By Yuying Qian, 2025.06.20

As we continue to receive increasing inquiries from Chinese SMEs about entering the Singaporean market, we’ve decided to share some practical tips on relevant regulations in Singapore, along with insights tailored to Chinese businesses. These tips can benefit not only Chinese companies, but also other foreign firms—including large multinational corporations—that are new to the Singapore market.

Chinese F&B chain store distribution in Singapore

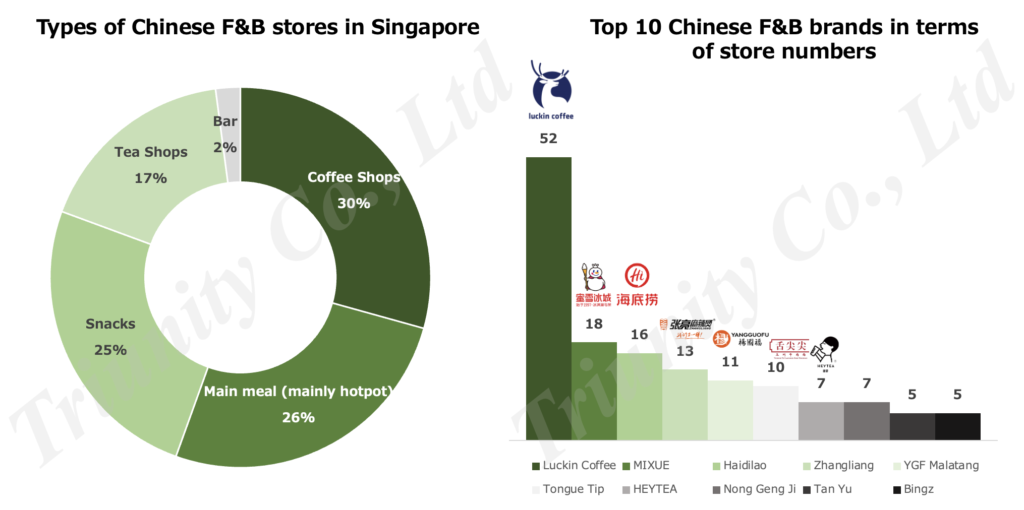

Singapore has emerged as the preferred hub for overseeing ASEAN expansion by Chinese companies due to its geographic proximity, culture similarity and pro-business policies. By the end of June 2024, about 35 Chinese Food & Beverage (F&B) brands were operating about 191 stores in Singapore. Especially after 2023, 15 new brands have entered Singapore, including COTTI Coffee, Luckin Coffee, Nong Geng Ji, Shaxian etc. ( About overseas expansions of Luckin Coffee and COTTI Coffee, you can also refer this article: Chinese Coffee Chains Going Oversea, “Grab-and-Go, Digitalized Coffee Life” )

Chinese F&B scene in Singapore is diverse, with a strong leaning toward casual dining and beverages. Beverage stores (coffee and tea shops) like Luckin Coffee, MIXUE make up the largest portion at 48%, main meals (mainly hotpot) are the second most common, usually selling Sichuan or northern Chinese cuisines comprising 27% of Chinese F&B outlets in Singapore. (About the supply chain of new style tea brands in SEA, you can refer this article: New Style Tea’s Global Growth: Optimizing Supply Chain for Success (MIXUE, HEYTEA, CHAGEE, ChaPanda))

Figure 1: Chinese F&B brands distribution in Singapore

With a sustained appetite for the cuisines and conducive market conditions, Chinese F&B chains look set to continue growing in Singapore. One big driving force is the huge Chinese ethic groups in Singapore. As of June 2024, 75.6% of the Singapore citizens are ethnic Chinese. Not to mention Singapore has become a popular destination for Chinese tourists, with 3.08 million visitors from mainland China in 2024, marking a 126% YoY increase and accounting for 18.7% of Singapore’s total inbound tourists last year. Large demand from Chinese tourists and high acceptance level among ethnic Chinese Singaporeans made it much easier for Chinese F&B chain stores to go to Singapore.

