By Yuying Qian, 2025.05.13

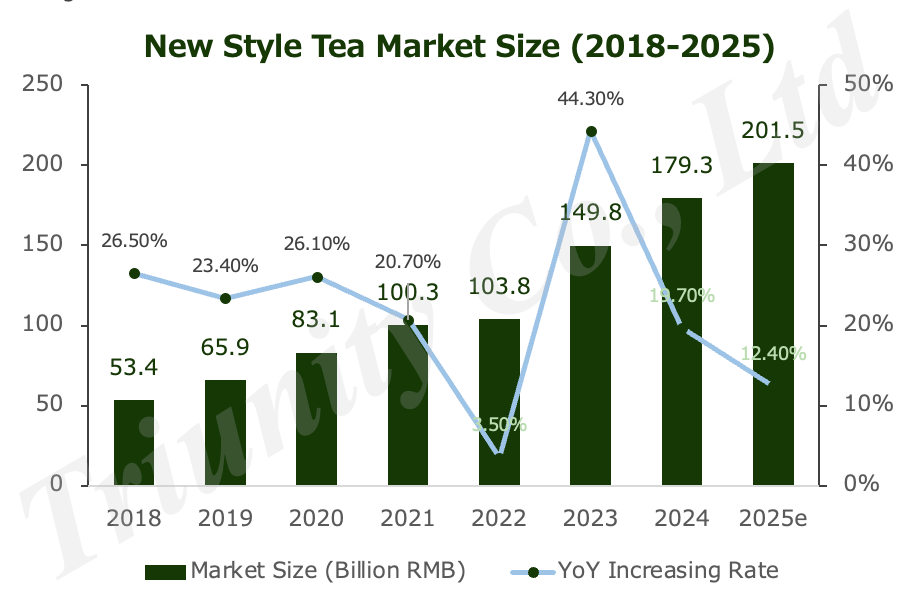

In the beginning of 2025, 3 Chinese new style tea brands Good Me (古茗), MIXUE (蜜雪冰城) and CHAGEE (霸王茶姬) went listing in Hongkong and US. The surge in the number of listing points to the fierce competition on China’s crowded fresh tea drink market. According to a report released by China Chain Store & Franchise Association, China’s new style tea market is going to reach RMB 201 billion in 2025, but its growth speed has decreased from 44% in 2023 to 19.7% in 2024.

Figure 1. Market size and growth speed of new style tea in China

“Competition is so fierce that, to some extents, IPOs maybe their last chance” said Shi Li, an F&B analyst at online retail media Lingshouke (灵兽传媒). (About New Style Tea Market in China, you can also refer this article: Emerging Trends in China’s New Style Tea Market-Anticipation Builds Worldwide-)

