by Yuying Qian, 2024.09.05

Why Southeast Asia:

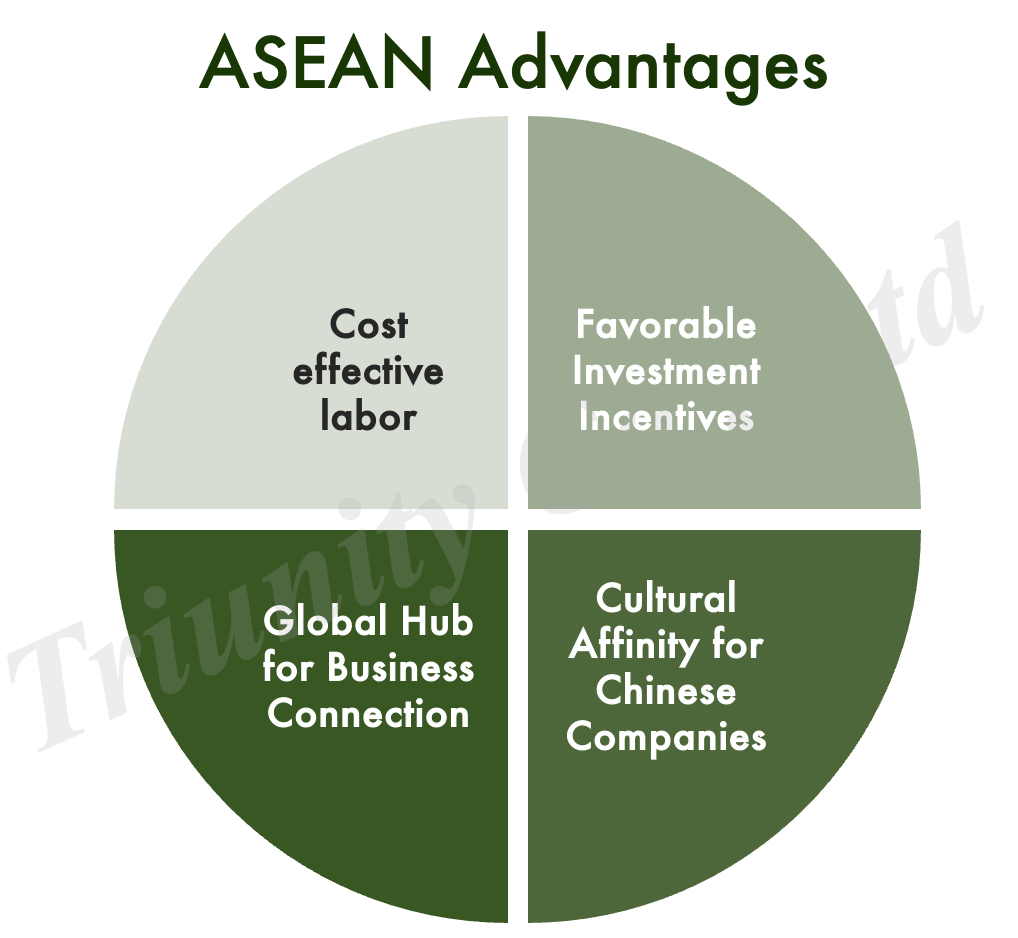

In addition to the geographical proximity, the Southeast Asian market also has the following attractive points:

1. Cost-Effective Labor:

- Large and fast-growing population. The six major Southeast Asian countries (Thailand, Indonesia, Vietnam, Malaysia, the Philippines, and Singapore) have a combined population of approximately 670 million, with one of the fastest growth rates globally.

- A young population: In all countries except Singapore and Thailand, over 50% of the population is under 35 years old.

- High levels of education among the workforce: Especially in countries like Malaysia, Singapore, and Indonesia, where many people are bilingual in Chinese and English. This helps companies integrate into the local market and tap into high-end markets.

This brings “low labor costs” for companies that want to expand business there. For example, the minimum pre-tax wage in Thailand is around 1,400 RMB, significantly lower than in China’s major regions, where it exceeds 2,000 RMB. In Vietnam, the average monthly wage is about 2,500 RMB, and in Cambodia, it’s even lower at 1,000-2,000 RMB, about one-fifth of the cost in China.

