka store

Source: HEYTEA Japan’s Instagram

- Most of its stores are situated in world-renowned iconic cities, primarily within local core business districts. Additionally, in the initial stage, they can target Chinese expatriates and tourists, as several locations are conveniently positioned near Chinatowns. Dotonbori street (道頓堀) in Osaka has myriads of Chinese tourists, which can be targeted by HEYTEA store. (For information about HEYTEA store in the U.K. and ideas about targeting at consumers from home country, please refer to our previous article: A Taste of Home – Diaspora, Gateway to Penetrate New Market ) .

- HEYTEA has introduced city-limited refrigerator magnets in line with the opening of new stores. These magnets blend classic local cultural and geographical elements with the iconic HEYTEA logo. For the Osaka stores, a magnet featuring Takoyaki, the city’s iconic soul food, was introduced.

Figure 7. Screenshot of HEYTEA’s city-limited refrigerator magnets of Osaka store

2-2. Concerns and proposals about HEYTEA’s Osaka store

2-2-1. Aggressive pricing

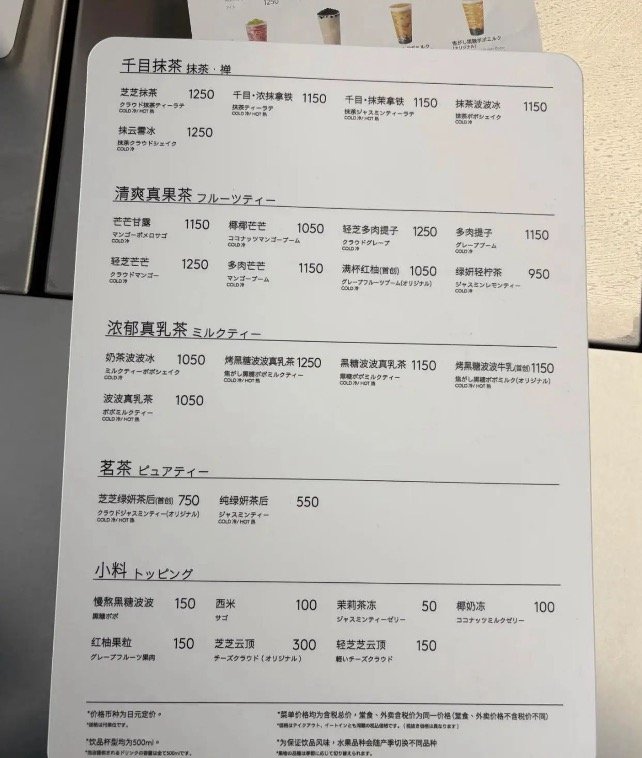

HEYTEA’s Osaka store features a diverse selection of classic offerings, including the Thousand Eyes Matcha series (千目抹茶), Real Fruit Tea series, and Milk and Green Tea series, among others though a number of types of products are more limited than China.

As mentioned by many media, one of the biggest concerns is their super-high pricing. The price of a drink ranges from JPY 1,000 to 1,300, while pure tea is priced between JPY 550 and 750, while Gong Cha’s Peach Alisan Tea Ade is around JPY 500 (*it does not seem to have many flesh of fruits inside.) and Starbuck’s Latte is also around JPY 500. In Osaka, JPY 1,000 is sufficient to enjoy a good lunch set. This can build a barrier against local customers to enjoy new products.

Figure 8. Screenshot of Hey Tea’s menu on mini program

However, I don’t oppose this high-end positioning of HEYTEA in Japan.

Firstly, it should be difficult to offer cheaper prices while keeping HEYTEA’s good quality in China. With Japan’s domestic fruit self-sufficiency rate at less than 40%, the cost of making fruit tea in Japan—whether using locally grown or imported fruits—will be several times higher than in China.