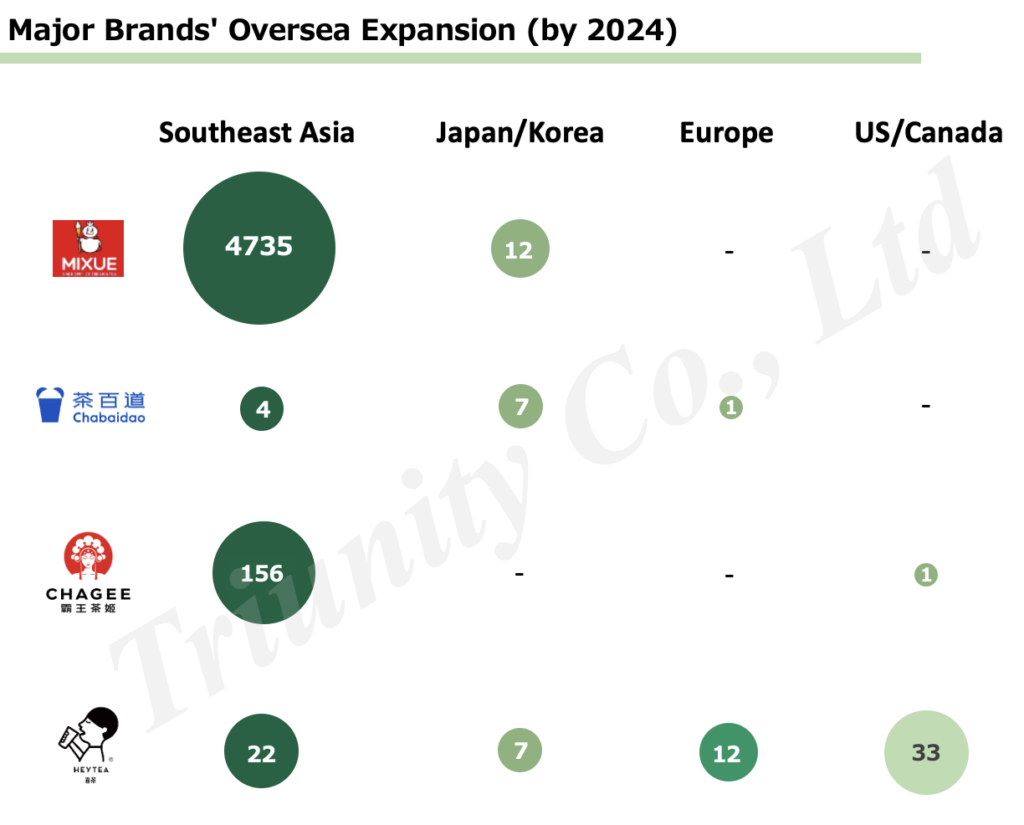

Leading brands have also been switching their strategy, focusing more on overseas markets as the Chinese market is turning to the red ocean. Different tea brands have established themselves in various geographical locations.

Most brands picked Southeast Asia as their first destination because of geographic proximity, drinking demands trigged by hot weather and high acceptance level of Chinese brands, especially MIXUE and CHAGEE. By the end of 2024, MIXUE has opened almost 4,800 stores in the SEA region, with a significant success in Indonesia and Vietnam by copying its low-price model in China. CHAGEE has positioned itself as a high-end milk tea brand in Malaysia and Singapore by selecting prestigious locations with Starbucks as a benchmark. ChaPanda challenges the South Korean market which is dominated by coffee culture. HEYTEA, on the other hand, seems to focus more on high end markets like North America and UK.(About HEYTEA’s overseas market expansion, you can also refer these two articles:A Taste of Home – Diaspora, Gateway to Penetrate New Market ; Can HEYTEA inspire Japanese consumers? )

Figure 2. Major brands’ oversea store number by 2024

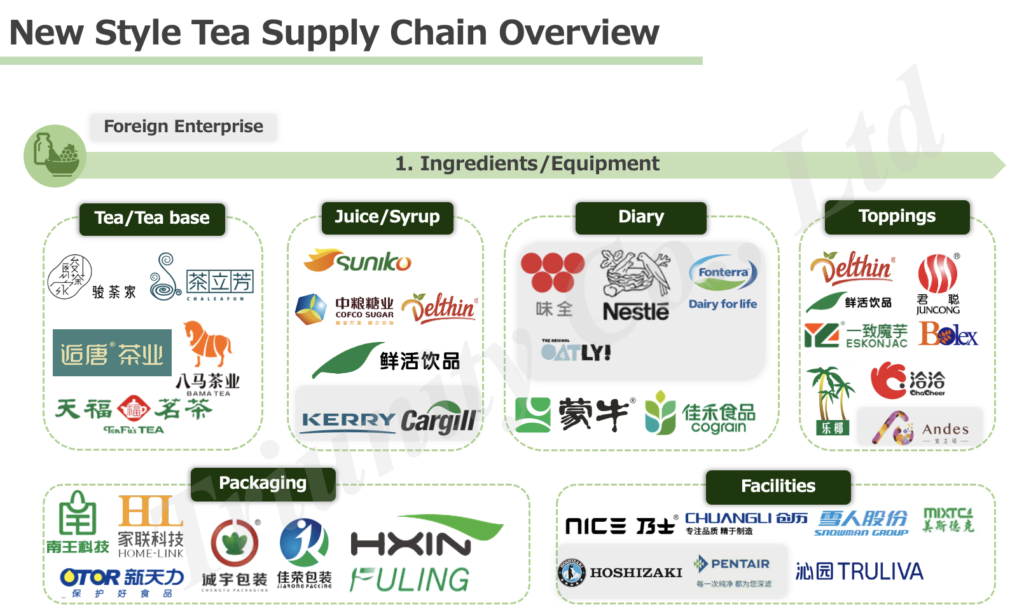

It is too early to tell who the winner at the end will be. One of the biggest challenges that new style tea brands face during their global expansion in the initial stage is supply chain: core raw materials relying on Chinese supply will greatly increase costs.

