By Qian Yuying, Akira Tsuruta, 2025.01.08

Triunity has launched an English podcast! We occasionally interview industry experts in international markets to provide in-depth insights into leading global industries. Key points are summarized in the accompanying article below. We invite you to enjoy the article alongside the podcast.

Magnificient markets of BIPV in 4 countries (Singapore, Japan, China, Australia) by Triunity, 22 min

Guest Speakers

Dr. Tianyi Chen, National University of Singapore

In this episode, we are thrilled to welcome Dr. Tianyi Chen with a Ph.D. at the National University of Singapore. He offers an in-depth discussion on the market outlook and entry strategies for Building Integrated Photovoltaics (BIPV) in Singapore, China, Australia, and Japan.

Dr. Cheng holds a Ph.D. in Architecture from the National University of Singapore and serves as a researcher at the Singapore Solar Energy Institute. He is a key member of the Solar Power for Traditional Timber Buildings project and has established his own solar power company in Singapore, Power Fahttps://www.powerfacade.net/cade, which designs and manufactures prefabricated colored solar panels.(https://www.powerfacade.net/)

This episode is essential listening for BIPV suppliers, integrators, and investors aiming to enter the market both domestically and internationally. It provides valuable insights for maintaining a leading position in this highly competitive industry.

4 key points

- The Singaporean government actively supports the use of prefabricated BIPV technology, primarily deploying it in government HDB public rental housing and private development projects. For facade PV, the color of photovoltaic panels and their installation design are crucial factors. Due to Singapore’s stringent fire safety requirements for BIPV projects, products certified in Singapore are more likely to meet regulatory standards in international markets.

- The cost of BIPV has significantly decreased compared to two years ago. The potential of the Chinese market is expected to emerge as local policies increasingly promote BIPV adoption. Notably, installing BIPV on the western facades of residential buildings can efficiently harness sunlight at dusk to generate electricity. It’s important to note that the challenge within the Chinese market lies not in the technology itself, but in effectively communicating with neighboring property owners regarding the distribution of solar power generation rights in community settings.

- Japan and Australia are also strong markets for testing BIPV. In both countries, prefabricated buildings are well-established and operate under relatively mature business models. Additionally, with high labor costs in the construction industry, prefabricated BIPV is likely to be welcomed, as it can significantly cut down on labor expenses.

- In addition to price and appearance, ease of installation and removal are crucial factors in BIPV deployment. While photovoltaic panels have a lifespan of only 25 years, buildings typically last 60 to 80 years. Therefore, the primary question an architect should ask is: “How can I easily replace the photovoltaic modules over the building’s lifetime?”

01

Singapore: The government is actively promoting prefabricated BIPV, and the market prospects for colored solar panels are promising. (*However, it should be noted that the current fire safety requirements for BIPV in Singapore are relatively strict.)

What are your thoughts on the BIPV market in Singapore?

Dr. Chen: I believe the market in Singapore is crucial due to its stringent fire certification requirements for BIPV. Securing certification here could pave the way for expansion into other markets. Singapore is also considered an excellent country for introducing solar power, with both the government and companies showing significant interest in this sector.

In Singapore, government agencies like the BCA are actively promoting prefabricated construction. 3D modular buildings are gaining popularity here due to the absence of earthquake or flood risks. These buildings can be pre-finished off-site and installed, which helps reduce labor costs—a significant consideration given the expected increase in labor costs in Singapore. Additionally, I know several startup owners in related fields who are leveraging Singapore as a demonstration hub to introduce their products to markets like Vietnam and Thailand.

Singapore is at the forefront of green and net-zero building initiatives, with numerous structures featuring vertical greenery and rooftop solar panels. Building-integrated photovoltaics (BIPV) is one of the newer passive design technologies that has gained traction in recent years. How is BIPV currently being implemented in Singapore, and are there any notable examples of buildings utilizing this technology?

Dr. Chen: Currently in Singapore, many people are inquiring about the availability of BIPV products and existing buildings that incorporate BIPV technology. However, there are still relatively few instances of installing solar power on building facades. Since September 2022, the Singapore Civil Defence Force (SCDF) has introduced stricter fire safety regulations, impacting the implementation of such technologies.

