By Akira Tsuruta & Yuying Qian, 2025.04.15

Intro

In the previous article “Can HEYTEA inspire Japanese consumers?”, we wrote about the analysis of HEYTEA’s overseas expansion into the Japanese market. We greatly appreciate the many readers who read this article and provided feedback and also realized that most non-Chinese readers lack a basic understanding of ‘New Style Tea‘ and its presence in the Chinese market. New Style Tea is an innovative addition to the global food market, showcasing the creativity of Chinese food chain brands. Today, we will examine the Chinese market for New Style Tea, analyze current trends, and identify which brands have the potential to succeed internationally.

1. Definition of New Style Tea

Compared to traditional tea beverages, New Style Tea drinks cater primarily to young consumers, especially 18-35-year-old women including Gen Z. When encountering these products for the first time, some products may seem too creative or novel for middle-aged men like me. Let’s look at its definition of New Style Tea.

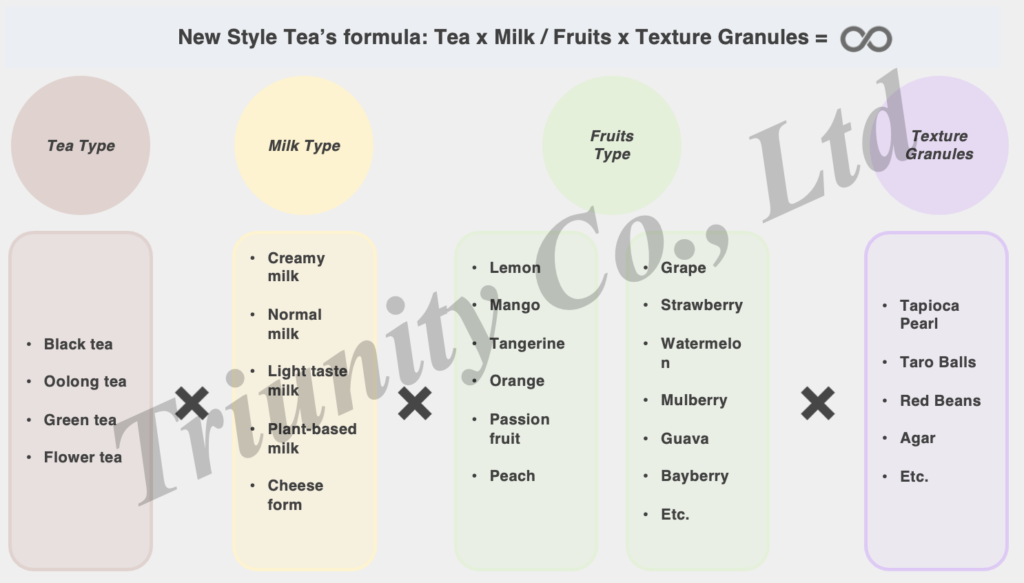

According to the group standard “Terms and Classification of New Style Tea Drinks《新茶饮术语和分类》” of the China Chain Store & Franchise Association(中国连锁经营协会), “New Style Tea drinks are beverages made from a combination of original leaf tea and/or tea infusions, together with ingredients such as fruit, freshly squeezed fruit and vegetable juices, whole fruit juices, vegetables, and dairy products. These drinks may include or exclude other food additives but do not contain solid beverage mixes. They are prepared and processed on-site.”

Figure 1. An infinite number of different types of modern tea depending on the combination.

Reference: Chinese New Tea Beverage Supply Chain White Paper 2024

To sum up, New Style Tea is a drink that blends original leaf tea or infusions with fruit, juices, vegetables, and dairy, prepared on-site without solid mixes. Based on their ingredients and processing methods, New Style Tea drinks can be categorized into five types: fruit tea, fresh milk tea, bubble tea, cold brew tea, and milk tea. In consumers’ minds, they roughly have two options: fruit tea or milk tea including bubble tea. Generally, in summer fruit tea is preferred while milk tea is preferred in winter by consumers. Consumers can personalize their drinks by adjusting the sweetness level and adding various ingredients like tapioca pearls.