2. Favorable Investment Incentives:

- Low corporate tax rates: Singapore has a corporate tax rate of 17%, and Thailand and Vietnam have rates of 20%. In certain economic development zones, further tax reductions are available. For example, in Vietnam, companies investing in economic zones enjoy a 10% corporate tax rate for 15 years.

- Other tax reductions include land rent exemptions, personal income tax reductions, and tariff reductions under the RCEP free trade agreement.

3. Global Hub for Business Connection:

Southeast Asia boasts a well-developed network of sea, land, and air transportation. Singapore’s port, one of the busiest globally, handles around 25% of the world’s trade. Southeast Asia’s importance lies not only in its local market but also in its ability to connect to European and American markets.

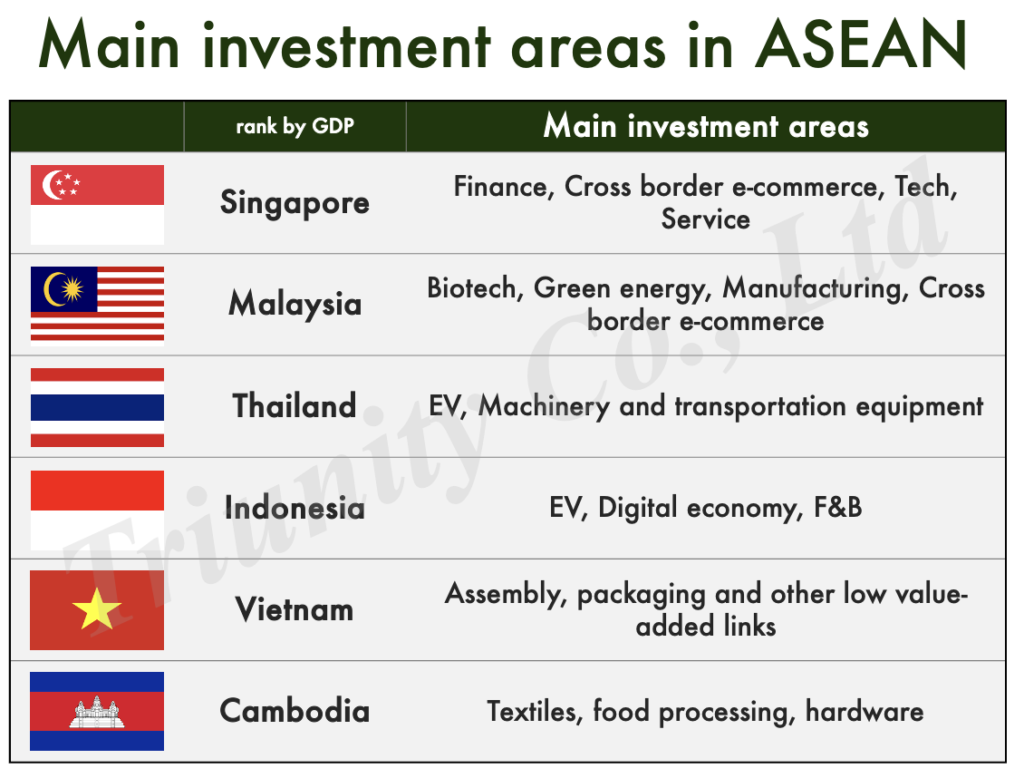

Current Status in Southeast Asia:

The industries in which foreign companies are expanding into Southeast Asia are diverse, including manufacturing, services, cross-border e-commerce, and new energy. The gaming industry, which has gained popularity in recent years, is also actively expanding into Southeast Asia. This article will first cover Malaysia and Indonesia, with Thailand, Singapore, and Cambodia to be discussed in the next part.

Indonesia:

References: “IEA An Energy Sector Roadmap to Net Zero Emissions in Indonesia”

Overview of Indonesia:

Indonesia is the largest country and economy in Southeast Asia, with GDP growth exceeding 5% since 2008. Its economic development is driven mainly by domestic demand rather than exports, with manufacturing and services as the main sectors. Indonesia also has a large young population, with a median age of 29, offering abundant labor resources and a vast consumer base.

