By Akira Tsuruta, 2025.09.05

1. Intro

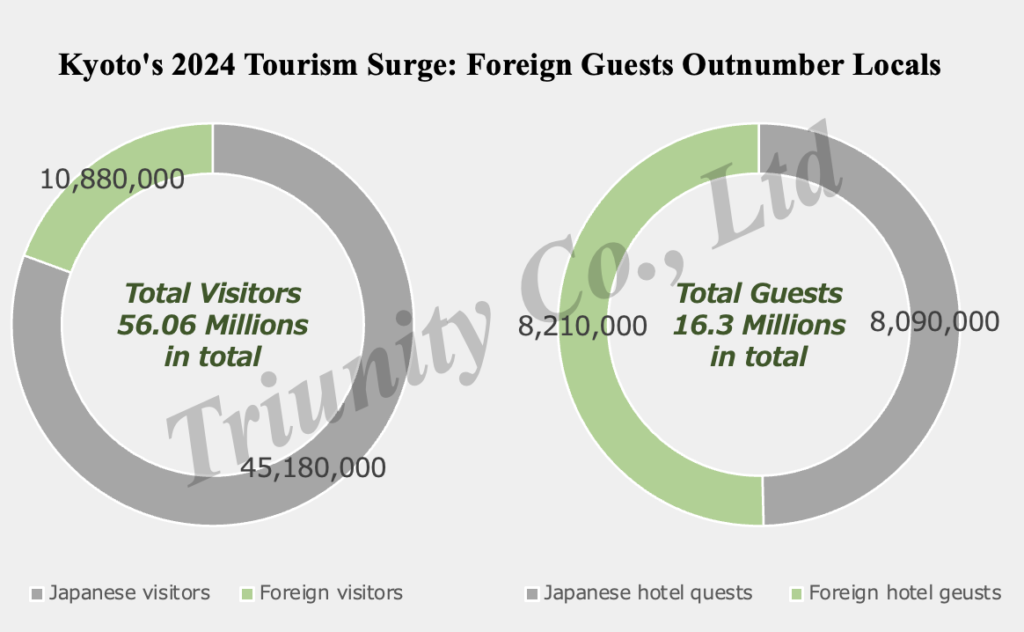

Returning to my hometown of Kyoto recently, I’ve noticed it has become a far more international and foreigner-friendly city than before. Numerous restaurants, particularly around the Gion district, now cater specifically to foreign tourists. Some ramen shops, for instance, may not seem authentic or appeal to local Japanese tastes but are designed to attract international visitors. Data confirms this trend, showing a steady increase in foreign visitors to Kyoto. In 2024, Kyoto City welcomed over 10 million foreign visitors for the first time, reaching a record 10.88 million. Notably, foreign hotel guests outnumbered Japanese guests. Targeting international tourists is a smart and understandable business strategy.

Figure 1. Kyoto’s 2024 Tourism Surge: Foreign Guests Outnumber Locals

The trend of catering to international visitors in Kyoto is not limited to local brands. Recently, M Stand, a trendy Chinese coffee chain, opened its first overseas location near Nanzenji Temple (南禅寺), one of Kyoto’s most popular sightseeing destinations. Visiting this iconic store reveals a striking contrast to its surroundings: the customer consists primarily of Chinese tourists and other international visitors, with notably fewer local Japanese customers. This looks different from neighboring Blue Bottle Coffee, likely due to distinct marketing strategies.