Figure 3. New style tea raw material overview in China

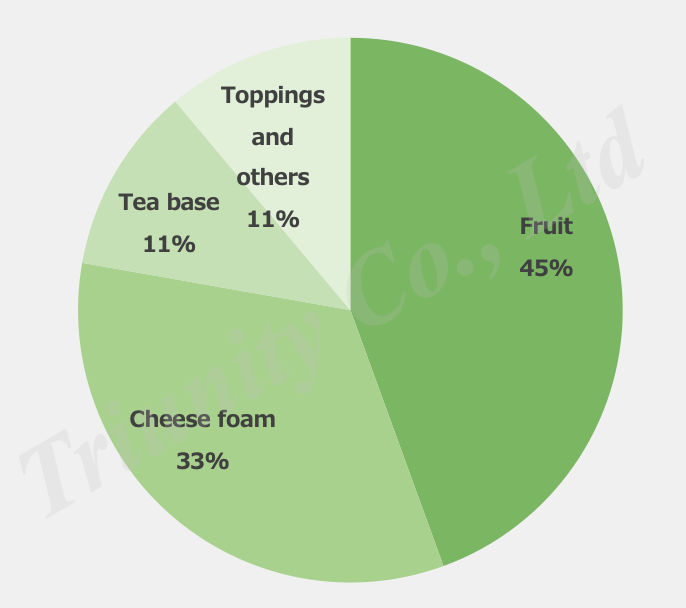

Among raw materials, one key is fruits, which is one big difference between new style tea and old styled ones. Ingredients costs usually takes up to 40% of a fruit tea’s total cost. And the cost of fruits usually costs the most comparing to other raw materials like tea, milk and toppings. For example, below is a rough cost breakdown of a typical fruit tea named grape cheese tea. Fruits take up to 45% in total raw material costs.

Figure 4. Rough cost breakdown of Grape cheese tea

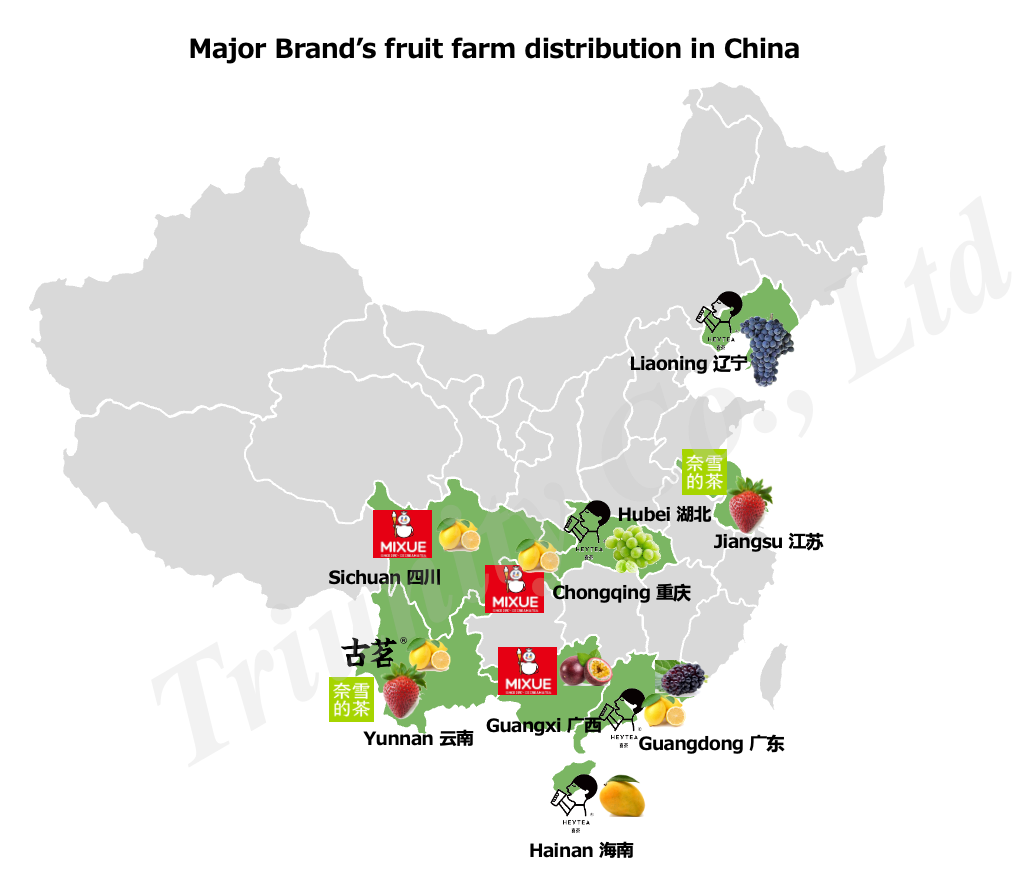

Thus, a strong fruit supply chain is critical to cut the costs. In China, leading brands have mostly established their domestic farms in southern provinces. For example, MIXUE’s lemon farm in Sichuan and Chongqing have helped its lemon procurement cost to decrease from RMB 4 /kg to only RMB 1 /kg.

