by Akira Tsuruta, 2024.10.25

Intro

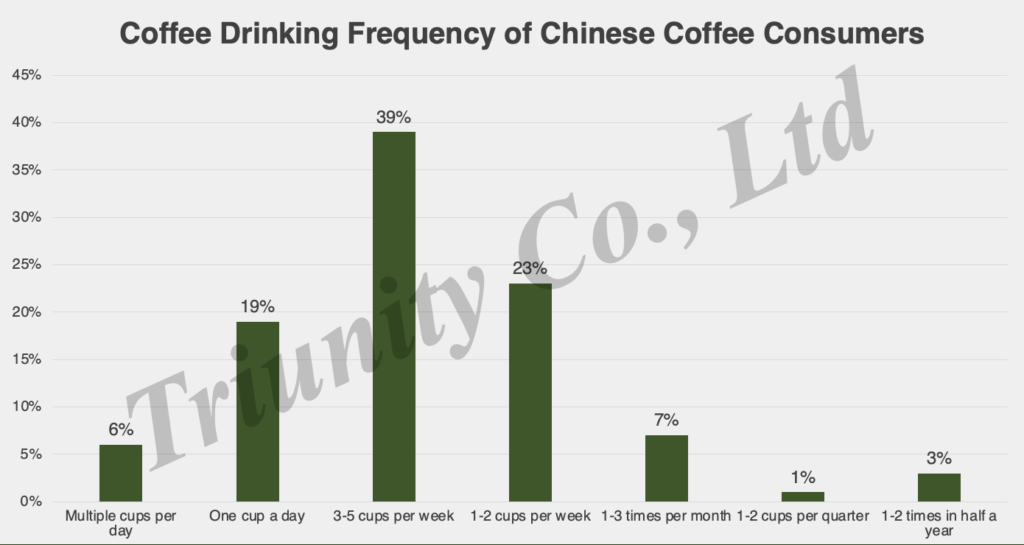

When I arrived in Shanghai in 2017 for business school, a Japanese senior advised me to bring instant coffee from Japan. It was cheaper in Japan and quality coffee was scarce near the school, except for Starbucks, which cost 30-40 RMB per cup and was pricier than in Japan (I remember that I had many options of black coffee which cost 5RMB – 30 RMB in Japan.). In 2017, bubble tea was popular among my classmates, but in 2018, Luckin Coffee’s rise shifted their habits to drinking coffee daily. In my second year on campus, during class, friends often invited me to join Luckin Coffee orders using discount coupons for drinks like Lattes or Americanos, which cost about 10-20 RMB per cup. I no longer needed to suggest that my junior classmates bring instant coffee from Japan. CBN Data shows that most respondents of their consumer survey now drink coffee weekly, with about 25% enjoying at least one cup daily. Chinese consumers have shifted from seeing coffee as just a functional boost to appreciating it as a source of pleasure. Coffee is increasingly becoming a way for consumers in China to relax and heal.

Figure 1. Coffee Drinking Frequency of Chinese Coffee Consumers as of 2023 April

Data source: CBNData 2023 April coffee drinker survey, “How often do you drink coffee in the past six months?”