The installation of photovoltaic panels in Singapore must adhere not only to IEC and ISO standards but also to the local fire safety regulations set by the Singapore Civil Defence Force (SCDF). As a result, after a year and a half of these regulations being in place, only one company, Jolywood (Suzhou) Sunwatt, has successfully complied with them. However, the company’s primary focus remains on standard rooftop photovoltaics. In terms of BIPV systems, the facade’s architectural design necessitates higher aesthetic standards, suggesting the need for color photovoltaic panels.

Consequently, standard black or blue solar panels do not satisfy the requirements of construction or property developers. Introducing color pigments necessitates additional testing and certification, which will extend the timeline for BIPV to gain market traction in Singapore.

Compared to rooftop solar power, BIPV demands higher design standards, with colored solar panels showing significant promise. What technologies are currently available for producing colored solar panels?

Dr. Chen: There are two primary technologies for creating colored solar panels:

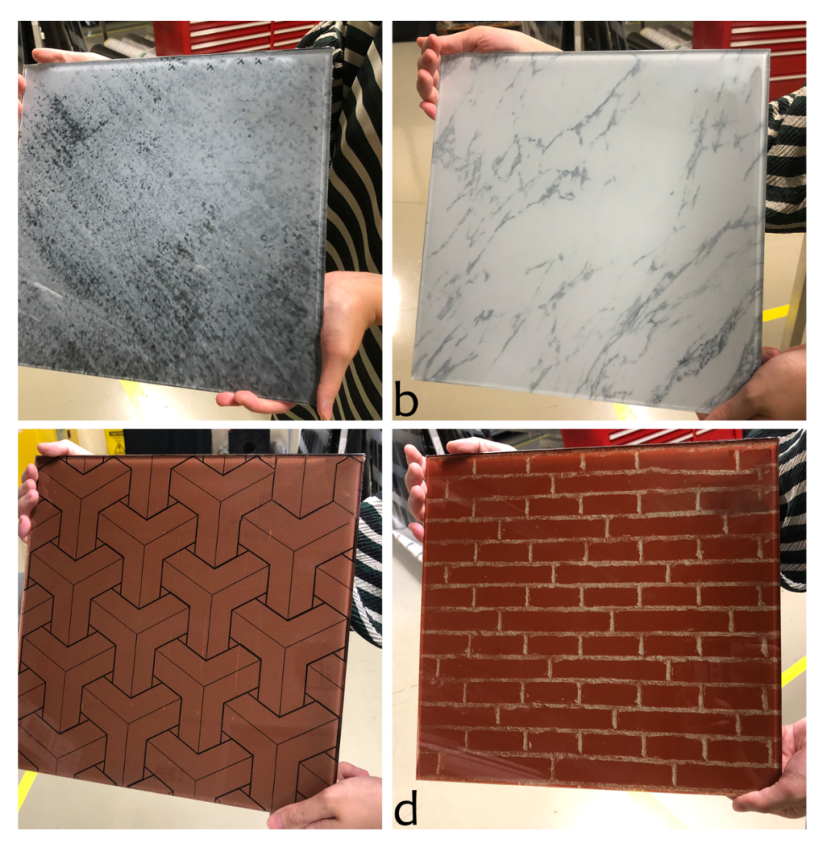

One approach is to use ceramic printing technology to digitally apply color onto the underside of the solar panel’s top glass. Although this technique may incur higher costs, it provides substantial design flexibility, allowing for detailed customization with a variety of colors and patterns on a single panel.

Another method involves using color uniformity technology, currently being developed by a Spanish company called Kromatix.

However, it’s important to note that tinted photovoltaic panels may lead to hotspot effects. These are localized issues caused by damaged or obstructed cells within the solar module.The varying colors of solar panels can cause different levels of solar radiation to penetrate the solar cells, leading to a risk of elevated temperatures in certain areas, potentially reaching 60-80 degrees Celsius. In Singapore’s tropical climate, even standard solar panels without added color can reach operating temperatures of around 60 degrees Celsius. In this scenario, hotspots are more likely to develop, which can decrease the efficiency of the entire assembly and, in severe cases, compromise the lifespan of the solar module. This issue is particularly prevalent with ceramic printing technology.