Figure 5. MIXUE’s lemon farm in Sichuan Anyue

Figure 6. Major brands’ fruit farm distribution in China

However, in the initial stage, brands usually have not yet established a matured supply chain in oversea, especially for raw material like fruits. If rely on air transport from China comes with an expensive shipping cost around $4/kg (RMNB 29), not to mention the strict local custom quarantine procedures and issues related to loss. If source fruits locally in market like Japan, US, UK and Australia, fruit procurement costs would potentially be 5-10 times higher than in China. According to internet information, HEYTEA did not use fresh fruit but frozen fruit puree in UK to reduce high fruit procurement costs, but this action has raised some disappointments from its local Chinese fans and could damage its brand trust in overseas.

In this case, pure milk tea brands such as CHAGEE may possess a comparative advantage in overseas expansion due to their inherently simpler supply chain requirements, while fruit tea brands like HEYTEA and Nayuki could face more challenges in cost control. They need to think of other ways to reduce costs elsewhere or enter markets with low fruit prices first like MIXUE in SEA. Local supply chains and product localization are crucial for successful global expansion. Whether brands adopt a franchise model, partner locally, or enter new markets independently can significantly influence their ability to scale up.

Strategy of MIXUE, HEYTEA, CHAGEE and ChaPanda

Currently, MIXUE is leading in oversea supply chain building, opened almost 4,800 stores in Southeast Asia and already set up 7 warehouses in Southeast Asia while other brands are still in more initial stages.

Most brands have considered the franchise model in the beginning to spread quickly in the new market. However, franchise model in the beginning does not always work, especially for mid-high brands, franchise model is less effective for quality control and might damage brand image instead. Brands could even face “betrayal” of the franchisee like CHAGEEE’s case in Singapore. In this case, franchise model could even slow down oversea expansion and supply chain construction.

In the beginning, it is better to apply the direct management model, having localized marketing and product development team to utilize local raw materials could be one key for success. One good example is ChaPanda, it achieved high local customer purchase rate by inventing exclusive orange drinks in South Korea using the local fruit: Hallabong orange. Not only solved the supply chain issue but also attracted lots of Korean customers for future scalability.

1. MIXUE: Strong supply chain + franchise model

MIXUE replicated its Chinese model: “mass market penetration in lower tier cities + strong supply chain + franchise model” into Indonesia and Vietnam. Except for geographic proximity, higher percentage of younger generation among SEA countries and more tea drinkers, these two countries also have low fruit prices. And it is a region that more sensitive to prices, so its low-price strategy would work again.

Same as in China, MIXUE adopted the franchise model in Southeast Asia as well. In the beginning, it cooperated with Oppo and Vivo phone dealer in Indonesia to transform some of their stores into MIXUE stores or added bubble tea stands. By utilizing these existing networks, MIXUE quickly spread out in the nation. Later on, MIXUE tightened the franchise requirement a bit but still considered easy to join.