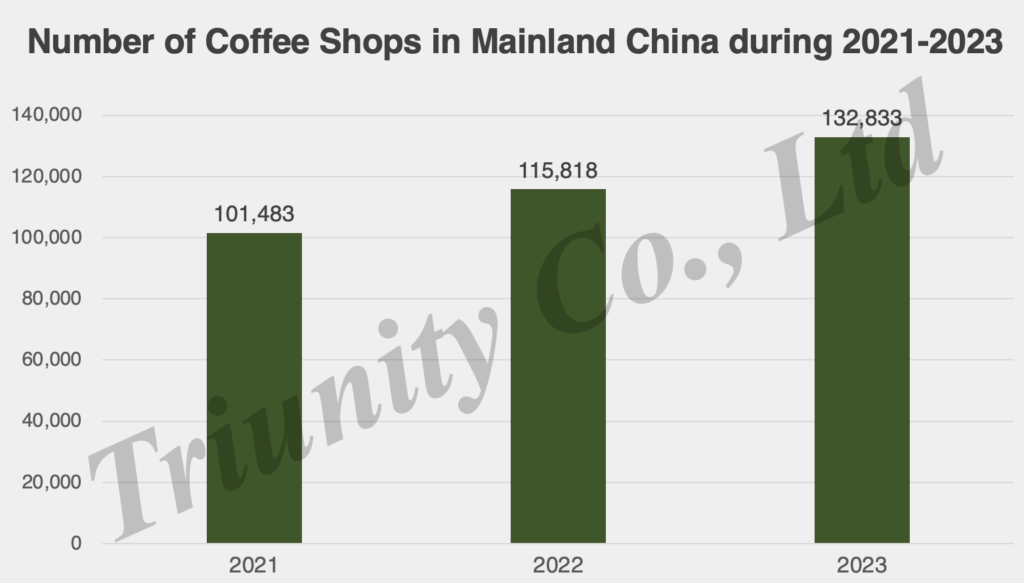

After graduation, I began noticing many new café chains in my daily life in Shanghai. Meituan Data points out that Shanghai has 8,530 coffee shops in 2023, becoming the city the highest number of coffee shops in the world, according to the 2023 China Urban Coffee Development Report. In addition to Luckin Coffee and Starbucks, Manner Coffee and Cotti Coffee caught my attention.

Figure 2. Number of Coffee Shops in Mainland China During 2021-2023

Data source: Meituan data

Unexpectedly, I developed a habit of drinking more coffee from cafés in Shanghai than I did when I was in Japan, with their unique and convenient OMO (Online Merges with Offline) features, especially for takeaway. In the morning during my commute to the office, I order a hot latte or iced Americano through Manner’s WeChat Mini-program (approximately 15-25 RMB per cup). I pick it up without any wait on the first floor of our office building before heading up to my office. Many businesspeople in Shanghai seem to share the same habit, called “Grab-and-Go” for freshly-brewed coffee in this article, which is quite different from my experience in Japan around 2015, when I purchased an Americano at Seven Eleven and served myself. It seems that many of my friends in Japan still maintain this habit today, as there are fewer cafés that focus on takeaway in Japan.

Figure 3. A screen shot of Manner Coffee Wechat Mini Program in China / 7-Eleven’s self-serve coffee machine in Japan

This change in habits among businesspeople in Shanghai, including myself, has been driven by the integration of offline and online store operations, along with aggressive discount promotions, improvements in coffee product quality, and the development of new products like Coconut Latte, Brown Sugar Bobo Tea Latte, and Maotai Latte by Luckin Coffee. As a result, the Chinese coffee market has experienced the rapid growth, with the freshly-brewed coffee and café sectors particularly standing out. In 2023, the total number of domestic coffee consumers is projected to reach approximately 399 million, with a consumer penetration rate of 28.30%, according to Huaon.com.

One key question I have is how or where to expand this business model beyond China. The article focuses on the expansion of the Chinese cafe chains into overseas such as the Southeast Asian market.

Trend of Overseas Market Expansion in the Asia-Pacific Region, particularly the Southeast Asian market.

Currently, some of Chinese café chains are targeting overseas expansion while also extending their domestic presence from tier 1 and tier 2 cities to lower-tier cities. In March 2023, Luckin Coffee entered Singapore as its first oversea venture. The Singapore market can be considered a testing ground for overseas operations and for developing business models, particularly when expanding into the Southeast Asian market. As of August 2024, it has 38 directly run stores in Singapore. It has also been reported by Latepost, a unit of Caijing Magazine, that Luckin Coffee is planning to expand overseas with a focus on Southeast Asia and the United States. Additionally, since 2023, COTTI COFFEE, which is founded by Luckin Coffee’s founding team, has grown quickly and is now present in 28 countries and regions, covering Singapore, Indonesia, Thailand, Vietnam, Malaysia, Philippines, Japan, Korea, Canada, and Middle East. Also, in a September interview with 36Kr, the coffee chain brand NOWWA announced plans to expedite its expansion into overseas markets within the next month. Beyond Southeast Asia, a popular target for international growth, NOWWA also aims to enter the North American and European markets.

To compete with local brands and global brands like Starbucks, what kinds of strategy should Chinese coffee chain take it? What’s their advantage?