Figure 2. A wide variety of product of New Style Tea in the Chinese market

Source: Each Brand’s WeChat Mini Program

2. Development of New Style Tea in China

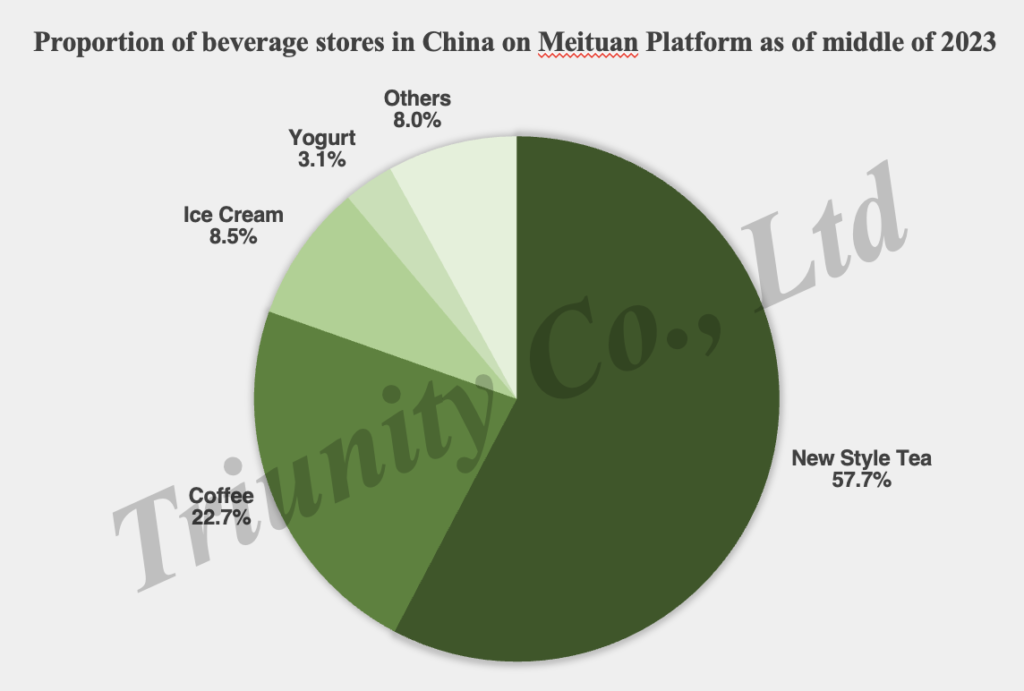

Over the years, the new tea beverage industry has grown significantly and is now a mainstream market with high consumer engagement.

As stated by Chinese New Tea Beverage Supply Chain White Paper 2024, in the 1980s and 1990s, pearl milk tea and bubble black tea became popular across the Taiwan Strait, offering young people a tasty, affordable drink. By around 2015, startups like HEYTEA and Sexy Tea (茶颜悦色) began using freshly brewed tea instead of tea powder and creamer to create milk tea, offering a high-quality, flavorful experience. This innovation led to what is now known as “New Style Tea“. By 2022, numerous large-scale chain brands have entered the production and sales arena, enhancing product quality as well as brand packaging and design. As a result, the average customer spending has risen significantly. Beginning in 2023, brands are upgrading new tea drinks by streamlining supply chains and leveraging advanced technology. This can enhance taste, quality, freshness, health, transparency, and cost-effectiveness. Infusing diverse cultures into teas, a single drink can influence consumers’ lifestyles. Now, you can find many brands of New Style Teas everywhere in China. Consequently, coffee brands like Starbucks need to fight with many New Style Tea brands, which should be one of the reasons why Starbucks is said to be struggling in China.

Figure 3. Proportion of beverage stores in China on Meituan Platform as of middle of 2023

Source: Chinese New Tea Beverage Supply Chain White Paper 2024

3. Chinese Market Overview

According to XinKuaiBao (新快报), in 2024, China’s New Style Tea market size reached RMB 354.72 billion. It is projected to experience steady growth over the next few years, with expectations to surpass RMB 400 billion by 2028.