M Stand’s approach appears to incorporate elements of diaspora marketing, targeting Chinese travelers abroad, but its ambitions seem broader. This suggests a more visionary strategy aimed at capturing a diverse, global audience. In this article, I explore the impact of global branding in Kyoto, using M Stand’s entry as a key example. (If you’re interested in China’s café market, we highly recommend reading the article: A Taste of Home – Diaspora, Gateway to Penetrate New Market)

Figure 2. M Stand’s First Overseas Store Opens in Kyoto

2. Kyoto’s Allure in Global Branding

Kyoto, Japan’s ancient capital, is renowned for its rich history and breathtaking scenery. The city captivates visitors year-round with cherry blossoms in spring, verdant greenery in summer, vibrant foliage in autumn, and tranquil snowscapes in winter, all framed by iconic historical landmarks. Unique cultural elements, such as Maiko and Zen, further define this sophisticated city. These attributes create powerful associations for Kyoto-based brands, offering brands an opportunity to elevate their image through the city’s timeless allure.

Figure 3. Kyoto’s Seasonal Splendor: Scenic Beauty Across Four Seasons

Images from “京都観光Navi” and “絶景に行こう!!”

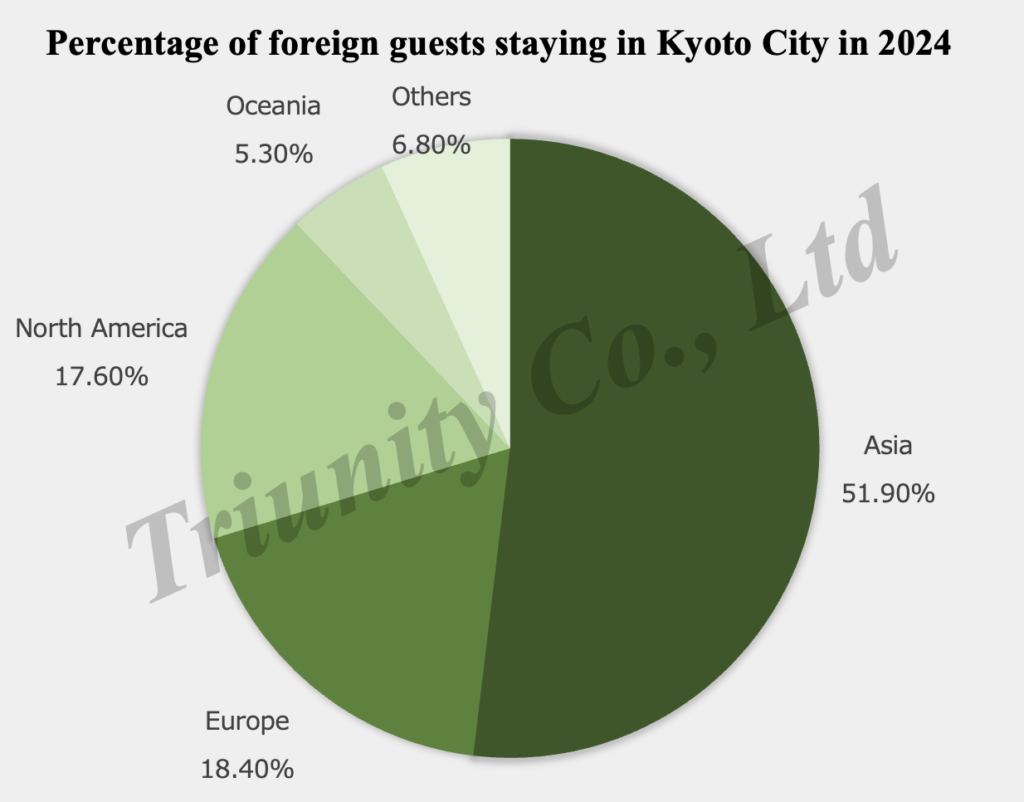

Kyoto attracts visitors from around the world, providing brands in Kyoto with exposure to diverse consumers and enhancing their global brand awareness. According to the Kyoto City Industry and Tourism Bureau(京都市産業観光局), Chinese guests make up the largest group, followed by visitors from the United States, South Korea, Australia, Italy, and France. Kyoto is an appealing location for Chinese brands, as it allows them to target Chinese tourists familiar with their brand for immediate revenue with minimal marketing effort. Simultaneously, they can promote their brands to other international visitors and local Japanese consumers, laying the groundwork for future expansion into global markets.