In an earlier interview with ZUU online about 8 years, Reiko Beta, the Japanese partner of TWG—a high-end Singaporean tea brand that chose Japan for its first overseas store in 2010—remarked, ‘Japanese customers are looking for high-quality products and are willing to pay for them, but many gourmet brands prefer to stay within the mainstream market and overlook the needs of quality-focused consumers.’ Given this insight, it can be reasonable that HEYTEA takes a high to middle -end market position in Japan by offering high-quality tea, fresh fruits, and milk in Japan.

Furthermore, Japanese consumers regard fruits as expensive and often use them as gifts. Since the fruits in the product are visible from the outside of the cup, this presentation can justify a higher price. HEYTEA’s cheese milk cap also should be priced higher. Considering Japanese consumers may initially perceive the cloudiness of cheese and tea blended together as unusual or even unappealing, if unknown foreign brands introduce innovative products at lower prices, conservative Japanese consumers might find them weird and may choose to avoid them. To attract early adopters, their high premium pricing is understandable.

Yet, 4 digits look too high for Japanese consumers. HEYTEA had better save price blow JPY 1,000 though it is tough to keep its good quality. One solution is that they can offer smaller size to cut the price. The most popular size of Starbucks in Japan is tall size (350ml), so the current 500 ml size of HEYTEA can be too big for Japanese consumers, especially female consumers. If HEYTEA can develop smaller size of products, they can reduce and localize the price while still taking high-end positioning.

Also, cross-boarder branding with luxury brand as they did with Fendi can help local consumers get persuaded to purchase expensive products. Though, since Japanese consumers appear less focused on brand logos compared to Chinese consumers, the initiative may need to explore alternative ways to engage with them.

2-2-2. Better to avoid prioritizing the promotion of Matcha products

When looking at mini program app of HEYTEA’s Osaka and their menu at the store, Matcha products are at the top of the list. It seems they prioritize matcha-related product to sell at this store. If targeting at mainly Chinese tourists, this will work well because Matcha is a kind of Japanese representative product flavor.

Figure 9. HEYTEA’s menu at Osaka store

However, pushing matcha products should not be prioritized to target local customers. Firstly, matcha is Kyoto’s representative flavor and it may be a bit mismatch with Osaka’s taste. As a consumer, I don’t select Matcha flavor after eating Osaka’s rich source flavor food and street snacks. It seems to heavy to combine both. More interestingly, based on my 10-year-retail experience, local consumers don’t prefer matcha so much unexpectedly. Especially, Kyoto people who often go shopping in Osaka don’t like matcha so much. Basically, matcha flavor-products are for domestic or international tourists.

If you are Chinese, “Do you wanna eat Japanese Yángròu chuàn (羊肉串, mutton kebab) in Beijing?” You may try it but should not be your priority. Why Japanese local consumers choose Japanese representative products, matcha, when entering Chinese brand stores in Japan? Of course, matcha flavor products have a large potential to be popular among even local consumers. But, when HEYTEA introduces their brands initially, they should push their photogenic fruit tea or milk tea to young female consumers. In terms of taste, the emphasis could be on low-sugar versions of fresh fruit tea, fruit vinegar, and fresh milk tea. The idea of Japan associated with Matcha is a bit simplistic. Given that matcha products are everywhere in Japan sightseeing locations, to differentiate from others, they should promote other types of products.

Plus, since the Japanese frequently buy teas at convenience store, HEYTEA also can sell RTD products and raise their awareness among Japanese consumers. Their RTD products, Light Fruit Tea (轻果茶) & Strong Fruit Tea (浓果茶) , have a potential in Japanese market.

Figure 10. HEYTEA’s Light Fruit Tea (轻果茶)

2-2-3. Waiting line management: Need much time for Japanese consumers to embrace the HEYTEA Go concept

According to Japan-China Catering Industry Exchange Promotion Association’s article, some customers reported experiencing confusion and queue-jumping during the ordering and pick-up process, which significantly detracted from their overall experience. There are two core issues behind this.