Figure 4. Market size of New Style Tea drinks in China (2016-2024)

Source: 新快报

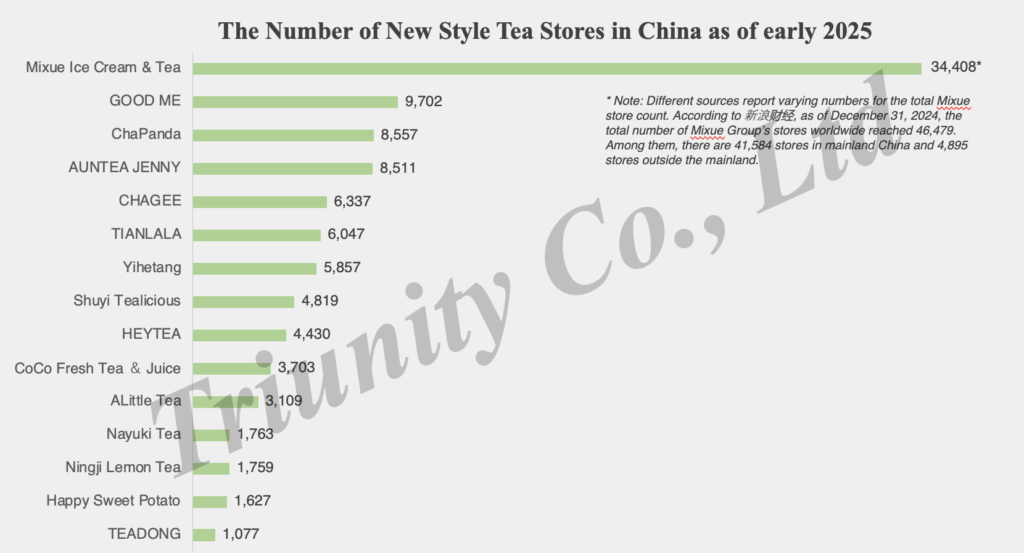

Qichacha (企查查) data shows that the number of companies at the end of 2024 reached 361,900, and many brands entered this market and the competition has not ended yet. The size of a store network is one crucial indicator of a brand’s strength. Here are the major 15 brands in terms of the store numbers as of early 2025.

Figure 5. The number of New Style Tea stores in China as of early 2025

Source: 窄门餐眼

As the graph shows, it is obvious that the most dominating player in the New Style Tea market in China is Mixue Ice Cream & Tea (蜜雪冰城). According to the MIXUE’s prospectus, MIXUE’s market share surpasses the combined market share of GOOD ME (古茗) and ChaPand (茶百道).