Figure 4. Percentage of foreign guests staying in Kyoto City in 2024

% Arabica, a global café chain, exemplifies successful marketing, transforming from a local venture into an international brand. Founded in Hong Kong by Japanese entrepreneur Mr. Kenneth Shoji, the brand gained significant attention after opening its flagship store in Kyoto’s picturesque Higashiyama district. This strategic move propelled % Arabica’s rapid expansion, earning it widespread recognition and a presence in numerous countries worldwide.

Figure 5. %Arabica’s store in Higashiyama, Kyoto

Since its inception, % Arabica has grown rapidly, establishing three stores in Kyoto and expanding to over 200 locations worldwide in less than a decade. The brand now operates in countries including China, France, Cambodia, Thailand, the United Kingdom, the United States, and the Philippines, with China hosting the largest number of stores. Apart from % Arabica’s location at Fujii Daimaru (藤井大丸), its three other Kyoto stores are situated in prime sightseeing areas, which initially led me, a local resident, to overlook the brand while in Kyoto. It was only upon visiting Shanghai that I recognized its prominence. This strategic placement suggests % Arabica deliberately targeted tourists and international visitors in Kyoto during its early stages. Reflecting its global vision, the brand’s slogan, “See the World Through Coffee,” underscores the ambition evident since the opening of its flagship store in Kyoto.

Figure 6. Global Store Distribution of %Arabica’s, not focusing on Japan

%Arabica is called the brand from Kyoto, though it does not dominate Kyoto’s coffee market, and originally started in Hong Kong. According to Mr. Kenneth Shoji, “Kyoto is the best place to create a Japanese brand.” and I totally agree with this idea. More brands can come to realize Kyoto’s soft power as a compelling asset for building a distinctive and globally resonant identity.

