Author: Yuying Qian

In the last blog, we discussed about diaspora marketing, focusing on the local diaspora community as a way to penetrate into the new market quickly in the beginning. In this blog, we will deep dive into localization topic, introducing Japanese preference on sweetness level.

Japanese consumers exhibit a higher penetration of sugar-free beverages compared to most countries

Japan’s unique dietary landscape reveals a strong preference for low sweetness level, a stark contrast to many other nations. In Japan, convenience stores and vending machines are filled with sugar-free or low-sugar drinks. This preference of low sweetness level is deeply ingrained in their culture, impacting everything from beverage choices to dessert consumption. It is particularly pronounced among Japanese men during meals. In Japan, sugary drink market shares steadily declining since 1980, while sugar-free options have surged from a mere 1% to an impressive 54% in 2022.

According to a USDA report on global sugar consumption in 2024, the average annual sugar intake per person in Japan is approximately 14 kg, slightly lower than China’s 16 kg. In comparison, the intake in Western countries is two to three times higher than that of Japan. This indicates that Japanese people consume less sugar than many other nations.

Despite this focus on low-sugar beverages, the Japanese palate enjoys sweetness. A 2024 Line Yahoo survey found that over 90% of Japanese respondents aged 15-64 appreciate sweet foods, with a higher proportion of women than men expressing this preference. Younger individuals aged 10-30 also tend to favor sweets more than those over 60.

Sweetness level preferences vary by country and are closely linked to cultural dietary practices. Many Japanese individuals living in western countries often find local dishes and desserts excessively sweet. As international F&B brands expand into Japan, understanding local consumer preferences is crucial for successful product localization.

Japanese consumers exhibit heightened sensitivity to sweetness level

Research from Oxford indicates that Japanese individuals can detect sweetness at lower concentrations due to their early exposure to mildly sweet foods like rice and mirin, a trend that has persisted throughout their culinary history. Additionally, media campaigns in Japan promoting diabetes prevention have ingrained the notion that excessive sugar consumption can lead to health issues

So how sensitive are they to the level of sweetness?

A recent online survey in Japan revealed that over 63.5% of respondents choose black coffee or unsweetened tea.

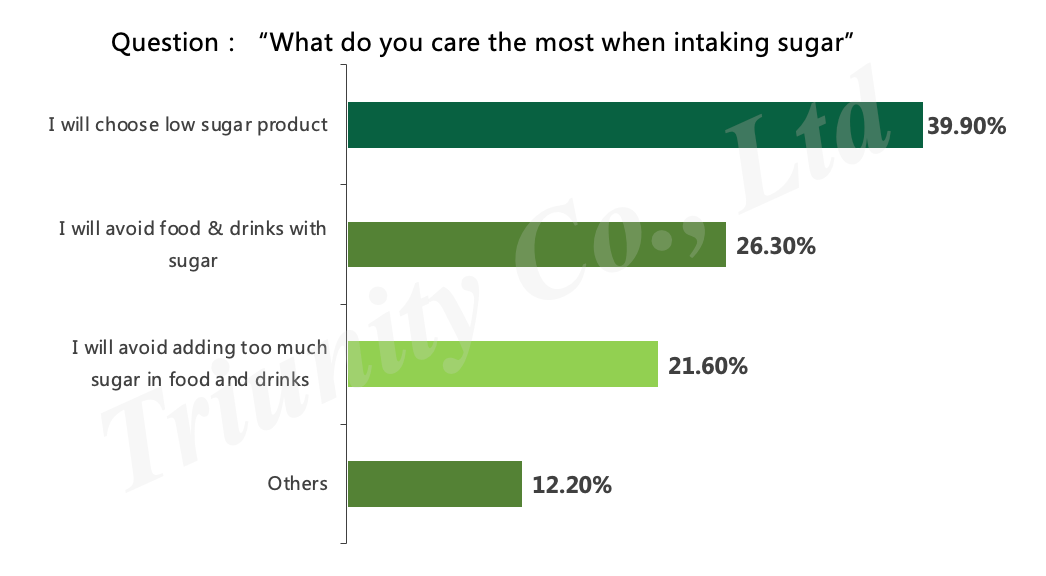

When asked about their habit regarding sugar intake, 39.9% of participants indicated a preference for low-sugar products. This was followed by 26.3% who aimed to avoid sugary foods and drinks, and 21.6% who wished to avoid added sugars in their food and beverages. Interestingly, many Japanese consumers are wary of artificial sweeteners due to perceived safety concerns.