Indonesia is a major producer of palm oil, coal, natural gas, and other key commodities. It also has abundant mineral resources, being the world’s largest producer of nickel and the second-largest producer of cobalt.

Opportunities for Expansion:

1. New Energy Batteries:

Indonesia holds 25% of the world’s confirmed nickel reserves, a critical raw material for electric vehicle batteries, especially ternary lithium batteries, which are in high demand. The availability of stable and affordable raw materials is a major factor attracting the battery industry to Indonesia. Since 2020, the Indonesian government has banned the export of unprocessed nickel ore, forcing companies to establish processing and battery manufacturing facilities locally. Companies like CATL and its supplier Longpan Technology have invested in nickel mining and battery projects in Indonesia. BYD and Wuling have also set up factories on Java Island. On July 3, 2024, HLI Green Power—a joint venture between South Korea’s Hyundai Motor Group, leading battery manufacturer LG Energy Solutions, and the state-run Indonesia Battery Corporation (IBC)—announced the commencement of operations at its electric vehicle (EV) battery cell factory. Additionally, due to the fragmented and unstable power grid across the Indonesian archipelago, frequent power outages occur. Currently, coal and natural gas are the main sources of power generation, but with Indonesia’s goal of carbon neutrality by 2060, the demand for solar energy storage and charging solutions may rise.

Policy Support:

- Pioneer Industry Tax Exemption: Auto parts manufacturing is considered a pioneer industry in Indonesia. New projects can enjoy a 50%-100% corporate tax reduction for 5-10 years, depending on the investment amount.

- Master list facilities: Companies in the industrial or service sectors can receive import tax exemptions for machinery, goods, and materials.

- Investments in Special Economic Zones (SEZs) or the new capital (IKN) can apply for various tax reductions, including corporate tax, VAT, and import tax.

2. Digital Economy:

Indonesia’s digital economy is growing rapidly, increasing by 22% in 2022 to reach $77 billion, and it is expected to double by 2025 to $130 billion. Indonesia currently accounts for about 40% of ASEAN’s digital economy. With a large young population, sectors like social media, e-commerce, digital payments, gaming, live streaming, and cloud computing can all target the Indonesian market. For example, in terms of YouTube audience size by monthly traffic, Indonesia ranks 4th with 139 million users, following India, the United States, and Brazil. Also, with an estimated value of 82 billion U.S. dollars, Indonesia’s e-commerce market is the largest in Southeast Asia, significantly surpassing other countries in the region. The Singaporean company Shopee surpasses the local platform Tokopedia in terms of users.

Policy Support:

- Pioneer Industry Tax Exemption: Digital economy activities, including data processing and hosting, are considered part of Indonesia’s pioneer industries*. New projects can enjoy a 50%-100% corporate tax reduction for 5-10 years, depending on the investment amount.

- Master list facilities: Same as above.

- Investments in SEZs or the new capital (IKN) can apply for various tax reductions, including corporate tax, VAT, and import tax.

3. Food Processing:

As the middle class expands and the proportion of young people increases, more Indonesians are likely to seek convenient and healthy food options. This is expected to drive demand for functional foods, ready-to-eat meals, and healthy foods. Although Indonesia is the world’s largest Muslim-majority country, it is flexible and open to new cultures, which may create opportunities to introduce various international cuisines.

*Indonesia’s Pioneer Industries include: upstream metal industries, integrated refining of crude oil and natural gas, basic organic chemicals derived from crude oil/natural gas/coal, basic organic chemicals derived from agriculture, plantations, or forestry, basic inorganic chemical industries, pharmaceutical raw material industries, radiation, electronic, and electrotherapy equipment manufacturing, key components for electronics and telecommunications equipment manufacturing, such as semiconductor wafers, LCD backlights, electronic drivers or displays, key components for machinery and machinery manufacturing, robot components supporting the machinery manufacturing industry, key components for power generation machinery manufacturing, automotive and automotive key component manufacturing, ship key component manufacturing, aircraft key component manufacturing, railway key component manufacturing, pulp industries derived from agricultural, plantation, or forestry products, economic infrastructure, digital economy covering data processing, hosting, and related activities.