3. M Stand in Kyoto

3-1. Who is M Stand

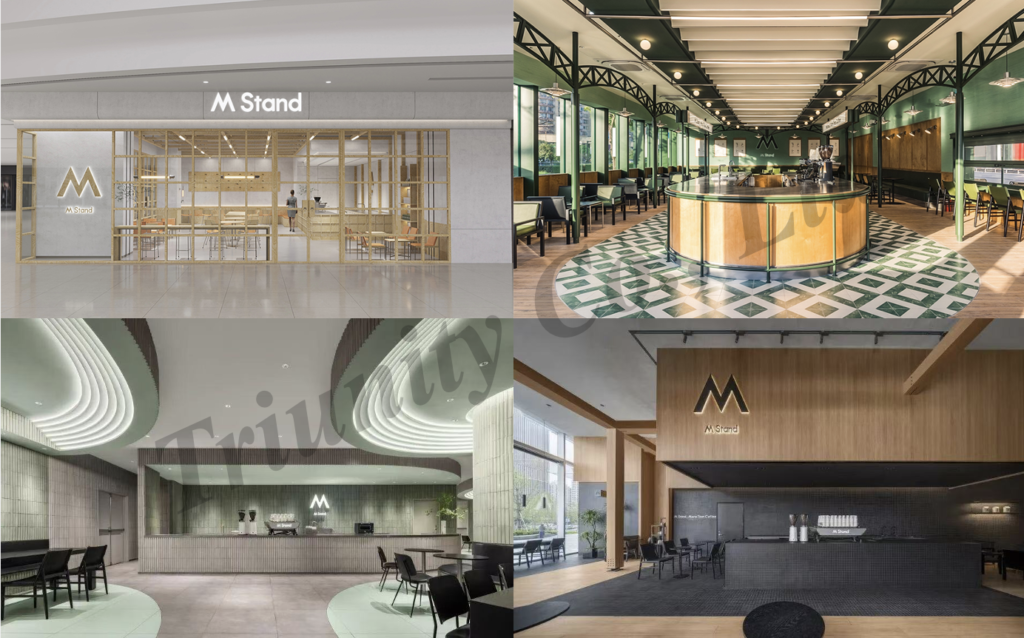

Founded in 2017 beneath Shanghai’s plane trees, M Stand is a dynamic brand that seamlessly blends youthful creativity and fashion-forward sensibilities with innovative product development and deep brand resonance, crafting a unique experiential space and identity. It is positioned as “the Starbucks for China’s new generation of youth“, providing high-quality coffee and a fashionable social space, as its brand slogan states, “M Stand, more than coffee”. Unlike other Chinese café brands such as Luckin Coffee, Cotti Coffee, and Manner Coffee, which primarily focus on takeaways, M(Mind)Stand emphasizes the in-store experience, creating a “third place” akin to Starbucks where customers can linger and connect. Embracing the concept of “One Store, One Scene (一店一景)“, M Stand crafts aesthetically captivating spaces that harmoniously blend fashion and commerce. This irresistible allure draws us to explore each new location. (If you’re interested in China’s café market, we highly recommend reading the article:Chinese Coffee Chains Going Oversea, “Grab-and-Go, Digitalized Coffee Life”)

Figure 7. Unique Features of Each Store in M Stand

One of M Stand’s standout strengths is its relentless focus on creative product development, sparking buzz, captivating young consumers, and setting itself apart from competitors. Its innovative menu features unique offerings like grapefruit coffee, oatmeal cookie latte, cement cheesecake, sea salt cheese black coffee, and brown sugar milk coffee. Notably, the visually striking oatmeal cookie latte and cement cheesecake, as shown below, have gained viral traction online. Because of its minimalist branding and relentless focus on innovative product development, M Stand evokes a similar vibe to HEYTEA, despite their distinctly different core offerings. (If you’re interested in HEYTEA, we highly recommend reading the article: Can HEYTEA inspire Japanese consumers?)

Figure 8. M Stand’s Oatmeal Cookie Latte and Cement Cheesecake

3-2. How’s the store in Kyoto

On July 26, 2025, M Stand celebrated the grand opening of its first international location in Kyoto, Japan. This milestone marks the brand’s first overseas venture, establishing a pivotal foundation for its expansion into the Asia-Pacific region and global markets.

–Location

The new M Stand store is strategically located in Kyoto’s historic Nazenji Temple district, a choice that underscores the brand’s focus on attracting tourists rather than local residents. As someone who has lived in Kyoto for over 20 years, I rarely visited this area, as temples are ubiquitous here and blend seamlessly into daily life. For local youth, these historic sites often lack novelty, as they are surrounded by such landmarks constantly, making them a routine part of existence rather than a special destination.

Figure 9. The store is situated along the route leading to Nanzenji Temple, positioned to attract tourists