This chart is based on internet survey @dime

So, what types of foods do Japanese people consider “low-sugar” or “slightly sweet”? Examples include almond tofu, Greek yogurt, japanese sweet potatos, pineapple cakes, and various fruits that naturally possess sweetness.

Photo from: PROFOODS

How to adapt to Japanese consumers’ sweet Level?

- Utilize Natural Sweetness from Ingredients

Japanese consumers have a perception that sweets are unhealthy, yet is it not they do not like them. The key is that they desire sweetness without the sugar. Understanding this is crucial before localizing products. In Japan, there is a trend towards developing products that emphasize the natural sweetness of ingredients to reduce sugar content while maintaining flavour. Ingredients like red beans, black sesame, and chestnuts contain natural sugars that are mildly sweet which are considered healthy by Japanese standards, as they are not associated with diabetes and offer beauty benefits. These ingredients are familiar to Japanese people and frequently appear in traditional desserts.

In some cases, the natural sweetness of Japanese tea is utilized in product localizations. A notable example is the Houji Tea Latte, which has long been popular among consumers at Starbucks in Japan. This drink is described as a “gentle sweet tea,” featuring moderate bitterness alongside a rich sweet aroma. It is refreshing and relaxing to drink. While the standard version contains syrup, some Japanese customers prefer to omit it to enjoy the subtle sweetness of the tea itself. Featuring sweetness of natural ingredients is one way to reduce the amount of sugar while keeping their sweet taste. Currently, even stores of Japanese confectionary which usually contains a lot of sugar tend to develop deserts without sugar and with or by highlighting sweetness of natural ingredients like 红豆、黑芝麻、黄豆、etc.

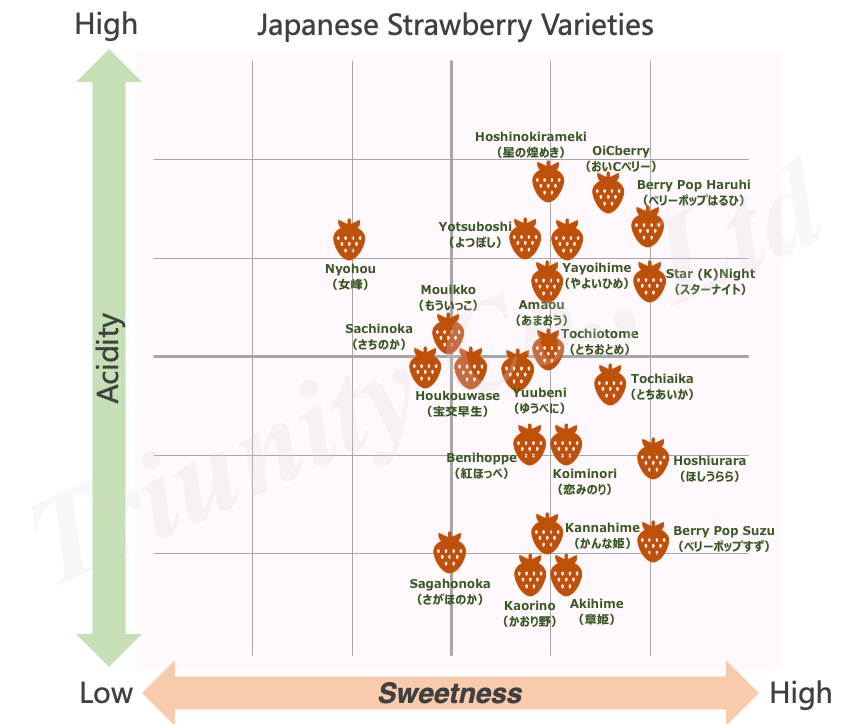

Fruits are also excellent sources of natural sweetness, with Japanese fruits generally being sweeter than those in some other countries. They often do not require additional syrups or artificial sweeteners to satisfy the Japanese craving for sweetness. Japan’s dedication to fruit cultivation reflects a “craftsmanship spirit,” with over 250 varieties of strawberries available. Popular varieties include Amaou and Tochiotome, which have comparable sweetness levels to strawberries like the Chinese 红颜草莓 but are more expensive—wholesale prices can be about 10 times higher than in China, and 7 times higher in France.