Figure 2: Luckin Coffee one store in Singapore

Nevertheless, opening a food or beverage chain store in Singapore has some risks. One of them is regulation compliance.

Key Regulations for Compliance

Food and beverage business is very strictly regulated through regulation and legislation in Singapore, involving multiple aspects such as food safety, sanitary standards, labor laws etc.

Basically, there are three types of compliances that companies need to pay attention to when they want to open a restaurant or coffee shops in Singapore. And they are:

- Market entry compliance

- Product compliance (for import)

- Operation compliance

a. Market entry compliance:

There are no specific restrictions on foreigners opening a restaurant or tea or coffee shops in Singapore. Foreigners can directly register a company with the Accounting and Corporate Regulatory Authority (ACRA) and obtain the necessary licenses to operate a restaurant.

In general, it is not so difficult to apply for food shop licenses in Singapore, just follow the steps provided by each department and apply on GoBusiness Portal.

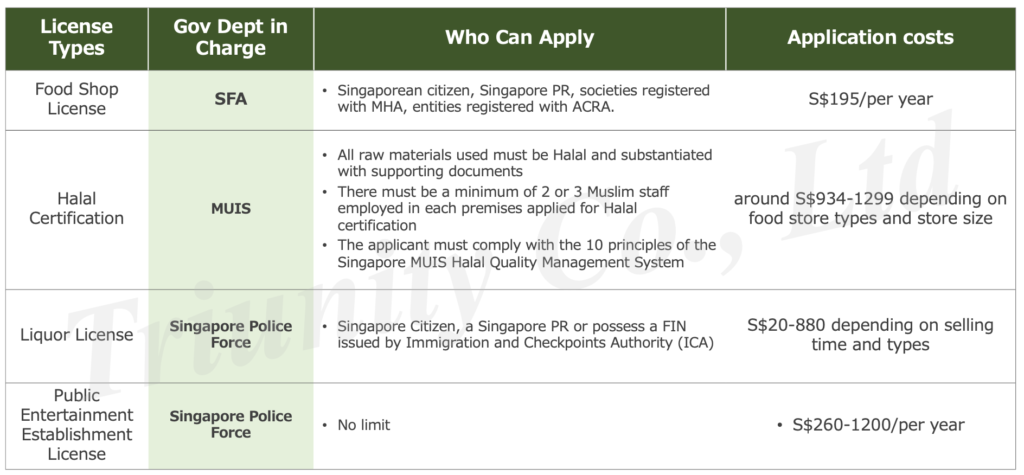

Figure 3: Common licenses applied to food stores

Local residency requirements

Whether you register as a sole partnership, local company, foreign company, limited liability partnership or limited partnership company, you need to have at least 1 locally resident to be appointed as manager, director or representative, to answer for all matters required to be done by the company.

For owners that would like to apply for Sole Proprietorship/Partnership and Foreign company in Singapore while reside outside of Singapore, it must appoint at least 1 locally resident authorized representative. This representative must be a Singapore Citizen, Permanent Resident, or Employment Pass/EntrePass holder which can be a foreigner. The representative might be liable to penalties imposed on the company for contravening Singapore’s Companies ACT.

There are also agent companies that provide such service for foreigners that cannot find a proper local residency representative, costing around S$ 2,000-5,000 per year.

b. Product import compliance:

According to Singapore Food Agency (SFA), Singapore enjoys one of the lowest incidences of food-borne disease outbreaks compared to the rest of the world. This is even though more than 90% of all food consumed here is imported.

Singapore has been implementing strict regulations on food imported from other countries to control source farm, transportation process etc. Entities may not be able to use the same ingredients that you use in China for your products. Understanding import regulation is crucial especially for catering business.

Can only source oversea ingredients from establishments accredited by SFA

Singapore has defined five types of high-risk food. These foods have a higher risk of being contaminated with pathogens (disease-causing viruses, bacteria, fungi or protists) compared to processed food or vegetables, it must be accredited by SFA (Singapore Food Agency) before they can be imported into Singapore. Entities can either source from a SFA certified establishments overseas or apply for accreditation from SFA on their own.