Source: the original image is from M Stand’s Xiaohongshu account

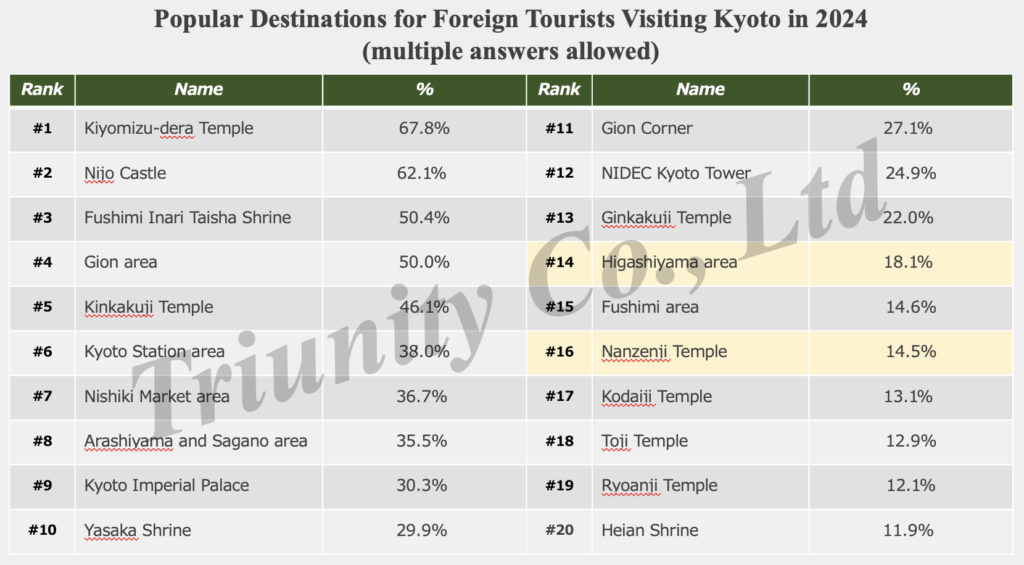

According to a survey by the Kyoto City Industry and Tourism Bureau, 74.4% of foreign visitors cited exploring sightseeing spots, such as temples, shrines, famous landmarks, and historical sites, as a key motivation for visiting Kyoto. Among these attractions, Nanzenji Temple ranks as the 16th most popular destination and is a popular destination for European tourists. (Interestingly, the Kawaramachi and Shijo area, a popular shopping district among locals, does not rank among the top 20 destinations for foreign visitors.)

Figure 10. Popular Destinations for Foreign Tourists Visiting Kyoto in 2024

M Stand’s location strategy differs notably from HEYTEA’s approach. While HEYTEA chose a site near Osaka’s Dotonbori bus terminal, a hub primarily for Chinese tour buses and thus catering to the Chinese diaspora, M Stand strategically positioned its Kyoto store in the historic district. This choice reflects M Stand’s focus on global tourists, leveraging the location as a cornerstone for its broader expansion into the Asia-Pacific and international markets. (If you’re interested in HEYTEA, we highly recommend reading the article: Can HEYTEA inspire Japanese consumers?)

Figure 11. The HEYTEA Osaka store is buzzing with Chinese tourists

–Store Design

While designed to attract global tourists, the store demonstrates a deep understanding of Kyoto’s regulations and cultural heritage, seamlessly blending international appeal with local sensitivity. The M Stand store, thoughtfully renovated from a historic Kyoto building, beautifully balances compliance with Kyoto’s strict regulations for preserving scenic beauty while embodying the brand’s signature minimalist design. With its innovative integration of local culture, the store’s exterior and interior feature generous white spaces, creating a striking and recognizable aesthetic that harmonizes elegance with cultural reverence. The store’s distinctive half-black, half-white design, paired with 270-degree panoramic windows, offers a unique second-floor viewing experience while setting a benchmark for modern commercial spaces. The photogenic design captivates younger customers, while the stunning panoramic views encourage customers to linger, reflecting a keen understanding of Japanese tourists’ preferences, who value both the café’s ambiance and its offerings. (Japanese customers value cafés as social hubs for interacting with friends more than Chinese customers do.)