Malaysia:

Overview of Malaysia:

Malaysia is the third-largest economy in ASEAN, with its economic growth primarily driven by the services sector. According to official data from the World Bank, Malaysia’s Gross Domestic Product (GDP) was valued at $399.65 billion in 2023 and its population is young, with a median age of 30.7 years. Its major industries include manufacturing (electrical equipment), agriculture and forestry (natural rubber, palm oil, timber) and mining (tin, crude oil, LNG).

Opportunities for Expansion:

1. Biotechnology

Malaysia is located in the center of ASEAN countries, with significant demand in agriculture and pharmaceuticals. As a tropical country, it is rich in tropical plants, medicinal plants, and marine life. These natural resources offer extensive research and development opportunities for biotechnology companies, including new drug development, natural extracts, and biopesticides.

Policy Support:

- BioNexus Status Tax Exemption: Companies granted BioNexus status can enjoy a 100% income tax exemption for 10 years or opt for an investment tax allowance. They can also benefit from exemptions on import duties and excise taxes, which helps reduce R&D and equipment import costs.

- Pioneer Status Tax Exemption: Biotechnology companies and those producing value-added products from palm biomass that obtain Pioneer status can enjoy a 100% income tax exemption for five years.

- Investment Tax Allowance (ITA): If a company does not qualify for Pioneer status, it may still be eligible for an ITA. Qualifying companies can enjoy a 60-100% deduction on qualifying capital expenditures (such as buildings, plants, machinery, etc.) for 5-10 years. These deductions can offset up to 100% of statutory income.

2. New Energy

In August 2023, the Anwar government launched the Malaysia National Energy Transition Roadmap (NETR), aiming to increase renewable energy capacity to 70% and electric vehicle market share to 80% by 2050. Malaysia is vigorously promoting new energy. Photovoltaic manufacturers like LONGi, Jinko, and Risen have already set up in Malaysia. In 2023, The Dutch-Norwegian company SolarDuck signed a letter of intent with subsidiaries of Tenaga Nasional Berhad (TNB), Malaysia’s largest utility, to develop a 780kW offshore floating solar plant off the coast of Tioman Island. During the same period, in the field of decarbonization, the French company TotalEnergies and the Japanese company Mitsui announced their partnership with Petronas, a state-owned enterprise, for a carbon capture and storage (CCS) project.

Policy Support:

- Green Investment Tax Allowance (GITA): Investments related to renewable energy, energy efficiency, green buildings, green data centers, and integrated waste management are eligible for a 100% tax deduction on the investment amount, which can be used to offset 70-100% of statutory income for five years.

- Green Income Tax Exemption (GITE): Solar leasing activities can enjoy a 70% income tax reduction for 5 or 10 years, depending on the installed capacity.

- Carbon Project Tax Deduction: Costs incurred from developing, measuring, reporting, and verifying carbon projects are eligible for an additional tax deduction of up to 300,000 MYR (approx. 492,149 RMB) to offset income earned from trading carbon credits on the carbon credit exchange.

- ESG-related Tax Deduction: From the 2024 to 2027 tax years, micro, small, and medium enterprises can enjoy up to 50,000 MYR (approx. 82,025 RMB) in tax deductions each year for expenses related to environmental, social, and governance initiatives.

3. Manufacturing and High-Tech Industries

Known as the “Silicon Valley of the East“, the state of Penang in Malaysia has developed a well-established industrial chain. In 2023, Oppstar, a local chip design company, was listed on the Malaysian stock exchange. Today, it stands as the sixth-largest semiconductor exporter globally and the biggest supplier of semiconductors to the United States, contributing over 20% of the total annual value, surpassing Taiwan, South Korea, and Japan. In 2021, Intel announced it would invest over $7 billion in Malaysia’s chip industry. This investment includes the construction of an advanced packaging facility in Penang, which will become Intel’s largest facility for 3D packaging technology.

Policy Support:

- Accelerated Capital Allowance (ACA): Manufacturing, service, and agriculture companies that invest in automation equipment, including elements of Industry 4.0, can receive a 100% accelerated capital allowance on the first 10 million MYR of qualifying capital expenditure. This allowance can be fully offset within one year. Companies are also eligible for a 100% income tax exemption on the equivalent capital expenditure.

- Pioneer Status Tax Exemption: As mentioned earlier.