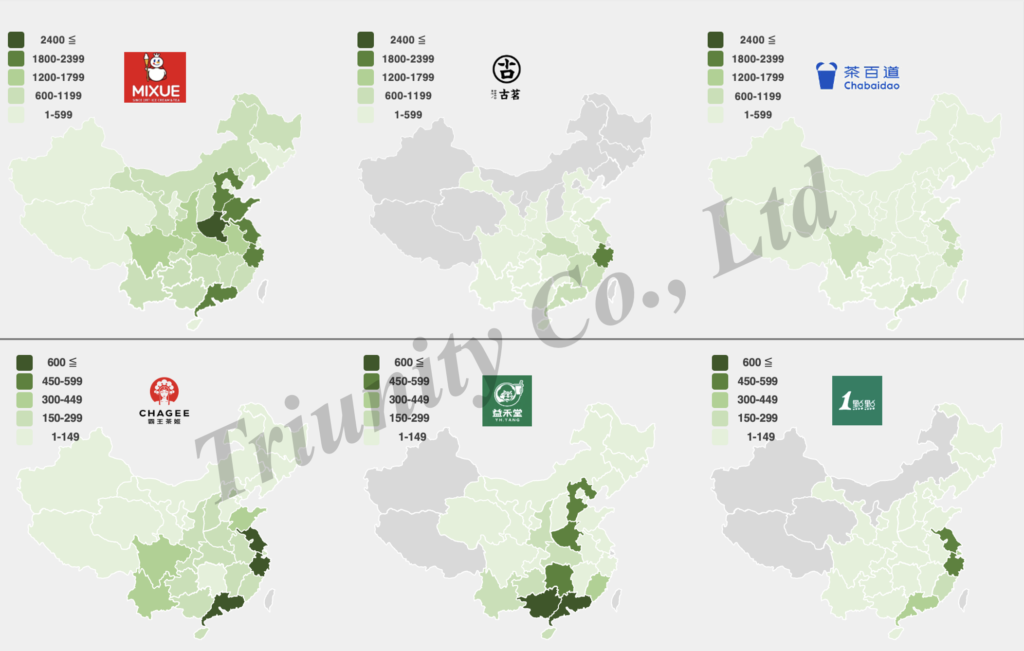

In terms of store distributions, generally Southern areas have more stores than Northern areas. Additionally, the store development strategy for each brand reflects distinct regional characteristics. Each province has its own set of winners. MIXUE is everywhere, dominating third-tier and lower-tier cities. Meanwhile, GOOD ME focuses on second-tier cities in the south, with similar store density to MIXUE in provinces like Zhejiang, Jiangxi, and Fujian, but has a limited presence in northern regions. We can’t find GOOD ME in Shanghai and some of my friends in Shanghai have never tried this brand though it’s dominating in terms of the store number.

Figure 6. The store distribution of MIXUE, Good me, ChaPanda, CHAGEE, Yihetang, ALittle Tea as of mid-2025

Source: 窄门餐眼

In other words, each brand has a different regional focus, and the presence of brands in high-tier cities does not always attracts local consumers in counties and towns within the sinking market. It means that a favorable brand concept, encompassing products and pricing, varies by region. Some brands like HEYTEA and Nayuki positions at high-to-middle-end seem to focus more on urban areas, while GOOD ME, Yihetang (益禾堂), Happy Sweet Potato (快乐番薯), and Sexy Tea positions middle-to-low-end focus more on tier 2 cities or sinking markets.

Let’s examine the Shanghai market as an example to understand the positioning of each brand.

4. Brand Positioning in the Shanghai Market

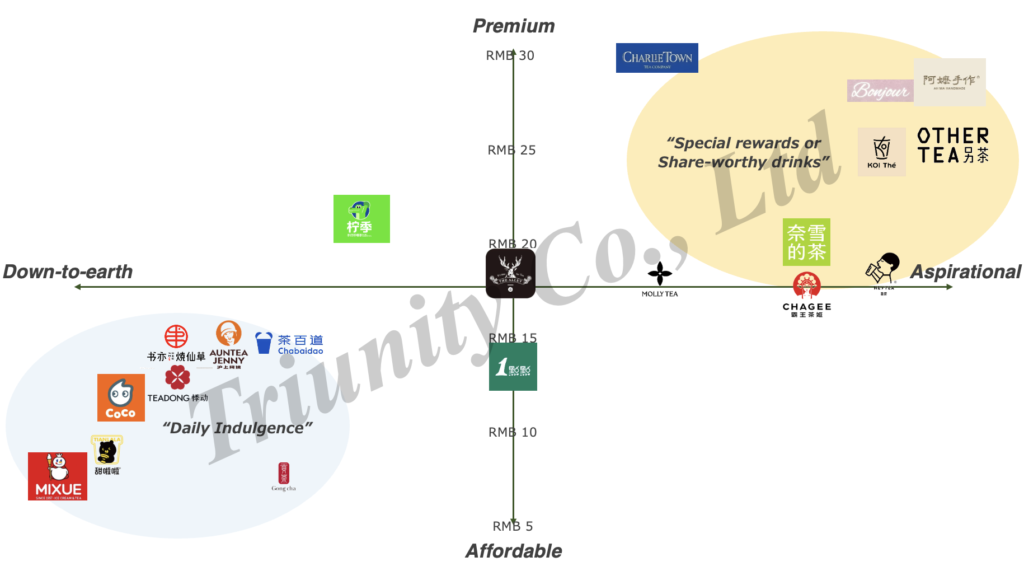

Amidst fierce competition in the new-style tea market, where brands can easily replicate each other’s popular products, they face the challenge of finding distinct strategies to stand out and must choose their strategy wisely. One approach is to engage in price competition by optimizing costs including streamlining the supply chain. Alternatively, they can differentiate themselves by focusing on branding, aiming to attract customers through unique intangible or emotional values. Roughly speaking, brands can be categorized into two groups as shown in the following chart: “Daily Indulgence” group and “Special rewards or Share-worthy drinks” group.