I believe the aesthetics of Building Integrated Photovoltaics (BIPV) are crucial. Is there a way to maintain these aesthetic advantages while also avoiding the hotspot effect?

Dr. Chen: Both the Solar Energy Research Institute of Singapore (SERIS) and my startup, Power Facade, have been experimenting with ceramic printing technology to increase design flexibility and mitigate hotspots. One method to prevent hotspots with this technique is by using specific color combinations. Simply put, some colors are more effective than others in this context.To improve color performance, we tested white and blue, which resulted in a relative power loss of approximately 15%. In contrast, green and yellow proved to be less effective, leading to power losses of up to 40%. By combining colors with varying power generation efficiencies to achieve similar radiation transmittance for each cell, it is possible to create a variety of design patterns while avoiding hotspots.

Colored Photovoltaic Panels of Power Façade

Are there any installation or engineering challenges that need to be addressed, or potential business opportunities ?

Dr. Chen: Concerning installation and engineering, the primary issue currently is the time-consuming process. Adding an extra layer of photovoltaic panels to an existing building requires lifting equipment. Even for new buildings, the installation is complex and involves multiple steps, one for each layer.

During my PhD studies, I developed a prefabricated modular Building-Integrated Photovoltaic (BIPV) system. Similar to Lego blocks, the solar panels and insulation materials, like ROKU fiberglass panels, can be assembled as desired and preassembled in a factory. This approach allows workers with no electrical experience to easily get started. In a test installation of a 9m² solar panel, the process took only 1-2 hours. This system offers architects significant design flexibility, as they can easily change the color of the photovoltaic panels. Additionally, we provide pre-assembled power optimizers that enhance compatibility with various types of photovoltaic panels. Moreover, the system can integrate not only with photovoltaic panels but also with other non-photovoltaic materials, such as windows and doors. We refer to it as an open system, for which we have secured a patent in China. We are currently in the process of applying for patents in Australia and Singapore.

02

In the Chinese market, the primary challenge lies not in the technology itself, but in aligning the interests of all stakeholders and effectively distributing income within the community. (*Notably, local policies are increasingly supporting the promotion of Building Integrated Photovoltaics (BIPV)).

Shanghai has numerous old apartment buildings. As these structures are demolished and replaced with new ones, will this create an opportunity for BIPV manufacturers to enter the Chinese market?

Dr. Chen: In residential construction, that is our goal. In China, the north and south sides of buildings typically face natural landscapes, allowing for more daylight to illuminate the interior. However, the east and west sides are often designed with solid, windowless surfaces. The western façade, in particular, bears the brunt of the afternoon sun. Consequently, most windows in Chinese homes open towards the north and south to optimize lighting and comfort. We believe that Building Integrated Photovoltaics (BIPV) can be effectively installed on the west façade of a house to harness the energy of the afternoon sun for electricity generation. Concurrently, local governments in several provinces and cities in China have introduced policies aimed at increasing the proportion of green buildings.

Although the market outlook appears promising, installing solar panels on the facades of residential buildings in China presents certain challenges. The difficulty lies not in the technology but in effectively sharing the benefits with the community. Rooftop solar power generation tends to be easier to handle, as the rooftop area is typically leased to the investor or owner of the system, and the project is funded through the sale of the generated electricity. However, when it comes to installing solar panels on a building’s facade, determining how the generated electricity or energy should be distributed becomes more complex. This process requires the consent of all building owners and involves relatively high communication and transaction costs.

In this context, I believe the Singapore market serves as an excellent testing ground for building-integrated photovoltaics (BIPV). This is largely because public housing, such as HDB flats, is government-owned, giving them the ultimate authority on construction decisions, including the implementation of BIPV systems.

03

Australian market: favorable for prefabricated BIPV.