Uniqueness of Chinese Coffee Chain: “Grab-and-Go” for freshly-brewed coffee

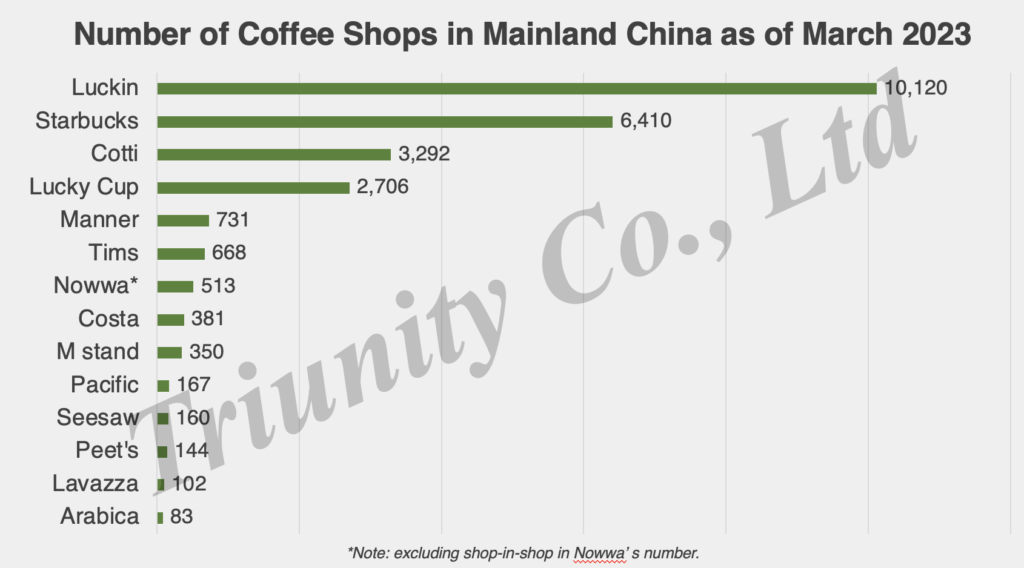

By comparing Chinese domestic brands with Starbucks, the strengths and weaknesses of the Chinese brands become apparent. Luckin Coffee outnumbers Starbucks in terms of the stores in China with its more affordable prices and diverse product offerings.

Figure 4. Number of Coffee Shops in Mainland China as of 2023

Data source: Meituan data

In my opinion, most consumers—except for those who are truly passionate about coffee—likely cannot accurately distinguish the taste or quality of different coffees if the quality of a product exceeds a certain threshold, much like with wine products. We simply consume information. You can discuss coffee quality with friends to determine which coffee brand is better, but these perceptions are often unclear and influenced by branding. Consequently, branding including pricing and factors such as digitalization can be crucial for outperforming in the market.

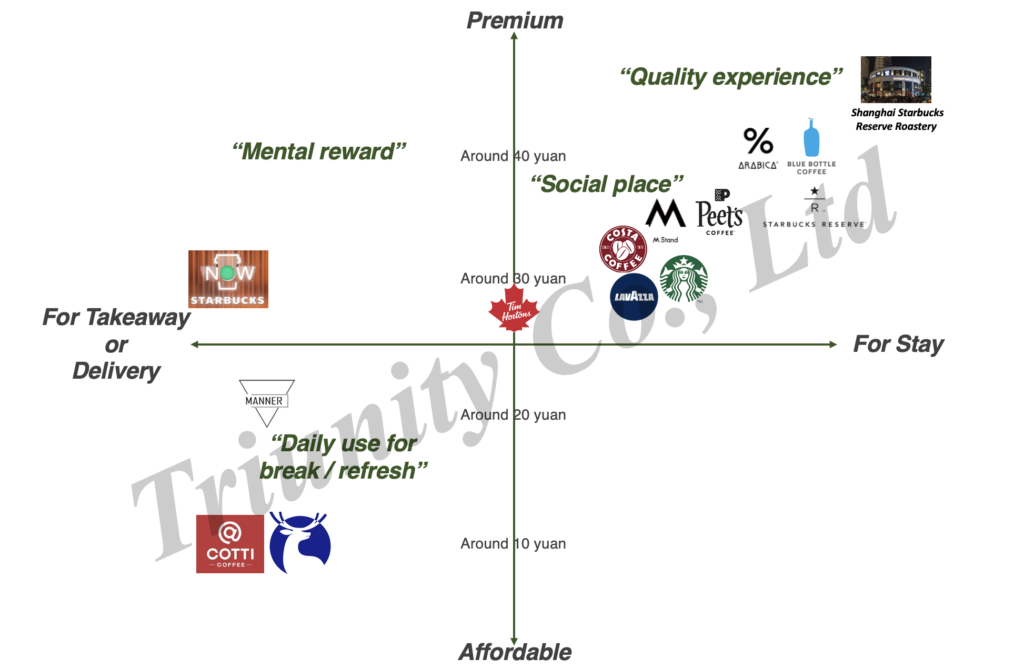

Here is my hypothetical brand positioning (brand perceptual mapping), categorized by price affordability, store size and comfort from the customer’s perspective. This assessment is based on a combination of market surveys and my daily observations.