- Investment Tax Allowance (ITA): As mentioned earlier.

4. Cross-Border Trade:

The growing young population and expanding middle class are driving demand for trade. In 2023, the e-commerce market grew by 15%, reaching $9.8 billion (MYR 44.6 billion). It is projected to reach $11 billion (MYR 50.3 billion) in 2024. Like other Southeast Asian countries, Shopee is one of the major cross-border e-commerce platforms. For example, Shopee actively promotes cross-border trade services in Japan to facilitate the sale of Japanese products to Malaysian consumers. According to them, key product categories with high sales from Japan include beauty and health care, home and living, hobbies, and food and beverages.

Policy Support:

- Malaysia Free Trade Zones: Certain imported products are eligible for tax exemptions or reductions within Malaysia’s free trade zones.

Appendix. Cultural Affinity for Chinese Companies:

Compared to Western markets, Southeast Asian customers have a higher acceptance of Chinese companies. Cultural similarities make it easier for Chinese businesses to integrate into the local commercial culture. According to the ISEAS-Yusof Ishak Institute’s 2024 Southeast Asia Annual Survey, 50.5% of respondents prefer China over the US if forced to choose. This is the first time since 2020 that China’s support rate has surpassed that of the US.

Due to regional advantages and geopolitical pressures, Southeast Asia has become a top choice for industry supply chain relocation in recent years. However, this also caused trouble for ASEAN companies. For example, as China’s economy continues to struggle and the weakening RMB supports exports, ASEAN’s imports from China have seen significant growth which led to local factory shutting down. In Thailand, over 1,300 factories closed last year, a 60% increase from the previous year. While ASEAN currently benefits from rising tensions between Washington and Beijing, further deterioration could lead to increased scrutiny of supply chains in the region by Western countries. Although ASEAN is unlikely to impose targeted taxes to attract foreign investment in the near future, this situation could change in the next phase of overseas expansion. For companies who are thinking of using ASEAN as transfer station for Europe and North America, time is limited, and quickly developing a clear strategy is crucial.

#SoutheastAsia #Indonesia #Malaysia #CCS #crossborder #outbound #siliconvalley

References:

[1] Oceanpayment, 2023.4.6, 掘金不止,东南亚市场的“时与势”、“变量与机遇”

[2] 第一财经,2022.1.18,劳动力成本仅中国的五分之一!东南亚取代中国成多数国际服装代工地

[3] 武汉市商务局,2023.12.15,东盟重点国家外商投资之越南

[4] Nikkei Asia, 2024.4.2, Majority of ASEAN people favor China over U.S., survey finds

[5] Nikkie Asia, 2024.8.2, Letter from Nikkei Asia’s editor: Chinese imports flood Southeast Asia

[6] 商务部,2023.2.28,印尼政府对到2025年数字经济规模翻一番持乐观态度

[7] 马来西亚KPMG, 2023.10, 2024 年国家财政预算案快解

[8] IT科技,2024.7.10,统计局:在国际移民的推动下,马来西亚人口将在2023年达到3340万

[9] KPMG, 2024, 馬來西亞投資手冊

[10] Jetro, 2024.07.11. 現代自動車とLG、インドネシアで東南アジア初のEV電池セル工場を開業

[11] statistia. Leading countries based on YouTube audience size as of July 2024

[12] statistia. Leading e-commerce sites in Indonesia in February 2024, by monthly traffic

[13] TRADING ECONOMICS. Malaysia GDP

[14] OFFSHORE ENERGY.2023.06.15. SolarDuck partners up for 780kW offshore solar project in Malaysia

[15] TotalEnergies.2023.06.26.TotalEnergies partners with Petronas and Mitsui on a Carbon Storage hub in Malaysia

[16] NIKKEI Asia.2024.04.12.Malaysian ‘Silicon Valley’ seeds homegrown chip startups

[17] IT BREW.2024.04.23. Tech, semiconductor companies investing in Malaysia’s chip industry

[18] retail asia.2024.05. Malaysia’s e-commerce market to grow by 12.8% in 2024

[19] Jetro.2024.03.22. インフルエンサーへの共感が購買につながるマレーシア越境EC市場

Leave a Reply