Photo from weather news

2. Highlight Sweetness level with Bitterness or Sourness:

Unlike preferences for uniform flavours, Japanese consumers enjoy contrasting tastes. For example, the combination of sweet and bitter flavours has roots in Japan’s tea ceremony tradition, where high-sugar confections are paired with matcha—a practice that has existed for over a thousand years. Gongcha in Japan has utilized this preference by developing seasonal offerings like “Matcha Strawberry Milk Tea” and “Strawberry Almond Milk Tea“, both have achieved 400,000 cup sales through this sweet-bitter combination. Additionally, salty-sweet and sour-sweet combinations are also well-received in Japan. For instance, Coca-Cola launched a clear lime-flavored soda in Japan during the summer of 2019, selling over 10 million bottles during the sales period from June to August and ranking sixth among new beverage releases that month.

The failure experience of American brand with high sweetness level in Japan:

Krispy Kreme, an American donut brand celebrated as the “favorited donut brand” by U.S. consumers for its original glazed flavour, opened its first store in Japan in 2006 without altering its American recipes. Despite successful marketing leading to 64 locations, sales began to decline sharply, resulting in the closure of about 30% of stores by 2018 when only 44 remained. Initially unaware of the reasons behind this decline, Krispy Kreme later discovered through consumer feedback that their donuts were excessively sweet for Japanese tastes. After communicating with their parent brand, Krispy Kreme introduced less sweet limited-edition flavours like Brulee Glazed and switched to dark chocolate to reduce overall sweetness. Following these adjustments, the number of stores rebounded to 60 by 2022.

Photo from Japan truly

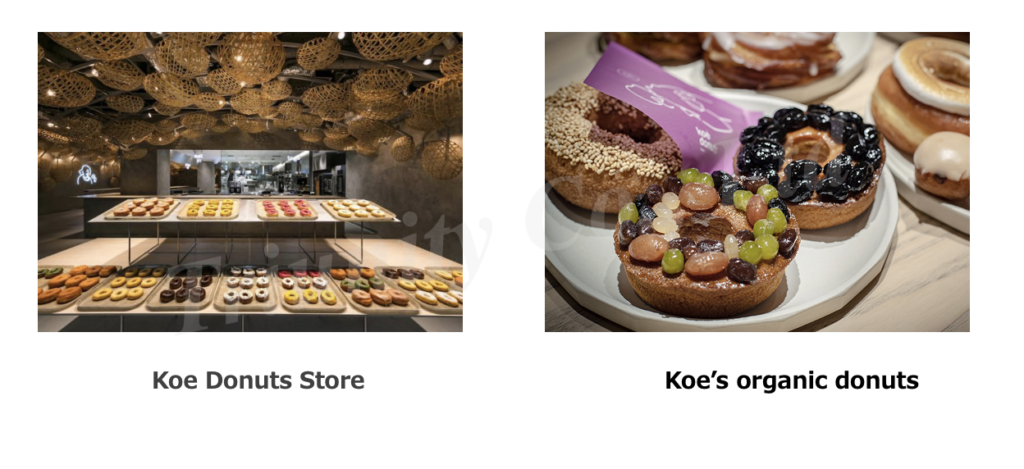

Conversely, Koe Donuts—a local brand from Kyoto—has thrived by emphasizing natural and organic ingredients sourced locally. Their donuts are made with organic wheat flour and sugar and fried in domestic rice oil while incorporating organic fruits and chestnut puree for lower-calorie options.

Photo from Spoon&tamago and japankuru

This experience offers insights for many western dessert brands looking to enter the Japanese market. Failing to adjust sweetness levels may hinder their acceptance among Japanese consumers.

What products align with Japanese sweetness level that could have a chance in Japanese market?