Figure 12. The second floor of M Stand store in Higashiyama, Kyoto

–Products

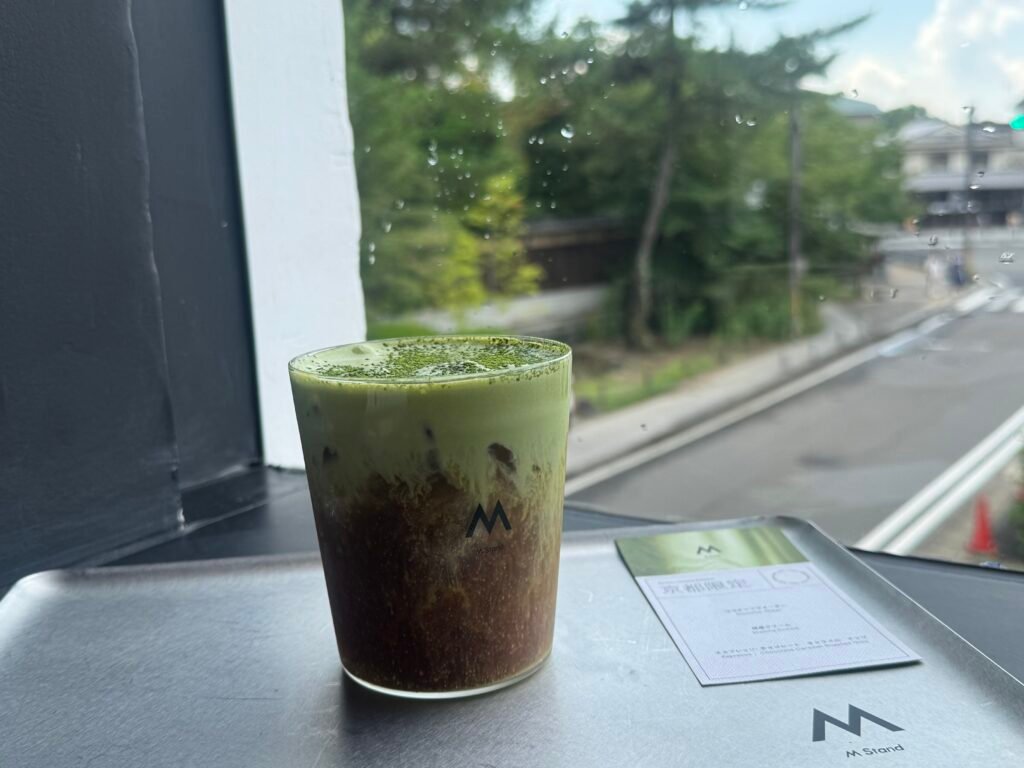

M Stand has successfully localized products, having Kyoto limited products like Matcha Coconuts Cloud Float and Caramel Pudding Affogatoe. Among them, the Matcha Cream Coconut Water Americano (抹茶クリームココナッツウォーターアメリカーノ), at 760 JPY, a Kyoto-exclusive specialty, stands out as a personal favorite, with its unique matcha flavor poised to captivate Chinese and international tourists alike. While Japanese customers, known for their discerning tastes, may initially be hesitant to embrace this innovative drink, its delightful flavor profile and distinctive appeal hold strong potential to win them over, especially if influential KOLs highlight it, much like the viral cement cheesecake in China. Regarding the store’s design, M Stand’s aesthetic and creative products are particularly well-suited to attract younger Japanese consumers, offering a fresh and modern vibe that could expand its appeal to local audiences. (If you’re interested in a topic of food product localization in Japan, we highly recommend reading the article: How to Satisfy Picky Japanese Consumers on Sweetness Level)

On Tabelog, Japan’s popular social platform for restaurants and cafés, some positive reviews about the store’s offerings are already gaining traction. Additionally, exclusive peripheral products available only at the Kyoto store, including coffee cups, passport holders, and refrigerator magnets, are offered as unique souvenirs for tourists, creating higher profit margins and opening new revenue streams for the Japan location.