Figure 5. Brand Positioning of Major Coffee Chains in China

In terms of branding, Starbucks, especially Starbucks Reserve, and Blue Bottle Coffee appear to be superior to Luckin Coffee. As is widely recognized, customers value and essentially pay for the ambiance and environment in Starbucks, referred to as the “The Third Place.” by themselves. I don’t associate Starbucks with “affordable price” or “convenience” in Shanghai although Starbucks is somewhat convenient with their own app or WeChat Mini-program in China and in terms of store location. My experiences often involve visiting a Starbucks location to casually chat, work, or study while enjoying their coffee.

On the other hand, in digitalization, Luckin, Cotti, and Manner can outperform with foreign brands since lower prices and grab-and-go options should be highly preferred by casual coffee drinkers. Many customers using these brands seems to prefer not to linger and instead adopt a ‘Grab-and-Go‘ approach for these stores. To me, this aligns more closely with takeaway at the convenience store but it is quicker and has better quality by their supply chain and Barista.

In other words, Luckin is convenient and affordable to have on a daily basis, offering a better quality in our perception than convenience stores. This “Grab-and-Go with decent quality and cheap price” approach is a strength of Chinese coffee chains like Luckin Coffee, Cotti Coffee, and even Manner Coffee.

Figure 6. Example of Flow of Grab-and-Go

Of course, to penetrate the market, co-branding with other products like Moutai, as Luckin did to generate buzz among consumers, or using popular local celebrities as brand ambassadors can be effective in the short term. However, this should not be the key factor for achieving long-term success in the market competition.

To rapidly expand market share, Chinese coffee chains should highlight and the convenience of Grab-and-Go services by integrating both offline and online functionality, OMO (Online Merges with Offline) features, all while maintaining affordable pricing. This strategy will be essential for competing with foreign brands such as Starbucks and Blue Bottle Coffee.

Some might argue that Starbucks offers a similar level of convenience in China by integrating online ordering with offline service and launching Starbucks NOW that focuses on takeaway and delivery. However, our primary concern is not about the convenience or speed of getting coffee at “The Third Place”. Instead, consumers prefer to relax there, even if it means paying a higher price. If we don’t visit often, the convenience factor is less important. Starbucks is a bit too expensive for us to enjoy coffee every day or even weekly like ordering coffee during commutation. To maximize the benefits of their convenient OMO function, more affordable prices or discounts through coupons would be necessary.