Figure 7. Each New Style Tea’s brand positioning in Shanghai market

To enjoy new-style teas daily, consumers often choose brands located in the lower price range, such as MIXUE (蜜雪冰城) or ChaPanda (茶百道), which are more affordable. For social rewards or to share on social media, they tend to select higher-end brands that are more aspirational and Instagrammable. These brands stand out through their captivating brand story, product appearance, packaging design, or store interiors.

Figure 8. Images of two segments

Source: WeChat Mini Program, 小红书, 大众点评

Their product lineups partly or mostly overlap, although their taste and quality somewhat differ. When customers are price-sensitive, they tend to choose the left-side group, and for special occasion or mentally rewards, they sometimes choose the right-side group. For example, I frequently enjoy MIXUE and ChaPanda as daily drinks, ordering them two or three times a week, and I typically spend around RMB 5-10 each time with their discount coupons. On the other hand, once a week or twice a month, I treat myself to HEYTEA or CHAGEE, which costs about RMB 15-20 or more. I find these visits inspiring, especially while reading a book or chatting with friends at their store. Now, I and my friend are planning to visit OTHER TEA (ot另茶) and AH MA HANDMADE (阿嬤手作) to explore new experiences.

4-1. Daily Indulgence

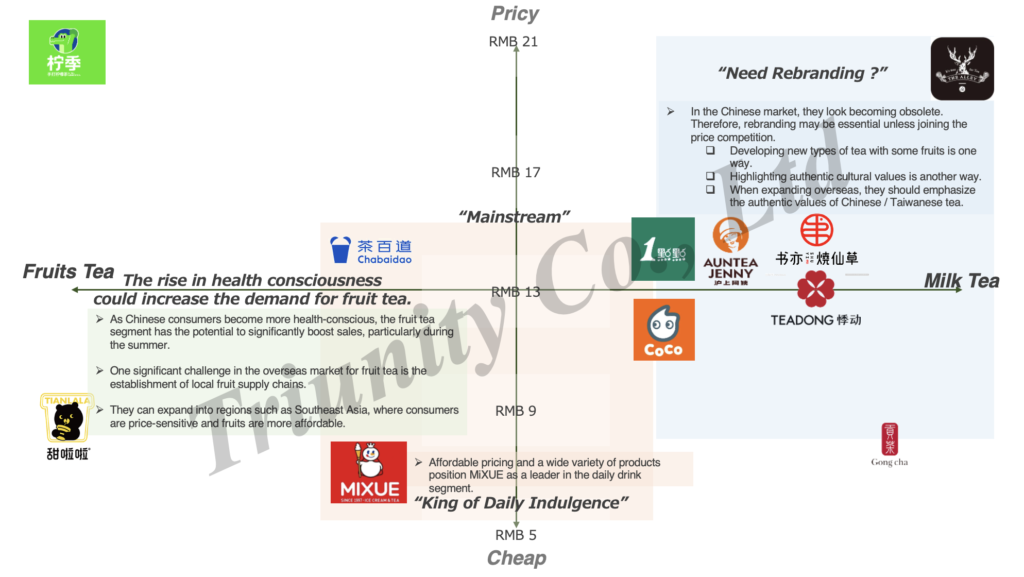

In the “Daily Indulgence” group, the price competition is even more fierce. Each brand offers slight differences in product type and variety, while making a discount effort. They can be classified as either fruit tea or milk tea, depending on their focus or consumer’s perception.

Figure 9. Brand positioning of middle-to-low-end New Style Teas in the Shanghai market

In terms of the price-competitiveness, MIXUE is undoubtedly the strongest among all brands and has its wider product variety for mass consumers, followed by ChaPanda, which can be considered the mainstream brand of New Style Tea, and their store numbers also reflect this fact.