Firstly, as widely known, the Japanese highly value social manners in a public place. Basically, they orderly wait in line in front of the store when purchasing popular products, but skipping order sometimes happen with or without their intention. Because waiting in line in an organized manner can be stressful even for Japanese customers, when some customers cut in line, people who are skipped feel offended and even can get furious, leading to customer’s frustration and dissatisfaction. When I worked as the floor manager of the department store, waiting line management is crucial to ensuring customers feel comfortable.

Secondly, as mentioned above, Japanese customers are not accustomed to preordering and prepaying through an app, allowing them to grab products without waiting a line although the method is convenient. As a result, they should feel they are bypassed when other customers pick up their pre-ordered items. This can lead to negative experiences and impressions. (For insights about grab and go, please refer to our previous article: Chinese Coffee Chains Going Oversea, “Grab-and-Go, Digitalized Coffee Life”)

Therefore, store staff should carefully manage the waiting line and promote their HEYTEA Go app while also educating customers on how to use the pre-order system. This helps to prevent any customer discomfort.

Figure 11. Waiting line in front of HEYTEA’s Osaka store

3. Looking Ahead

The news of HEYTEA’s new store opening in Osaka has sparked considerable discussion among netizens and business people in China. Their marketing strategy has received mixed reviews, with some expressing pessimism and predicting that HEYTEA might follow the same path as Naixue, which has already withdrawn its Osaka store from Japan. However, I optimistically expect their future success in Japan. HEYTEA’s strength is not only cheese tea, fruit tea, or promotion like cobranding, but also innovative product developments. They would develop localized popular products in Japanese market and inspire Japanese consumers. Also, becoming popular in Europe and the U.S. market, like California, can help their marketing activities in Japan. We will keep an eye on HEYTEA’s marketing activities in Japan.

References:

[1] 日本时事. 东京留学生活小助手.2025.02.25.【日本时事】喜茶日本首店开业!150平门店入驻大阪黄金地标

[2] Cross Marketing. 2023.10.12.お茶に関する調査(2023)

[3] PR TIMES.2024.10.29. 【コーヒー派 VS お茶派】職場の飲み物、約7割が「お茶」より「コーヒー」派!

[4] コーヒーステーション (Coffee Station)

[5] 全日本コーヒー協会.2025.03.03. 日本のコーヒー需給表.

[6] Statistia. 2024.04.05. Green tea consumption volume in Japan from 2013 to 2022

[7] Statistia. 2024.04.05. Black tea consumption volume in Japan from 2013 to 2022

[8] 霞光社ShineGlobal. “平价之光”蜜雪冰城,盯上了日本年轻人.

[9] ニッセイ基礎研究所. 廣瀬 涼.2020.11.16. 第3次タピオカブームを振り返る.

[10] 36Kr Japan. 2023.03.18. 中国発激安ティードリンク「MIXUE」、日本に上陸。タピオカブーム終焉の日本で果たして成功できるか

[11] 证券时报. 2025.02.19. 奶茶店“出海”!头部新茶饮大动作频频

[12] Product Iden GmbH. 2025.03.01.行业观察 | 喜茶出海及其品牌策略.

[13] 品牌声呐. 2025.03.06. 喜茶在大阪当“奶茶刺客” | 大声

[14] Rentio Press. hirata.h.2024.12.13.スタバのサイズと値段は?読み方や頼み方も紹介!ベンティはお得なのかも解説

[15] 日中餐饮产业交流促进. 2025.02.21.喜茶日本首店开业盛况空前,顾客体验后两极分化.

[16] ZUU.online.2016.01.24. 高級ティーブランド「TWG Tea」が日本で人気の理由.

[17] FoodTalks.2023.04.16. 喜茶推出“轻果茶”新品:葡萄黑加仑乌龙茶、柚柚铁观音乌龙茶.

Leave a Reply