Figure 13. Matcha Cream Coconut Water Americano of M stand

–Price

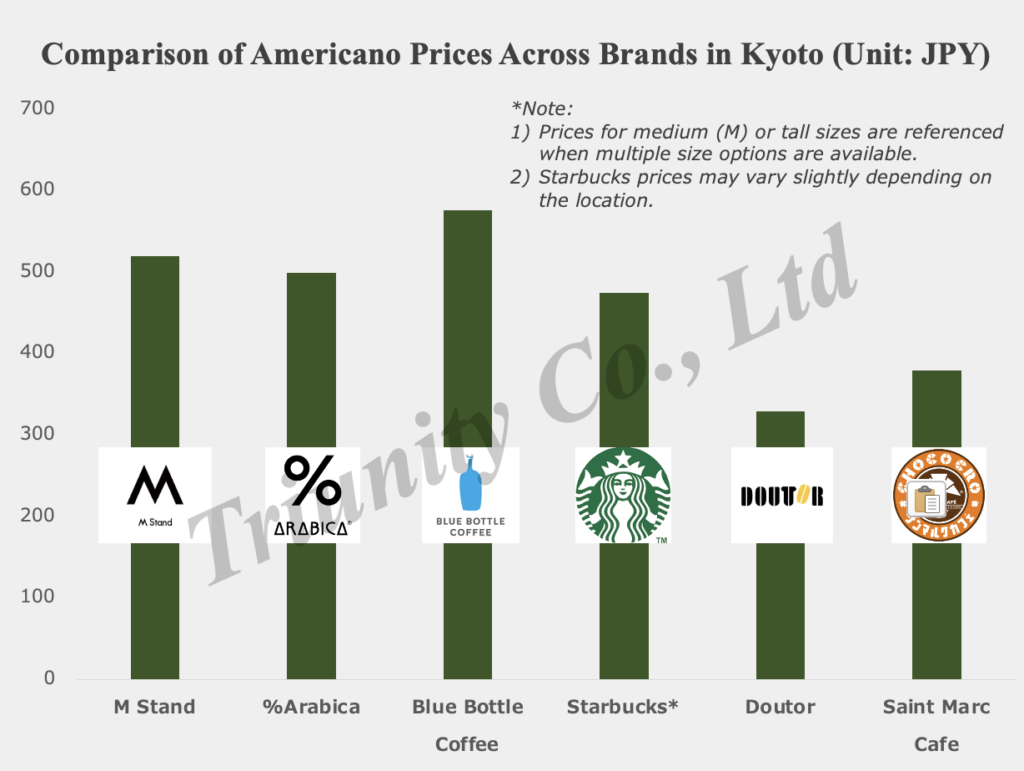

In terms of pricing, M Stand’s main coffee offerings are positioned slightly above average, with premium options ranging from 400 to 900 JPY, comparable to % Arabica. Given its focus on tourists in a prime location, this pricing is both reasonable and appealing. Unlike some restaurants in the Gion area that overcharge visitors, M Stand offers a fair and attractive value proposition.

Figure 14. Comparison of Americano Price Across Brad in Kyoto

Source: Official Websitse, Tabelog, and Xhaohongshu

4. Regulation of store designs for branding in Kyoto

For effective branding, store design plays a crucial role in conveying a brand’s concept when opening physical locations, alongside choosing the right location. As noted earlier, Kyoto’s strict regulations, like Kyoto City’s New Landscape Policy (京都市新景観政策) enacted since 2007, which is considered the most strict regulation in Japan, to preserve its scenic beauty require domestic and foreign companies to carefully adhere to these guidelines. This compliance not only ensures harmony with Kyoto’s unique aesthetic but also enhances a brand’s appeal, leaving a positive and memorable impression on visitors.

Kyoto City’s regulations impose detailed guidelines on the design of newly constructed properties to preserve its aesthetic charm. For instance, in urban scenic districts, buildings must use Japanese roofing tiles or flat tiles in oxidized silver, while metal roofing materials are required to be matte dark gray or black. These rules are especially stringent in culturally significant areas like Gion, Shimogamo/Kamigamo, and Sagano. A notable example is McDonald’s, which adapted its iconic red billboard to a subdued brown in some areas of Kyoto to comply with Kyoto’s regulations, harmonizing with the city’s traditional ambiance.

Figure 15. MacDonald’s brown billboard in Kyoto

Despite these regulations, it is entirely possible to craft a modern, stylish space while fully complying with Kyoto’s prescribed aesthetic guidelines. Brands simply need to collaborate with the right construction companies, designers, or consultants to achieve a harmonious blend of contemporary design and traditional compliance.