To achieve their cost optimization, MIXUE boasts a significant advantage with its highly digitized, large-scale end-to-end supply chain system. The brand secures 100% procurement of beverage ingredients, packaging materials, and equipment for franchisees. Over 60% of these ingredients are self-produced, the highest in China’s ready-made beverage industry, with all core beverage ingredients being 100% self-produced.

The brands positioned right in the picture above, which might be perceived as typical milk tea, may benefit from rebranding. In the Chinese market, they could face the risk of becoming obsolete. Therefore, rebranding may be essential unless joining the price competition. Shuyi Tealicious (书亦烧仙草) and TEADONG (悸动烧仙草) focus on milk tea with grass jelly (仙草) which is believed to have cooling and detoxifying properties in traditional Chinese medicine to appeal to young consumers with growing demand for “healthy indulgence“. However, milk tea is often viewed as sweet and associated with weight gain or even diabetes, which could limit its appeal. Strengthening its allure through compelling storytelling should be necessary.

As Chinese consumers become more health-conscious, the fruit tea segment (the left side) has the potential to boost sales, particularly during the summer. ChaPanda, recognizing current trends, has developed seasonal fruit tea products like “Green Grape Jasmine Tea (青提茉莉)” and introduced other health-oriented products such as “Fitness Wheatgrass (纤体小麦草)” and a lower caffeine Jasmine Tea. In 2024, the brand was honored as one of the “F&B Brands Most Liked by Gen Z (2024食品饮料行业‘Z世代’喜爱品牌)”.

Figure 10. ChaPanda’s Green Grape Jasmine Tea (青提茉莉)

Source: ChaPanda HongKong’s Instagram Account

4-2. Special Rewards or Share-Worthy Drinks

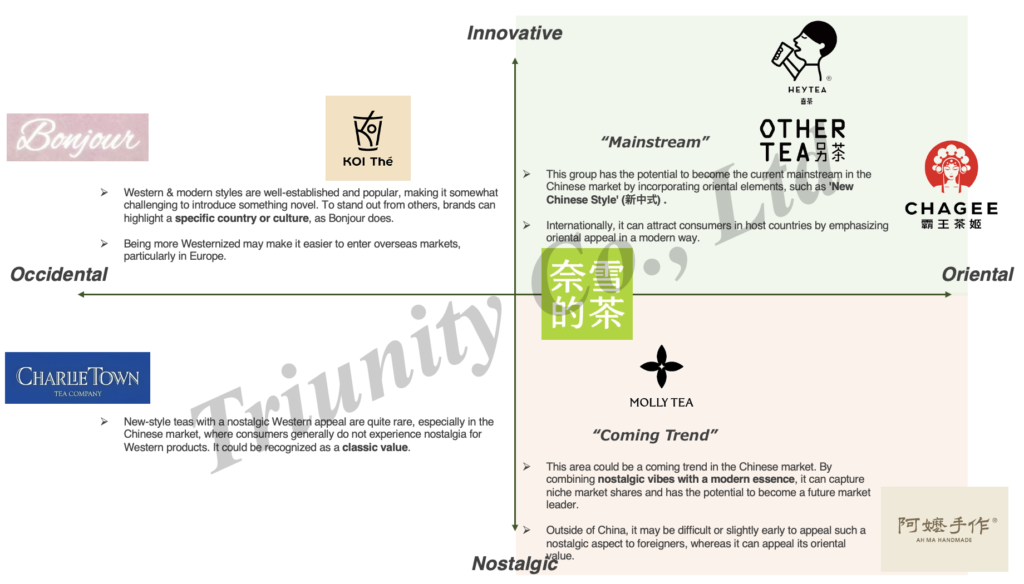

In the “Special rewards or Share-worthy drinks” group, branding matters. While maintaining the quality of their products and brand image, they should continue to enhance their brand by developing delicious, iconic, and photogenic offerings. Additionally, refining store and packaging design and pursuing co-branding opportunities with partners in various segments can further elevate their image. Brands can be classified as follows.