Dr. Chen: Australia has an abundance of land, but faces a challenge with high labor costs. As a result, using prefabricated solar pannel presents a promising solution. This approach could be effectively integrated into their existing prefabricated construction industry.

04

Japanese market: Similar to Australia, the prefabricated buildings are well developed and it is one of the ideal test fields for BIPV.

Dr. Chen: Prefabricated construction is highly developed in Japan, supported by an established business model that includes solar power products. Unlike China, which faces certain challenges, Japan has fewer community structures and boasts a market with many independent houses, which is advantageous. Building owners in Japan benefit from not needing to navigate specific solar power promotion policies; they simply consult a local construction company. A significant advantage is the close relationship between Japanese construction companies and solar power manufacturers. As a result, solar power installations and applicable subsidies are directly integrated into the construction contract, eliminating the need for owners to apply for subsidies themselves. This streamlines the process and significantly reduces both the cost and the time required for communication.

05

In the Middle Eastern market, the abundance of land and low cost of electricity result in a lack of interest in building-integrated photovoltaics (BIPV) at present.

In recent years, several Chinese solar power companies, including Jinko, GCL, and Trina, have expanded into the Middle East. Do you believe there are opportunities for building-integrated photovoltaics (BIPV) in this region?

Dr. Chen: This is an excellent question. I reached out to my colleagues in the Middle East to gain insights into the BIPV market there. Their response indicates that Middle Eastern countries currently do not prioritize BIPV. With abundant land available for ground-mounted solar power generation and a focus on high architectural style and design, they are unlikely to adopt BIPV until the technology becomes more mature. Additionally, electricity costs in the Middle East are significantly lower—about one-third of those in Singapore or China—making traditional solar implementations more economically appealing.

Is it accurate to say that the Middle Eastern market currently shows limited interest in rooftop solar and BIPV installations?

Dr. Chen: I believe so. There might be a significant amount of rooftop PV, but they don’t seem particularly interested in BIPV.

06

Future trends: In addition to price and appearance, ease of installation and removal is also important.

What is the current price/cost of BIPV? Is the cost still considered high?

Dr. Chen: For colored PV panels being purchased in bulk nowadays, I believe the cost has decreased compared to two years ago. Back then, even a small batch of about 6-10 standardized colored solar panels would have cost around SGD 1,000. Currently, the cost for a total of 300 square meters of solar panels can be as low as SGD 300 when purchased directly from the factory, indicating a significant price reduction. Additionally, if you’re able to connect with a reliable Chinese factory or supplier, the price can be even more affordable.

Are you currently seeking manufacturers or partners to collaborate on your projects? What challenges do you anticipate in the future?

Dr. Chen: We believe that the developer is the most important stakeholder. If the developer is willing to invest in and install the system, implementing the project will be much easier. The primary cost of the project remains in the solar panels, particularly the colored solar panels.

If the cost of BIPV systems could be reduced substantially, similar to the pricing of standard curtain wall systems like metal curtain walls, their implementation would be much easier. Beyond cost concerns, there are also design challenges related to installation and removal. People frequently ask how to manage the system and how to disassemble it if the substrate gets damaged. Therefore, I believe that developing convenient methods for installing and dismantling BIPV systems is a crucial future challenge and direction for architects and engineers. Currently, dismantling BIPV systems, especially in high-rise buildings, remains difficult. It requires lifting equipment and other tools to transport workers to the top, making the process both challenging and hazardous. Photovoltaic panels have a lifespan of only 25 years, while buildings typically last 60 to 80 years. A key question architects must now address is: “How can photovoltaic modules be easily replaced during a building’s lifetime?“

At Power Facade, we are working on developing a solar panel with a metal backsheet that can be easily folded and attached. This design will allow for straightforward removal and replacement. Typically, solar panels feature an external frame or clamps. We are striving to minimize these components, although doing so poses safety challenges for high-rise buildings. We are committed to continuously challenging ourselves to improve our designs while ensuring safety.

Power Facade‘s Prefabricated Transparent Photovoltaic Wall System

If you have any questions about the content of this article or podcast, please feel free to contact Triunity.

Podcast: Play in new window | Download

Leave a Reply