Five types of high-risk food are:

- Meat & Meat Products, unless the products contain less than 5% meat

- Live Poultry

- Shell Eggs

- Processed Eggs (e.g., powdered, pasteurized, and whole egg forms)

- Fish & Fish Products, including types of seafood that are deemed to be of higher food safety risks, such as live oysters and pufferfish

Each import consignment must be accompanied by a health certificate issued by the Competent Authority of the exporting country or region such as CHINA ENTRY-EXIT INSPECTION AND QUARANTINE ASSOCIATION,CIQA (出入境检验检疫局), to verify it meets the SFA’s food safety standards.

During transportation from China to Singapore, it is assumed that food will be transported in the form of frozen or chilled food. Singapore government strictly regulates cold chain transportation.

As required, frozen food needs to be maintained at -18°C or below with a core temperature not exceeding -12°C during transportation, chilled food needs to be maintained at 4°C or below with a core temperature not exceeding 7°C during transportation.

Main steps involved to import high-risk food into Singapore:

Step 1: Check classification of your food products

You can check here: https://www.sfa.gov.sg/tools-and-resources/food-and-related-products-classification-tool

Step 2: Ensure you are eligible to apply as an importer with SAF

You can check here: https://www.sfa.gov.sg/tools-and-resources/food-and-related-products-classification-tool

Step 3: Check if your product meet SFA requirements

You can check here: https://www.sfa.gov.sg/food-import-export/commercial-imports/import-requirements-for-food-food-products#meat-and-meat-products-0

Step 4: Apply for import license with SFA

SFA will exam your products, storage process etc. You can register here: https://www.sfa.gov.sg/food-import-export/licence-permit-registration/application-process-fees-for-licence-permit-registration-for-import-export

Step 5: Apply for import permit on TradeNet

What you need to prepare include HS code, establishment code, health certificates and laboratory reports, etc.

Step 6: Receive and print your CCP (Cargo Clearance Permit)

Your CCP will state all requirement for your import (e.g., whether you need to book inspection or not)

Step 7: Inspection and clear your products with custom

Errors and offences could cause strict penalties up to S$100,000.

Figure 4. Singapore Customs

c. Operation compliance:

In daily operations, compliance mainly covers daily hygienic conditions, food safety, alcohol selling and staff recruitment. Restaurant inspections will happen once a year by hygiene officers from SFA. These inspections can occur at any time during the year, and you will not be informed prior to the inspection.

To maintain food safety, food stores need to:

- Establish a HACCP based Food Safety Management System (FSMS). Any retail food business approved to conduct catering activities must have at least one employee certified with WSQ FSC Level 4 and obtain competency certification.

- If there is a buffet area, enough hand sanitizers or disposable gloves must be provided in the food display area of the buffet for easy use by food handlers and customers.

- Coffee shops need to follow Singapore NEA’s ES (Environmental Sanitation) Standard and submit an ES Plan which includes cleaning and disinfection plans for windows, ceilings, dining areas, tray return stations, hand wash basin, toilet, centralized washing area etc.

As companies have limited quota to hire foreign employees, one way could be to hire a Singaporean employee who has certified with WSQ FSC Level 4 to save the hiring quota for foreigners.

Strict Liquor Selling Rules

Singapore has long maintained strict regulations on the sale, consumption, and advertising of alcohol.

A liquor license is required if the entity intends to supply any liquor (Liquor means a beverage containing more than 0.5% ethanol by mass or volume). After obtaining the license, the entity cannot sell liquor beyond the trading hours stated in the license.

Special alcohol restrictions are implemented in certain areas of Geylang and Little India. In these areas, anyone is not allowed to drink alcohol in public places. And restaurant or bars can only sell alcohol in limited times. (Monday-Friday: sales allowed from 7am to 10:30pm, Saturday, Sunday, holiday eves, and public holidays: sales allowed from 7am to 7pm).