Figure 11. Brand positioning of middle-to-high-end New Style Teas in the Shanghai market

4-2-1: Oriental Value x Innovative Value

An interesting trend is the growing popularity of oriental essences, traditionally found in authentic teas. Brands that emphasize these oriental values are gaining traction among young consumers. A quintessential example of this is seen in brands that embody the “New Chinese Style (新中式)“, which merges modern aesthetics with traditional Chinese cultural design. This trend is driven by a growing sense of national pride among Chinese consumers.

Figure 12. CHAGEE’s Product Package

CHAGEE (霸王茶姬) is the typical representative of this value. The packaging of CHAGEE painted the “Ancient Tea Horse Road (茶马古道)“, which facilitated Chinese tea culture communication between Han nationality and other ethnic groups in ancient times. Based on this, CHAGEE’s brand vision is to become the modern “Tea Horse Road,” continually spreading Chinese tea and its culture to countries around the world. Additionally, their slogan, “Meet friends from all around the world with oriental tea (以东方茶,会世界友)” conveys the inspiring vision of sharing Chinese tea culture internationally. One of their most popular tea in China, Jasmine Milk Tea (伯牙绝) should be preferred by a lot of foreigners including Japanese as I love it.

Figure 13. HEYTEA’s Stores & Products

HEYTEA (喜茶) also positions themselves as a modern tea brand that seamlessly blends traditional Chinese tea culture (oriental value) with contemporary aesthetics. It embodies a Zen-like sense of inspiration without relying on overtly Chinese elements, but rather capturing the soul of Chinese tradition. The brand aims to rejuvenate ancient tea culture, making it relevant and appealing to young, modern consumers. Moreover, with their concept of “Tea of Inspiration(灵感之茶)”, they focus on innovation and creativity in their product development instead of being limited to any singular type of tea, like cheese-foamed tea which they invented. Emphasizing high-quality, original tea products, HEYTEA seeks to inspire their audience and resonate culturally, positioning themselves as the leading brand in new-style tea drinks.

This group has the potential to become the current mainstream in the Chinese market by incorporating innovative products and oriental elements. Internationally, it can attract consumers in host countries by emphasizing oriental appeal in a modern way. By the end of 2024, CHAGEE have opened 156 stores across Malaysia, Thailand, and Singapore. Looking ahead to 2025, the company plans to expand significantly by launching 1,000 to 1,500 new stores worldwide. It is said that in the near future they will make their debut in the North American market with their first store set to open in Los Angeles, USA. (For more information on HEYTEA’s overseas expansion, please refer to our two articles: “Can HEYTEA inspire Japanese consumers?” and “A Taste of Home – Diaspora, Gateway to Penetrate New Market”.)

4-2-2: Oriental Value x Nostalgic Value

This area could be a coming trend in the Chinese market. By combining nostalgic vibes with a modern essence to deepen more oriental value, it can capture niche market shares and has the potential to become a future market leader. Outside of China or Chinese diasporas, it may be difficult or slightly early to appeal such a nostalgic aspect to foreigners, whereas it can appeal its oriental value. (About diaspora marketing, you can refer our article:A Taste of Home – Diaspora, Gateway to Penetrate New Market )

Figure 14. AH MA HANDMADE (阿嬷手作)’s product & store

Source: 品牌星球Brandstar & 阿嬷手作’s WeChat Miniprogram

AH MA HANDMADE (阿嬷手作) has positioned themselves as a high-quality, nostalgic brand. The name “AH MA (阿嬷),” which means “grandma” in Hakka, Hokkien, and Cantonese, reflects this focus on tradition and warmth. The name and handmade aspect of the product immediately evoke nostalgic memories of enjoying grandma’s homemade milk tea from the past. Additionally, the product description frequently uses words like “hometown (家乡)”, “wanderer (游子)”, “family (家人)”, and “home-cooked meal (家常菜)”. When it comes to their product offerings, they diverge from modern health trends that emphasize reduced sweetness. Instead, they spotlight their “family inherited wellness drinks(家庭代际间养生认知),” which underscore the natural quality and nourishing properties of the ingredients themselves. For example, they use ingredients like eggs, rice, Lipu yam (荔浦芋), and fermented glutinous rice (酒酿), all of which are regarded as beneficial based on ancient knowledge from the “Huangdi Neijing” (黄帝内经).