Blue Bottle Coffee, located near M Stand Kyoto store, serves as a prime example of transforming a traditional Kyoto house into a modern store while adhering to the city’s aesthetic regulations. Its design seamlessly blends contemporary style with Kyoto’s cultural heritage, creating an inviting and harmonious space. This style, blending tradition with modernity, is increasingly common in Kyoto, allowing visitors to immerse themselves in the city’s distinctive ambiance. Compared to this, M Stand’s store design stands out as more unique and innovative. From my observations, Blue Bottle Coffee adopts a more conservative approach, attracting a predominantly middle-aged Japanese customer, whereas M Stand’s vibrant aesthetic draws in a younger, trendier crowd. Presumably, this is because M Stand focuses on boldly showcasing its unique brand values to stand out, while Blue Bottle Coffee, already well-established in Japan’s market. The choice of which brand’s store design approach to reference depends on how you aim to position your store in Kyoto’s unique market.

Figure 16. Blue Bottle Coffee’s store in Higashiyama

5. Looking Forward…

In summary, Kyoto stands out as an ideal city for global brands seeking to expand internationally. For companies with ambitious global visions, Kyoto can be prioritized over Tokyo or Osaka as a strategic entry point into Japan. To effectively convey your brand’s values, it’s essential to understand and adhere to Kyoto’s strict store design regulations, ensuring your store harmonizes seamlessly with the city’s iconic scenic beauty.

While strolling through Kyoto’s vibrant downtown, I noticed an M Stand advertisement for staff recruitment, suggesting potential plans for additional stores to boost brand visibility in the city. M Stand’s approach to entering the Japanese market differs notably from HEYTEA’s strategy, and we’ll continue monitoring both brands’ progress in Japan and beyond for future updates. With growing interest in Kyoto’s market, we anticipate more brands will be drawn to its allure. However, with prime locations in Kyoto being limited, we recommend acting swiftly to secure attractive spaces. If you have any questions about this article or Kyoto’s market, please don’t hesitate to reach out.

Figure 17. M Stand advertisement for staff recruitment in Kyoto

Appendix

Last but not least, the M stand store offers a unique and complimentary “water fortune telling (水占みくじ)” experience that’s incredibly fun. When visiting, it’s highly recommended to try it and discover your luck!

References:

#1.京都市. 京都市産業観光局観光 MICE 推進室.2025.6.11. 令和6(2024)年 京都観光総合調査の結果

#2.Foodaily每日食品.2025.7.28. M Stand海外首店落地日本京都,正式开启海外市场战略新篇章.

#3.%Arabica official website.

#4.中日友人万事屋.2024.10.15. %Arabica—源于香港、崛起于日本的世界知名咖啡品牌.

#5.美艺文化.2025.02.17. 生活 | %ARABICA咖啡,为什么那么火?.

#6.数英DIGITALING.2023.05.12. M Stand价值定位研究–橙就品牌战略咨询.

#7.gooood谷德设计网.2024.06.22.另外建筑|M Stand上海苏河湾万象天地店.

#8.gooood谷德设计网.2024.05.28. WBS里外工作室|Mstand济南万象城店.

#9.搜狐.com.2025.07.23. M Stand日本京都店周末开业,紧临蓝瓶咖啡.

#10.bilibili.2025.07.26. M Stand海外首店-京都 不仅可以喝限定饮品 还能玩水占卜!!.

#11.京都府.2007.03.16. 京都府景観条例.

#12.京都市都市計画局.新景観政策.時を超え光り輝く京都の景観づくり

#13.株式会社美家.2023年8月8日京都の景観条例とは?住まいどのように影響するのか、色彩やデザインをわかりやすく解説!.

#14. マクドナルド公式サイト.よくあるご質問.マクドナルド情報について.

Leave a Reply