Figure 7. MIXUE local store in Indonesia

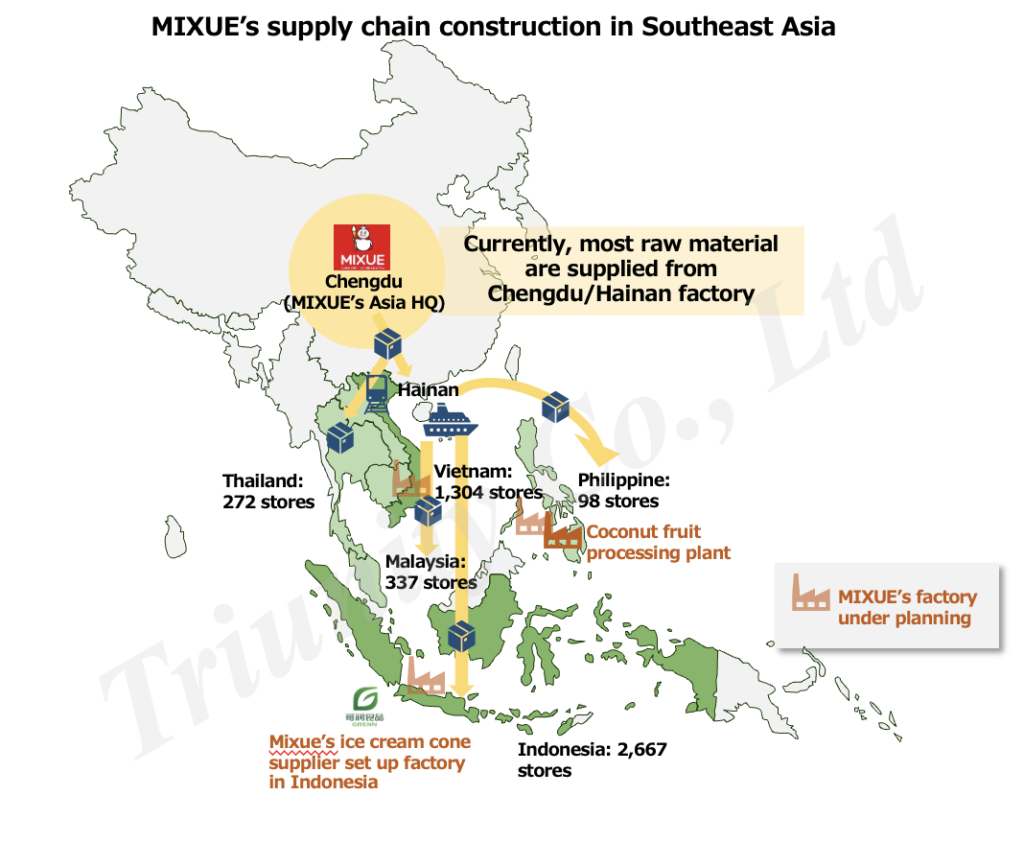

Considering the construction of the China-Malaysia Railway, in 2021, MIXUE decided to set its Asia HQ in Chengdu, Sichuan, a province which connects to Vietnam and Thailand through this railway. In 2023, a production site (mainly produces tea, syrups, packaging), warehouses, and export base have also been set up in this area.

Figure 8. MIXUE’s Asia HQ

According to the company’s official statement, the warehouse can meet the business needs of more than 6,000 stores. The number of MIXUE stores in nearby provinces (Sichuan, Guizhou, Yunnan etc.) is approximately 3,041 by 2024, considering that there are also factories in Chongqing and Guangxi, the remaining supply capacity of nearly 3,000 stores are assumed to be shipped to Thailand and Vietnam etc. Goods can be shipped from Chengdu to Vietnam in 7-10 days with a 20% lower cost.

Figure 9. MIXUE’s supply chain construction in Southeast Asia

Except to that, MIXUE has also set up an export company and a production base in Hainan, leveraging on Hainan’s location proximity to SEA and local tax benefits. This Hainan base is able to export frozen fruits, coffee, syrup, coconut milk, and toppings from Hainan to Southeast Asia countries. So far, 70% of MIXUE’s supplies in SEA are still mostly from its Chengdu and Hainan base with low supply costs, and lemon which is for their core product, lemonade, is sourced locally.

Unlike fruit tea brands like HEYTEA which mostly uses fresh fruits, MIXUE mainly used frozen fruits or fruit cans to save costs (except lemon, orange etc.) MIXUE may just need to establish cold chain transportation in oversea locally. By establishing 7 warehouses in SEA and a coconut factory in Philippine, it already achieved stock delivery within 48 hours. But that’s not enough, based on MIXUE’s IPO Prospectus, it will construct 3 local factories in Indonesia, Vietnam and Philippine to produce key raw materials, and two regional logistic centers in Thailand and Malaysia to accelerate its expansion in SEA.

Based on its fast supply chain construction speed, by the end of 2024, MIXUE has already achieved almost 4,800 stores in SEA. One characteristic of its supply chain strategy is to focus on one neighboring region first, deeply rooted in the region then move on to the next neighboring area. This is very different from HEYTEA’s scattered around global expansion strategy in which we will talk about next.