Figure 5: Liquor control zone in Geylang

Strict rules for hiring foreigners

Quota System:

Singapore implements a quota system, also known as a dependency ratio ceiling (DRC) to limit the number of foreigners can be hired in one company.

In the service industry, companies can recruit foreign workers for up to 35% of their total workforce. In addition, for Chinese workers there exists a sub-cap, which means only 8% of the workforce hired by one company can be Chinese.

Levy:

The foreign worker levy, commonly known as “levy”, is a pricing mechanism to regulate the number of foreigners in Singapore. Companies must pay a monthly levy for Work Permit holders, which ranges from S$450-800 per month per employee for the service industry depending on how many foreigners you already hired.

Singapore has been increasing the qualifying salaries and levies for work permit holders which can make hiring foreigners more difficult and costly, especially for SMEs. In 2024, MoM (Ministry of Manpower Singapore) increased the minimum qualifying monthly salary for EP (Employment Pass) from SGD$5,000 to S$5,600, and SPass from S$3,150 to at least S$3,300.

Real Violation Cases

Case one:

In 2018, one hotpot chain store caught didn’t wear glove when cutting watermelon. That store was fined S$800 by NEA (National Environmental Agency) and suspended its business license for two weeks.

Case two:

In July 2024, TikTok’s Singapore office was hit by a mass food poisoning incident, 130 affected people to have abdominal pain. It was caused by canteen food supplied by one Chinese restaurant and one central kitchen supplier. Later, inspectors found their stir-fried diced chicken contained bacteria and 10 cockroaches in their store. The restaurant was fined S$3,500 and suspended its business license for two weeks.

Figure 6: Ambulance come to TikTok Singapore Office

Case three:

In 2024, one Chinese wholesaler illegally imported 400kg meat products (*kinhwa dry-cured ham) into Singapore without a valid import permit. The company was fined S$4,000.

Figure 7: 400kg meat products detained by the Singapore Custom

*Kinhwa dry-cured ham is a common ingredient used in Chinese cuisines to flavor stewed and braised foods as well as for making the stocks and broths of many Chinese soups. (It’s delicious, trust me)

Case four:

In 2025, MoM found a shell company that illegally obtained working visa for 20 foreign workers in exchange for money. The number of foreigners he hired already exceeded its quota to hire. The director of this shell company that was involved in all offences can be jailed for up to two years, fined up to S$20,000, or both. Even caning may also be imposed.

In Conclusion

In conclusion, costs related to regulation compliance in opening a company are not small for SMEs. When considering opening your business in Singapore, it is critical to do pre-research about the regulation.

Bigger corporations are generally more capable of complying with local laws. However, when it comes to food safety, climate differences between China and other countries increase the risk of food contamination. In operations involving younger staff or part-time employees, proper training and daily coaching become essential. It is highly recommended to select store operation managers not only for their sales and promotional skills but also for their ability to train and educate team members.

Likewise, beyond the food industry, Triunity conducts regulatory research across various sectors, including the new energy and ESG fields. If you have any requests or questions regarding industry regulations in Singapore, Southeast Asia, Japan, or even China, please feel free to contact us.

References:

[1]新加坡政府七部门, 2024.9, Population in Brief 2024

[2] Jing Daily, 2025.3.11, Chinese tourist visits to Singapore surge 126% YoY in 2024

[3]云片,2024.5.15, 云出海|餐饮出海新加坡:中国味道何以攻略狮城

[4] Singapore Food Agency

[5] Singapore Police Force

[6] Singapore MoM

[7] Singapore MUIS

[8]联合早报,2018.2.14,食物不干净 处理食物没戴手套 克拉码头海底捞吊销执照两周

[9]财经头条,2025.6.6,新加坡字节跳动食物中毒案进展:云海肴被告上法庭 食品质量存问题

[10] The Straits Times, 2024.9.12, Wholesaler fined $4,000 for illegally importing meat products into S’pore from China

[11] The Straits Times, 2025.1.9, Cleaning company owner charged with various employment offences

Leave a Reply