Strategy of Low Price and “Grab and Go” for Oversea Expansion

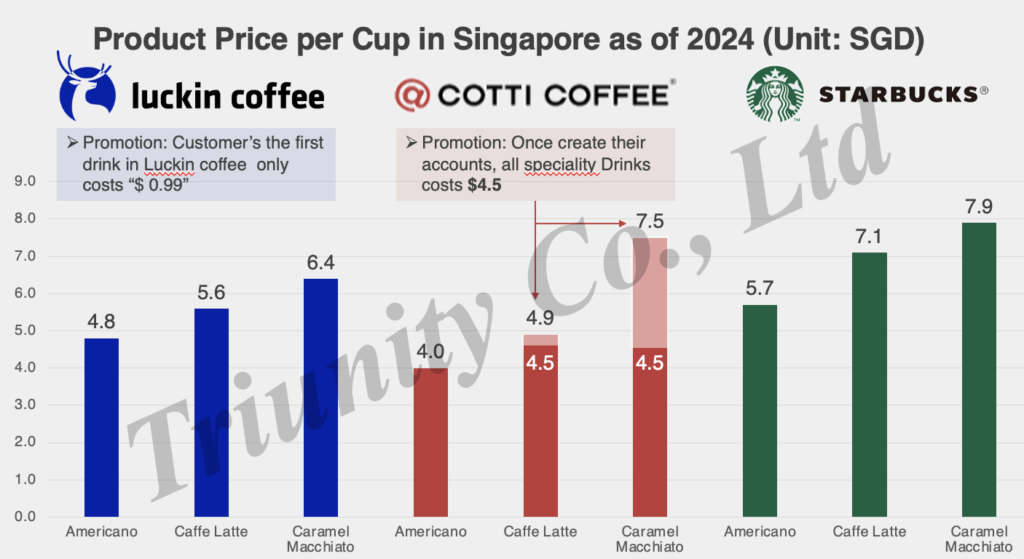

As mentioned, the combination of convenience by digitalization and low price could be central to my hypothesis. When Chinese coffee brands enter the overseas market, they should not overlook this key success factor. However, it is said that Luckin Coffee adopted a different strategy when entering the Singaporean market. While offering active price promotions, such as a 99 cent first drink promotion, its pricing of coffee in Singapore itself is more premium compared to China. Moreover, it features a dual-store format that caters to both takeaway and dine-in customers, providing consumers with the option to socialize while enjoying their coffee. On the other hand, Cotti Coffee reportedly employs a similar strategy in China by promoting all specialty drinks for 4.5 SGD for customers who have registered accounts on their app, while doing discount promotions like store opening promotion that serve ameciano for 1.9 SGD.

It’s intriguing to note that while Luckin Coffee is attempting to establish a high-quality brand in Singapore to avoid the existing perception of being “cheap,” Cotti, founded by the original Luckin founder, aggressively continues the same strategy as used in China driven by entrepreneurial spirit. If my hypothesis is correct, Cotti has the potential to outperform Luckin, even though factors like celebrity endorsements or new product development might play a more significant role in the initial stages.

Figure 7. Price Comparison of three foreign brands in Singapore

Figure 8. Example of Cotti’s store opening promotion in Singapore

Risks for this Strategy

However, this strategy comes with certain risks.

First, the familiarity and widespread use of online payment systems are crucial. The convenience of digital transactions primarily relies on FinTech solutions like Alipay and WeChat Pay. If online payments are not widespread or if people prefer using cash—as I did before moving to China—achieving this level of convenience can be challenging.

For example, in Japan, online payment systems are still developing. Even though options like PayPay are becoming more common, most major options for payment is cash in Japan. According to PCMI, digital wallet takes 17% of POS payment methods, while it takes 66% in China in 2024. It is likely to take more time for widespread adoption of digital payment functions, similar to those in China. Also, in Indonesia, E-wallet and digital / mobile wallet takes 32% share of payment method at point of sale (POS) in Indonesia, which is still even lower than China (66% in 2024 according to PCMI). In such a region, promoting the convenience of “Grab-and-Go” for freshly-brewed coffee might be more challenging.

Therefore, coffee chains should enhance digital payment methods alongside their products and services. In May, 2024, Cotti Coffee and Adyen, the financial technology platform, have announced a partnership as they embark on a global expansion. This collaboration will bring Cotti Coffee to customers in Canada, Australia, Japan, Singapore, and their newest market—the United Arab Emirates. Adyen provides quick processing and international payment solutions to enhance customer’s experience at Cotti’s store.

Second, local competitors have the potential to replicate this strategy. With the prevalence of online payments, a robust supply chain, and sufficient capital, they are well-positioned to adopt similar tactics. The widespread media coverage of Luckin Coffee’s success has attracted the attention of numerous entrepreneurs and competitors. If these competitors replicate its strategy and capture market share, Chinese coffee chains may struggle to secure a significant share in new regional markets.

For instance, TOMORO Coffee, Jakarta-based start-up’s, which is currently expanding into the SEA market including Vietnam, Malaysia, Thailand, Philippines, and Singapore. They have a similar business model of Luckin Coffee in China. Their app function looks like Luckin coffee and Cotti Coffee and their strength is also affordable price. The menu includes classic coffee options like a Caffe Latte (S$4.90) and a Cappuccino (S$4.90), as well as the signature TOMORO Aren Latte (S$5.90) in 2024.

Figure 9. TOMORO Coffee’s app

Third, an aggressive low-pricing strategy can damage their brand image. Through discussions with a Chinese café owner in Osaka, we discovered that Japanese consumers do not always appreciate low-priced products as Chinese consumers do. In Japan, there is a phrase, “安かろう悪かろう,” which expresses the idea that “you get what you pay for” or that “cheap things are often of poor quality.” They are sometimes cautious of extremely cheap products, suspecting they may be of poor quality. However, younger consumers in Japan are beginning to embrace affordable products, as seen with the recent popularity of SHEIN for closings. Therefore, focusing on the younger generation seems reasonable when expanding into the Japanese market.