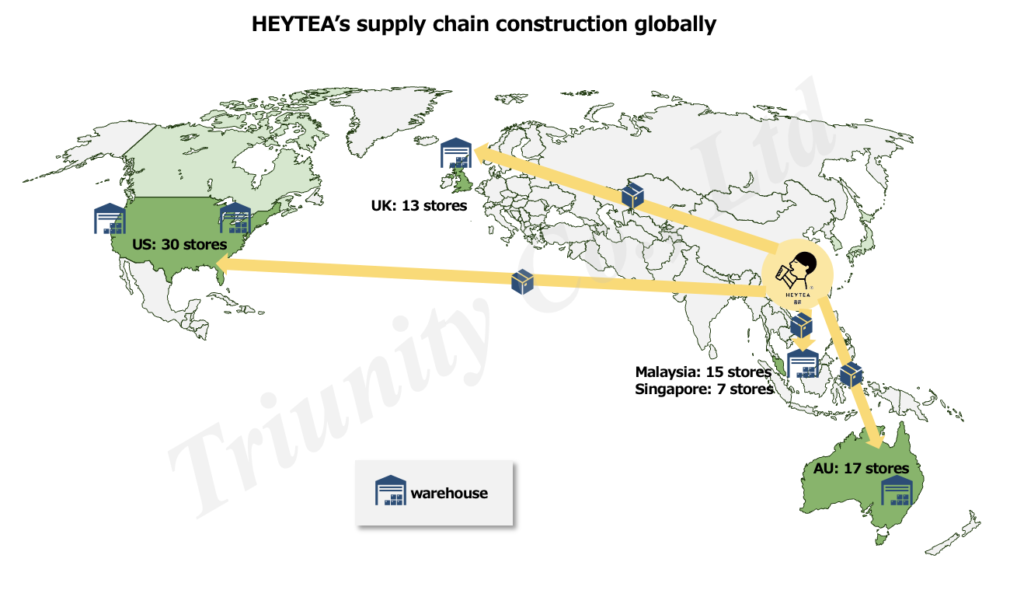

2. HEYTEA: Decentralized oversea expansion

Unlike MIXUE, HEYTEA uses lots of fruits, and it is trying to keep the same menu as in China and overseas. By targeting premier locations in developed countries which is far away from China, HEYTEA could be having a tougher time overseas than MIXUE now. (About HEYTEA’s overseas market expansion, you can also refer these two articles: A Taste of Home – Diaspora, Gateway to Penetrate New Market ; Can HEYTEA inspire Japanese consumers? )

Figure 10. HEYTEA’s supply chain construction globally

High fruit procurement price, high rent and labor costs would drastically increase its operation costs in developed countries. Not to mention it implies the franchise model overseas, which could make it hard to maintain product quality. HEYTEA is already facing some backfire of its brand image in foreign countries due to low quality control. For example, the use of frozen fruit puree in UK have led to some complaints and disappointment from its fans.

Due to the availability of raw materials, directly copy Chinese products might be costly and thus a bit hard to sustain profits. A better way for HEYTEA could be to suspend its franchise model in other countries like in China and develop inspired products specifically for each country based on local culture and local resources. By setting up local R&D / strategic office in each region, they can communicate with local suppliers and observe local consumers so as to develop local original products. HEYTEA may have already realized the importance of localization of products so that they launched ‘Ocean’s Glow‘: a beauty-boosting tea with Vida Grow in Australia and the UK. The collaboration merges Eastern tea heritage with Western advancements in health and beauty, delivering a uniquely global experience to consumers. For this product, Marine collagen peptides are supplied by Vida Grow.

Figure 11. HEYTEA’s cooperation product with Australian cosmetic brand “VIDA Glow”

As a fruit tea brand, it is a bit difficult to balance its cost and maintenance of products’ update pace with domestic market at the same time. However, if fruit is not the core ingredient, overseas expansion would be easier. Let’s look at CHAGEE.

3.CHAGEE: Simplest supply chain + Franchise model

So far, CHAGEE has opened 156 stores in SEA in 6 years, and recently opened its first US store in Los Angeles. It aims to expand its oversea stores to 1,000-1,500 by the end of 2025.

Figure 12. CHAGEE’s supply chain construction in Southeast Asia

Compared to other new style tea brands that use lots of fruits, CHAGEE’s supply chain is much simpler: tea, milk, and packaging. CHAGEE’s founder once said they will only integrate their tea supply chain, that of milk and packaging will be outsourced. This enables CHAGEE to have a highly efficient supply chain. Its logistics costs are under 1% of its global GMV, and inventory turnover is just 5.3 days — the fastest among major Chinese tea drink brands(e.g., MIXUE 48.5 days).