4-2-3: Occidental Value x Innovative Value

Western & modern styles are well-established and popular, making it somewhat challenging to introduce something novel. To stand out from others, brands can highlight a specific country or culture. Also, being more Westernized may make it easier to enter overseas markets, particularly in Europe.

Figure 15. Bounjour’s product and store

Source: 茶咖观察 & 大众点评

Bonjour (本就茶饮) drew inspiration for their name from the French word “bonjour”. From store design to product offerings, the brand incorporates French elements throughout. For instance, they use ingredients like “brulee” cake, pistachio, and rose, setting it apart from many Chinese New Style Teas that traditionally emphasize Chinese ingredients. Additionally, Bonjour’s store and packaging design embrace a French style, making them particularly photogenic and appealing for customers who love taking pictures.

Conclusion

China’s New Style Tea, which can be recognized as one of the most significant innovations in the global food and beverage industry, is still evolving amidst intense competition. To succeed in this competitive landscape, they must strategically focus on branding while also streamlining their supply chain. In addition, many brands are now targeting overseas markets to escape the crowded domestic scene and to discover new growth opportunities beyond China. The world anticipates their arrival, and we expect some of these brands to disrupt host-country markets and win the hearts of consumers abroad.

References

[1] 智研咨询.2025.01.03.2024年中国新茶饮行业产业链、品牌格局及发展动向分析:健康理念催生茶饮新消费,国产品牌纷纷强化供应链谋出海[图].

[2] 鲜活饮品 x 第一财经.中国新茶饮供应链白皮书 2024.

[3] 新快报.2025.03.16. 新式茶饮市场有望冲4000亿,健康养生概念成新增长点.

[4] 零售商业财经.俞盈盈.吕鑫燚.2024.06.01. 新茶饮TOP30:从规模之争到品质之战,谁主沉浮?.

[5] 窄门餐眼.

[6] 蜜雪冰城股份有限公司. 2025年2月21日.Prospectus.

[7] 中国茶叶流通协会. 每日经济新闻.2024.10.29. 茶百道荣获“2024食品饮料行业‘Z世代’喜爱品牌”.

[8] chinaskinny.2024.02.19. Trending in China: New Chinese style is on the rise.

[9] TJ品牌研究. 2024.04.18. 霸王茶姬品牌元素分析(新中式茶饮品牌).

[10] Hans.胡运鑫.霸王茶姬“国风茶饮”营销策略研究.

[11] 搜狐. 2017.05.12. 【创业故事】喜茶90后创始人聂云宸:我开过很多很失败的店,没有人可以只靠营销成功.

[12] 新华网. 经济参考报. 2024.04.01.霸王茶姬何以冲刺“新茶饮美股第一股.

[13] SOHO设计区.2019.07.25. 南宁·“城市山水”喜茶(万象城店) / 绽放设计.

[14] SOHO设计区.2020.02.07. 深圳·“喜茶HEYTEA”LAB实验室店 / 東木筑造.

[15] ArchDaily. 喜茶上海虹桥新天地店 / DAS Lab.

[16] ArchDaily. 喜茶·厦门磐基名品中心店 / 绽放设计.

[17] 美通社.PR Newswire.2020.11.11. 牛奶黑科技成就超厚牛乳 喜茶波波家族新品上市首日热销近五万杯.

[18] 品牌星球Brandstar.2025.01.23. 地方茶饮品牌:当「在地」成为一种差异化策略.

[19] 品牌星球Brandstar.2025.033.24.阿嬷手作,以「家」为题的品牌化实践.

[20] 茶咖观察. 2024.08.30. 排队10小时,黄牛价300一杯,杭州这家奶茶店疯了.

[21] Each brand’s WeChat Miniprogram and eleme page.

Leave a Reply