If these three risks materialize, branding will become even more crucial. In such a scenario, Luckin’s strategy in Singapore could prove to be effective and might start to influence market expansion.

Recommendations

When café chain companies evaluate market data to decide which country to enter, the popularity of fintech, along with coffee-drinking habits and other demographic information, are important factors to consider. Also, the market size and growth of ride-sharing and food delivery services should serve as key indicators of how prepared local consumers are to embrace a digitalized, convenient coffee lifestyle. According to an interview with a café owner in London, many consumers in the U.K. may not favor the “Grab-and-Go” style. This is partly because they are accustomed to socializing and chatting in cafés for extended hours, and partly because they are concerned about privacy issues related to registering their financial information on a coffee chain’s app.

Additionally, they should consider price sensitivity and the potential damage that discounts may cause to the brand’s value, as pointed out above.

Moreover, to localize products or services, consumer’s behavior and consumer preference for the taste and product type in the target market must be surveyed. For example, unlike in China, where some consumers, particularly from the older generations, are hesitant to have cold beverages, iced Americanos or cold brews are likely to be more popular in the Japanese and Southeast Asian markets.

Last but not least, as consumers in developed countries, such as European consumers, seem to prioritize ESG and sustainability factors, Chinese companies may need to adapt their business models or branding accordingly.

Upcoming posts will delve into these factors, so stay tuned for our publications.

References:

[1] 虹桥国际咖啡港 & CBNData, 2023中国城市咖啡发展报告.

[2] Shanghai Municipal Commission of Commerce. 2023.05.24. Shanghai retains crown as city with the most coffee stores.

[3] 华经情报网.2024.08.08. 2024年中国咖啡行业现状及趋势分析,下沉市场消费潜力大「图」

[4] Euromonitor International.2024.03.28. What’s Next for Coffee Shops in Southeast Asia.

[5] Lux Café Club. 2024.08.11. COTTI COFFEE Celebrates Global Expansion with Exciting New Campaign.

[6] KrASIA.2023.08.23. Cotti Coffee takes battle with Luckin Coffee overseas.

[7] 民生证券. 2023.08.08.新消费研究之咖啡系列报告:中国现磨咖啡市场有多大&瑞幸的天花板在哪?

[8] Deloitte.2021.04. White paper on China’s freshly brewed coffee industry.

[9] InsideRetail.2024.05.06. Luckin Coffee’s revenues surge 41.5 per cent

[10] 36氪出.2024.10.20.中东白领喝起库迪,中国咖啡品牌进击全世界.

[11] SgrestaurantMenus.2024.10.13.LUCKIN COFFEE SINGAPORE MENU PRICES 2024

[12] COTTI COFFEE. Mobile APP.

[13] MENU PRO.2024.05.22.Starbucks Singapore Menu & Updated Prices.

[14] PCMI.2024.06.21. The Most Popular Payment Methods in APAC.

[15] Statistia.2024.05.22. Market share of cash, credit cards, and other payment methods at point of sale (POS) in Indonesia from 2017 to 2023, with a forecast for 2027.

[16] Adyen. 2024.05.13. Cotti Coffee taps Adyen for overseas expansion.

[17] FINANCE MAGNATES.2024.05.16. Adyen Brews Up Global Expansion with Cotti Coffee Partnership.

[18] GlobalCoffeeReport.2024.06.08. Tomoro Coffee CEO Xing Wei Yuan on ambitious growth plans.

[19] InsideRetail.2024.06.21. Indonesian coffee brand Tomoro Coffee plans expansion in the Philippines.

[20] DANIELFOODDIARY.COM.2024.05.24.Tomoro Coffee – Famous Indonesian Coffee Chain Opens At NUS And Novena Square 2.

[21] World Coffee Portal. 2023.11.24.Tomoro Coffee makes China debut and targets 400 new outlets in Indonesia.

[22] vulcanpost.2024.03.13. A new TOMORO for S’pore’s coffee scene, here’s what the Indonesian chain brings to the table.

[23] yeeyi.2023.12.28.今天,中国这一大品牌登陆新加坡!刷屏朋友圈!邀请好友下单免费0元喝

Leave a Reply