Figure 13. CHAGEE’s iconic products without fruits. Pic from CHAGEE Malaysia Facebook

It has not established any global supply chain yet. In April 2025, CHAGEE went public in the US, in which part of the investment collected will be used to build its global supply chain, and likely a tea production site in North America or locally procure tea due to high US tariff under Trump.

CHAGEE takes 1+1+9+N model in China to control product qualities under their franchise model. 1+1+9+N means 1HQ + 1 local team + 9 directly-operated stores + N franchise stores. Outside of China, they did not seem to copy this model in Singapore, which may bring the risk of mismanagement or quality control issues to them. Indeed, CHAGEE stopped its franchise model in Singapore, where no directly-operated stores were located, in early 2024, assumably it might because of some management conflicts between the regional franchisee and CHAGEE. The 12 franchised stores in Singapore ended agreements with CHAGEE in early 2024 and rebranded themselves as “Amp’s Tea”.

Figure 14. Amp’s TEA product and store picture

Currently, CHAGEE’s Singapore outlets are now operating under the direct ownership of the main company based in China. After constructing a profitable business model in Singapore, it might then open to franchising again. Also, in other regions like the U.S., they would bring directly operated stores at first to avoid such issues.

Figure 15. CHAGEE’s new store in Orchard Gateway

4. ChaPanda: Locally adjusted supply chain + Direct management model

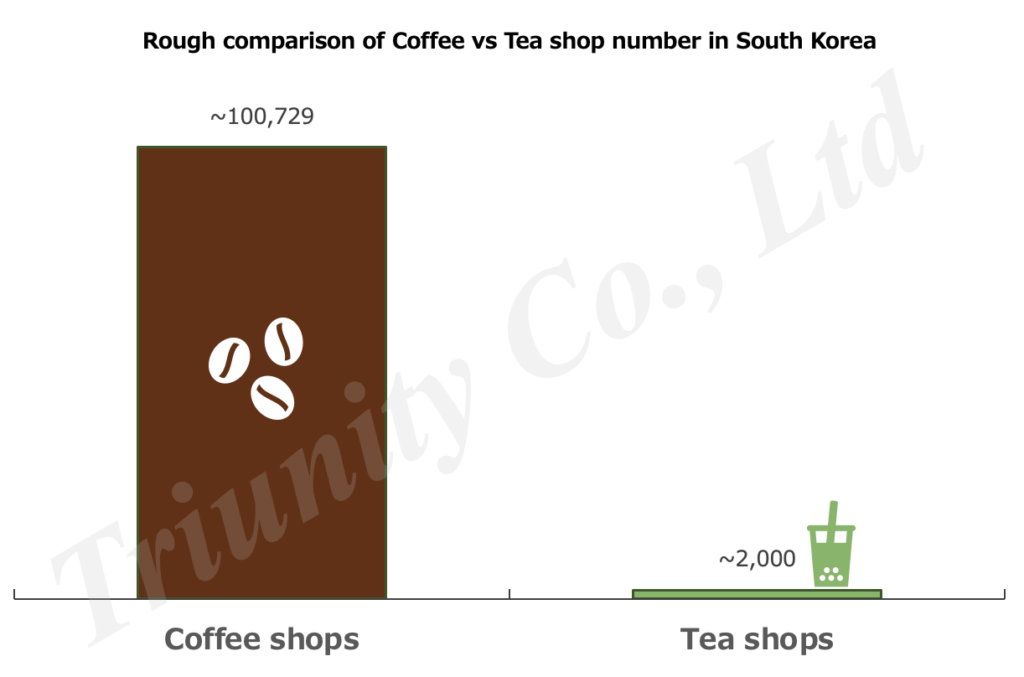

Unlike other mid-end fresh drink brands, ChaPanda picked South Korea as its first destination in oversea in 2024, where drinking culture exists but dominated by coffee consumptions. By around 2022, there were around 100 thousand coffee shops in South Korea, but only roughly 2,000 milk tea shops. ChaPanda realized there might be huge opportunity in this country.

Figure 16. Rough comparison of coffee vs tea shops number in South Korea

Potentially, ChaPanda will prioritize Thailand, Vietnam, Malaysia and South Korea market first. Everyday, materials like packaging, tea, and some dairy products will be dispatched from the Shanghai warehouse and shipped to South Korea, while the Guangzhou warehouse will be responsible for delivering the raw materials to Southeast Asian stores.