Kombucha and Low sugar Acaí Bowl

Kombucha which is fermented tea can differentiate itself with its health benefits and unique flavors, appealing to Japan’s tea-drinking culture that values the combination of sour and sweet. Labeling kombucha as “natural,” “organic,” and “aid digestion” could resonate well with consumers. Low-sugar Acaí Bowl also presents an opportunity despite existing products like Calbee’s granola existing on Japanese shelves. If you check the material statement carefully, Calbee’s granola actually contains 270kal calorie/50g with lots of sugar, which is not so friendly for people want to keep fit and on diet. Acaí Bowl with non-sweetened acai berries, nuts, seeds and fruits can be popular as a substitution of normal granola.

Photo from Liquid Remedy

However, one challenge is the high cost of raw material, wholesale prices for fruits like berries, for example strawberry, in Japan can be 7 times higher than those in France. High price of kombucha or Acaí Bowl can make Japanese hesitate to purchase. Nevertheless, this issue could be addressed through effective marketing strategies and branding.

Appendix: Useful Japanese vocabulary for sweetness level

Common terms used to express mild sweetness include honnnori (ほんのり), yasasiku (優しく) and amai.

The term “生” is also liked by Japanese consumer, examples include raw tea, raw chocolate, raw caramel, and raw bread—all popular concepts originating from Japan. In many countries, “raw” might evoke concerns about safety or undercooked food; however, in Japan, it conveys freshness, deliciousness and absence of additives. This perception stems from historical dietary practices centered around fish and vegetables established after Buddhism was introduced to Japan. To enjoy fresh fish safely, early Japanese people began using vinegar and cultivating antimicrobial plants like Sichuan peppercorns and perilla leaves—allowing them to enjoy raw foods while minimizing food poisoning risks. This cultural affinity for raw food continues today as it remains associated with deliciousness in the Japanese mindset.

Photo from Taobao and Amazon

Also, you can check out our Japanese website here:

Reference:

[1] PR Times, 2024.2.13, 【LINEリサーチ】9割以上がスイーツ好き!好きなスイーツ1位は「アイスクリーム/ジェラート」

[2] Shijie Yang,Takashi Doi and Tatsuro Miyake, 2024.4, Sensitivity to sweetness of Japanese students and Chinese international students

[3] R. Ishii, S. Yamaguchi, M. O’Mahony, Measures of taste discriminability for sweet, salty and umami stimuli: Japanese versus Americans, Chemical Senses, Volume 17, Issue 4, August 1992, Pages 365–380, https://doi.org/10.1093/chemse/17.4.365

[4]PR Times, 2024.3.22, ゴンチャ史上、期間限定ドリンク最大のヒットを記録 春の定番「いちご杏仁」

[5]日本食品出口展,日本糖果零食展|日本民众对甜食的偏爱是出了名的,那么究竟哪些甜点能够俘获他们的味蕾呢?

[6]搜狐,2022.10.17,什么是适合国人口味的创意咖啡?T97给出了答案

[7]@dime,2018.11.1,「甘さ控えめ」に弱い日本人、約4割の人が微糖、低糖、無糖を選んでいた https://dime.jp/genre/616828/#google_vignette

[8] Medipalette,2024.3.11,コーヒーや紅茶に砂糖を入れない人は6割超!砂糖の摂取量の目安とは

[9] チコちゃんに叱られる!】なぜ日本人は「生」が好き?生ビールや生チョコ、日本人の「生」へのこだわりを解説|9月27日放送

[10]Ryutsuu biz, 2019.7.24, 清涼飲料/6月1位はキリン「生茶」

[11] Ryutsuu biz, 2019.7.24, コカ・コーラ/昨年1000万人が飲んだ透明なコーラに「ライム」味

[12]Savvy Tokyo, Healthy Japanese Sweets To Keep An Eye Out For

[13]Biglobe, 2024.1.15, いちごの品種による甘さの違い 「いちごチャート」で酸味もチェック

[14]Fun!Japan, 2024.8.9, Kyoto】Popular Sweet Shop “koe donuts” Launches New Products: Full Lineup Revealed

[15]azuchanblog, 2020.12.27, 【ほうじ茶ティーラテ】元スタバ店員が基本情報とおすすめカスタムをお伝えします

[16]华福证券,2023.8.28,代糖专题一:减糖趋势下代糖对食糖的增量替代空间探讨

[17]搜狐,2023.10.25,饮料乳品行业研究报告:复盘日本软饮变迁,探究行业潜力赛道(附下载)

Leave a Reply