Figure 17. ChaPanda’s supply chain construction in Southeast Asia

ChaPanda faced some procurement difficulties in South Korea in the beginning. For example, the key ingredient for ChaPanda’s best-selling product Mango Pomelo Sago(杨枝甘露), was difficult to ensure a stable supply as South Korea mainly plants Thailand Mango, which is sweet enough but not aromatic. After spending quite an amount of time, they finally found a small supplier that has North America Mango in South Korea to replace it.

ChaPanda also encountered some challenges regarding the import of raw materials. For example, one of their products named Soybean Milk Rice Mochi (豆乳米麻薯), uses black glutinous rice. Due to the South Korean government’s efforts to protect local farmers, high tariff policies have been implemented on agricultural products, including black glutinous rice, with the tariff set at eight times the original rate, making the import costs excessively high, and ChaPanda have to give up this product in South Korea.

Figure 18. Two drinks mentioned above

Nevertheless, ChaPanda did lots of market research in South Korea, coming up with several localization strategies including three new exclusive products using the local popular fruit: Hallabong orange. Feedback from the market have been very positive. According to Wanghuan, Head of ChaPanda’s Global Operation, local consumers account for over 80% of ChaPanda’s customers in South Korea. ChaPanda’s store show that how important.

Figure 19. Hallabong orange

ChaPanda’s case shows the importance of directly operated store for the localization of the product for new markets. Shortly after it entered South Korean market in 2024, it successfully developed localized products based on the local supply chains. Relying solely on the franchising model, it may be difficult to adjust local needs and conditions. This successful approach in South Korea likely provides valuable know-how for their anticipated expansion into Southeast Asia, other rival brands should refer its initiatives.

Figure 20. ChaPanda’s Seoul Store

Conclusion

As the global expansion of new-style tea is in its early stages, immature global supply chains present challenges such as potential cost increases and quality issues. However, the establishment of localized supply chains and marketing teams is expected to mitigate these concerns and unlock scalability. One clear thing is that if they rely solely on local partners for market penetration, it should be tough, and it may hinder a brand’s ability to fully satisfy local customer needs though it’s convenient.

Looking ahead, the development of streamlined global supply chains must also incorporate decarbonization strategies, particularly as many of these companies are pursuing IPOs. Our next article will delve into the crucial aspect of supply chain decarbonization.

References

[1] 搜狐,2024.7.26,现制饮品创新趋势研究

[2] 新浪财经,2025.1.6,一个真实的蜜雪冰城是怎样的

[3] Equal Ocean, 2024.1.22, Chinese New-style Tea CHAGEE Renames All Singapore Stores Amidst Franchisee Allegations

[4] Basenton, 2025.2.27, How Much does it Cost to Ship from China to Japan

[5] 界面,2021.9.14,蜜雪冰城密集投资西南和海南,并剑指东南亚

[6] 腾讯网,2025.1.9,中国企业转向产能出海新模式,汽车、餐饮供应链本地化成趋势

[7] 投中网,2023.10.23,中国新茶饮决战印尼

[8] 观研报告网,2025.3.6,蜜雪冰城上市!我国茶饮行业资本盛宴开启 供应链、海外市场成品牌发展焦点

[9] EqualOcean, 2025.3.27, 蜜雪冰城上市:低价茶饮巨头的资本野心与全球化征程

[10] 一带一路杂志,2022.4.19,成都首趟跨境直达“企业定制”专列发车 成都双流直达越南河内

[11] 证券时报网,2025.4.18,霸王茶姬美股首日大涨15%!出海成为必选项?

[12] COSMETICS BUSINESS, 2025.1.8, HEYTEA and Vida Glow partner to launch ‘Ocean’s Glow’: a beauty-boosting tea collaboration

[13] 台湾服务贸易商情网,2024.12.27,中式茶饮品牌赴美展店 如何突破难关

[14] Farm Flavor, 2024.2.15, These U.S. Tea Farms Are Brewing Up the World’s Favorite Beverage

[15]财经网,2024.1.14,茶百道海外首店首尔店昨日试运营,9款饮品含3款韩国限定产品

[16]搜狐,2024.5.4,茶百道出海韩国:重塑供应链

[17]财经网,2024.7.16,茶百道、几素们的亚洲出海路,一场品牌再造的闭卷考

[18] Singapore Foodie, 2024.8.3, CHAGEE Is Set To Enter Singapore With First Store At orchardgateway This Weekend!

[19] 咖啡网,2025.5.12,供应难!英国喜茶改用冷冻原料

[20]Tiktok account: tinythena

Leave a Reply